- Cryptotwits

- Posts

- This Week: Banks Lobby Their Debanking Victim For Protection From Competition 🤦

This Week: Banks Lobby Their Debanking Victim For Protection From Competition 🤦

There's irony and there's whatever the fook this is

OVERVIEW

This Week: Banks Lobby Their Debanking Victim For Protection From Competition 🤦

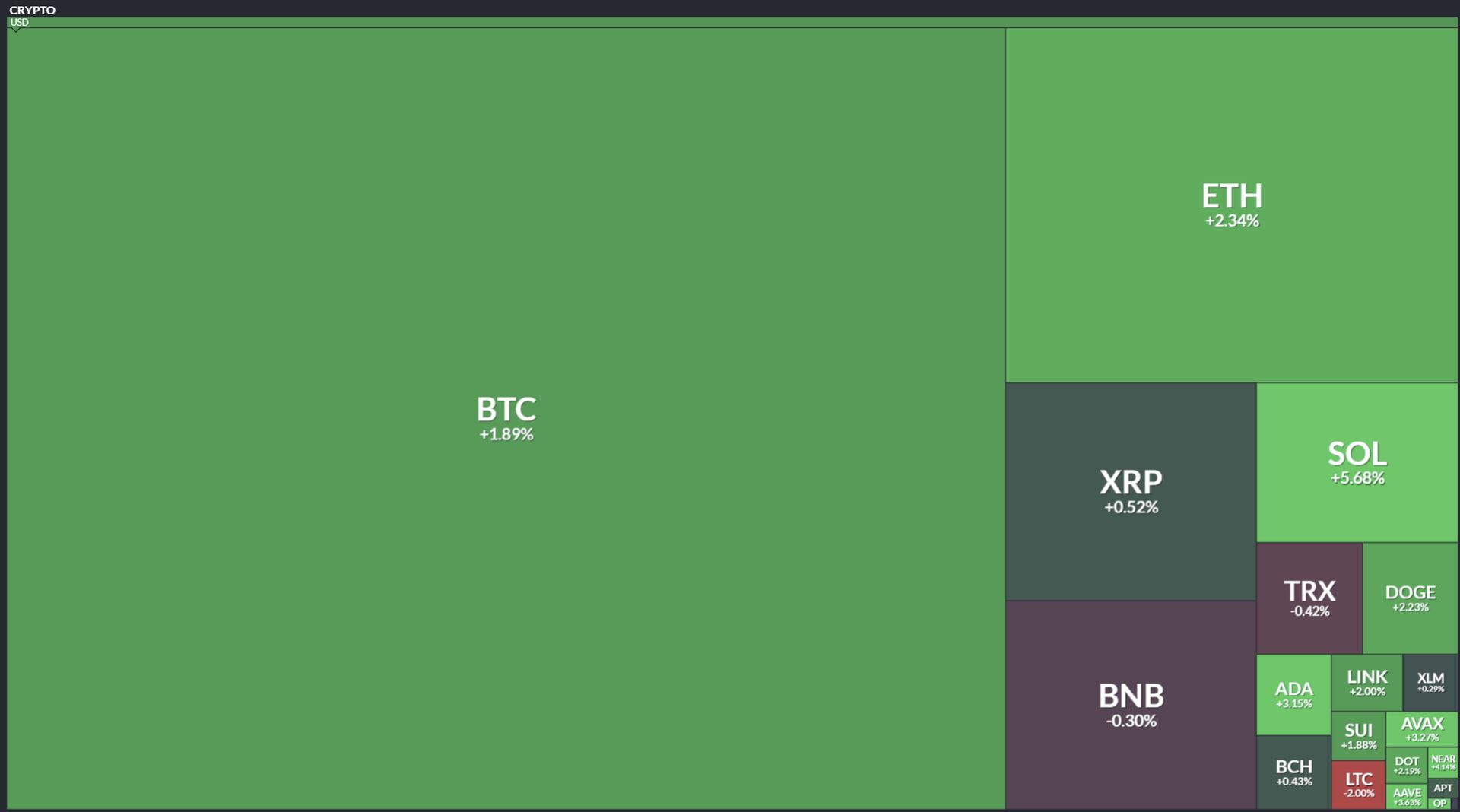

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

CRYPTO

Banks Debanked Trump & Now Want Protection 🤣

The Senate Banking Committee marks up the CLARITY Act this week (January 15), and the banking industry is in full panic mode. 😱

The American Bankers Association, all 52 state banking associations, and the Bank Policy Institute are flooding Capitol Hill with letters demanding Congress ban stablecoin yields.

Their argument? If crypto platforms keep offering 4-5% on USDC while savings accounts pay 0.6%, depositors might actually leave.

The horror.

Let’s Talk Numbers

The Treasury Department's worst-case scenario puts potential deposit flight at $6.6 trillion.

Citi projects $1 trillion gone by 2030.

The Fed says high stablecoin adoption could contract bank lending by $600 billion to $1.26 trillion.

Banks currently sit on $2.9 trillion parked at the Fed earning 4% interest - money they're not passing through to depositors or lending out. But sure, stablecoins are the threat to American lending.

Here's where it gets rich. Remember Operation Choke Point 2.0? The OCC confirmed in December that nine major banks "inappropriately" restricted crypto businesses between 2020-2023: JPMorgan, Bank of America, Citi, Wells Fargo, U.S. Bank, Capital One, PNC, TD Bank, and BMO.

The House Financial Services Committee documented at least 30 crypto companies and executives who lost banking access during this period.

And Trump specifically? Deutsche Bank cut him off in January 2021 after years and $2.5 billion in lending. Signature Bank closed his personal accounts holding $5.3 million. Capital One shuttered roughly 300 Trump Organization accounts, earning itself a lawsuit alleging "woke" political motivations.

Now these same institutions want the guy they debanked to protect their deposit base from the industry they tried to strangle. Peak irony doesn't begin to cover it.

The crypto lobby isn't taking this lying down. Over 125 industry players - Coinbase, Gemini, Kraken, Ripple, the Blockchain Association - sent their own letter arguing Congress "deliberately" preserved platform reward capabilities in the GENIUS Act.

The January 15 vote will show whether crypto's political momentum survives its first real collision with entrenched banking interests - or whether the institutions that tried to kill this industry get bailed out by the administration they abandoned. 🤷

DEFI

Curve Just Made Passive LPs Dangerous Again ⚠️

I do a boat load in the DeFi space, specifically with liquidity pools. But most people don’t. And to be perfectly honest, there’s so much shite to know that even when you think you know something it gets changed so fast. ⏩️

Most of them are marketing decks with a smart contract attached. But Curve's new FXSwap mechanism? This one actually does something.

The problem it solves is real: volatile pairs on AMMs are a mess. Price moves, liquidity gets stranded, LPs either babysit their positions like a day job or watch their capital sit useless out of range. Uniswap V3 basically turned liquidity provision into active trading. Great for sophisticated players. Brutal for everyone else.

FXSwap's answer: automate the whole damn thing. Liquidity stays concentrated near the current price without LPs lifting a finger. The secret sauce is something called "refueling" - an external buffer that subsidizes rebalancing costs when prices drift. You deposit, you earn fees, you go touch grass. Novel concept.

The Numbers Don't Lie

Pangea ran an independent analysis comparing FXSwap to Uni V3 for BTC/USD flows. Same TVL window, apples-to-apples:

$10M trades: FXSwap delivered better execution in 80% of blocks

Average improvement: Around 2%

Worst-case Uni V3 slippage: Over 7% worse on identical trade size

The Stress Test

November 21st, BTC dumps below $83K. Both pools get rocked. Here's where design philosophy shows up:

Uni V3 hit 12%+ price impact on a $10M swap. Stayed ugly for a while.

FXSwap peaked at 7.5%, then automatically recentered down to 5-6%

Uniswap needs humans to fix the problem. FXSwap fixes itself. That's the whole ballgame.

Curve basically said "what if LPs didn't have to be degens to compete" and then built the thing. Passive liquidity that actually works for non-pegged assets. If this scales to FX stablecoin pairs like they're planning, you're looking at on-chain depth that could genuinely compete with centralized venues.

That's pretty badass. 👊

STOCKTWITS

Cryptotwits Podcast - New Episode! 🥳

You get not one, but two bald men in our latest crypto podcast. 👇️

Latest Stocktwits Media Drops

🏈 TrueOdds - NFL Worried About Prediction Markets?! Rams–Seahawks Pick, Nike Earnings & Jake Paul–AJ

NEWS

Starknet Goes Dark for 5 Hours, But the Post-Mortem is Actually Good 👍️

$STRK ( ▼ 4.55% ) face-planted on January 5th. Eighteen minutes of on-chain activity got nuked, and the network was down for nearly five hours. ⏲️

What Happened?

A bug in the blockifier (the component that executes transactions) got tripped by a very specific edge case involving nested function calls, variable writes, and reverts. When Function 2 panicked after Function 3 wrote to a variable, the system reverted to the wrong state.

The ‘silver lining’ here is Starknet's proving layer caught the inconsistency before it hit L1 finality. This is literally the point of validity proofs - the sequencer can screw up, but bad state doesn't become permanent. The architecture worked as designed, even if the sequencer didn't.

What The Starknet Team Is Doing Aboot It

Aggressive fuzz-testing against the prover

Full audit of revert logic

Faster prover execution so mismatches trigger auto-halt immediately

Five hours of downtime is bad. Reverting user activity is worse. But compare this to chains that just shrug and move on, or bury incidents in Discord messages nobody reads.

Starknet published the exact bug, admitted the failure, and laid out concrete fixes. That's the bare minimum we should expect - but it's more than most deliver. 🚚

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🏦 Brale Brings Stablecoin-as-a-Service to Algorand's Quantum-Resistant Rails

The U.S.-regulated platform now lets enterprises launch their own branded stablecoins on Algorand with full custody, compliance, and fiat on-ramps bundled in - no smart contracts to maintain, no licenses to obtain. Builders get revenue share on stablecoin reserves, which is a nice change from the "we keep all the yield" model pioneered by certain incumbents. Algorand.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🔄 MANTRA Is Doing a 4x Token Split and You Probably Don't Need to Do Anything

$OM becomes $MANTRA on March 2nd with a non-dilutive 4x redenomination - if you're on MANTRA Chain, just sit there and watch your balance quadruple automatically. If you're still holding on Ethereum, BSC, or Polygon, migrate before January 15th or your tokens become expensive souvenirs. The timeline got pushed back six weeks because coordinating with dozens of exchanges is harder than it sounds. MANTRA.

🔮 Sei Giga's Quantum Computing Problem Is Actually a Bandwidth Problem

Swapping to NIST's post-quantum signatures would push Sei's 200k TPS chain to 0.48–1.57 GB/s of signature data alone, which is less "high-performance blockchain" and more "signature DA layer with an EVM attached to the side." The viable paths are either zk proofs to batch verification off-chain or optimistic "commit now, verify later" models protected by economic bonds that make spamming expensive. Sei.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

Put your $GALA in eligible GalaSwap liquidity pools and get a 50% boost on pairs like ETH, BTC, and stables - or 100% if you're feeling spicy with the GALA/BENE pool. The daily snapshot now counts LP positions on top of your regular holdings, so your tokens can work two jobs. Still need 1 million GALA per node for max rewards. Gala Games.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🎯 Arbitrum Dia Makes Gas Spikes Feel Less Like Uber Surge Pricing

The upgrade smooths out fee volatility by using multiple gas targets across longer adjustment windows, so demand spikes don't immediately punish everyone trying to transact. They also bumped the minimum base fee from 0.01 to 0.02 gwei, which makes bot spam more expensive while stabilizing DAO revenue. Plus passkey support is now aligned with Ethereum's Fusaka spec. Arbitrum.

🏛️ Optimism Is Evolving From DAO Experiment to Whatever Comes After DAOs

Season 9 introduces Capital Allocation 2.0, where governance's main job becomes holding OP Labs accountable via veto rights rather than trying to actively drive progress through grants and open contributions. Retro Funding is paused for at least 12 months while they figure out what to do with 775M OP, and the Foundation proposed using 50% of Superchain revenue for buybacks. Optimism.

NEWS IN THREE SENTENCES

Protocol News 🏦

⚡ MultiversX Supernova Decouples Consensus From Execution Like They Should've Done Years Ago

So the secret to speed is just... not doing everything at once? Supernova lets validators agree on blocks first and run the actual transactions later in the background, which sounds obvious until you realize most chains still wait for execution to finish before moving on. This means sub-second finality, predictable behavior under load, and blocks that aren't bottlenecked by whatever expensive computation someone threw at them. MultiversX.

🧮 LayerZero and Commonware Wrote a Paper About Why Their Consensus Variant Doesn't Leak Secrets

C-Simplex modifies the original Simplex BFT protocol so honest nodes won't vote on proposals after they've already voted for a dummy block, which prevents malicious leaders from gaming VRF randomness by waiting to see entropy before proposing. LayerZero.

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋