- Cryptotwits

- Posts

- Theory: There's A Shadow Rotation Into $ZEC 🥷

Theory: There's A Shadow Rotation Into $ZEC 🥷

And not just ZEC, but privacy in general, that's my theory at least

OVERVIEW

Theory: There's A Shadow Rotation Into $ZEC 🥷

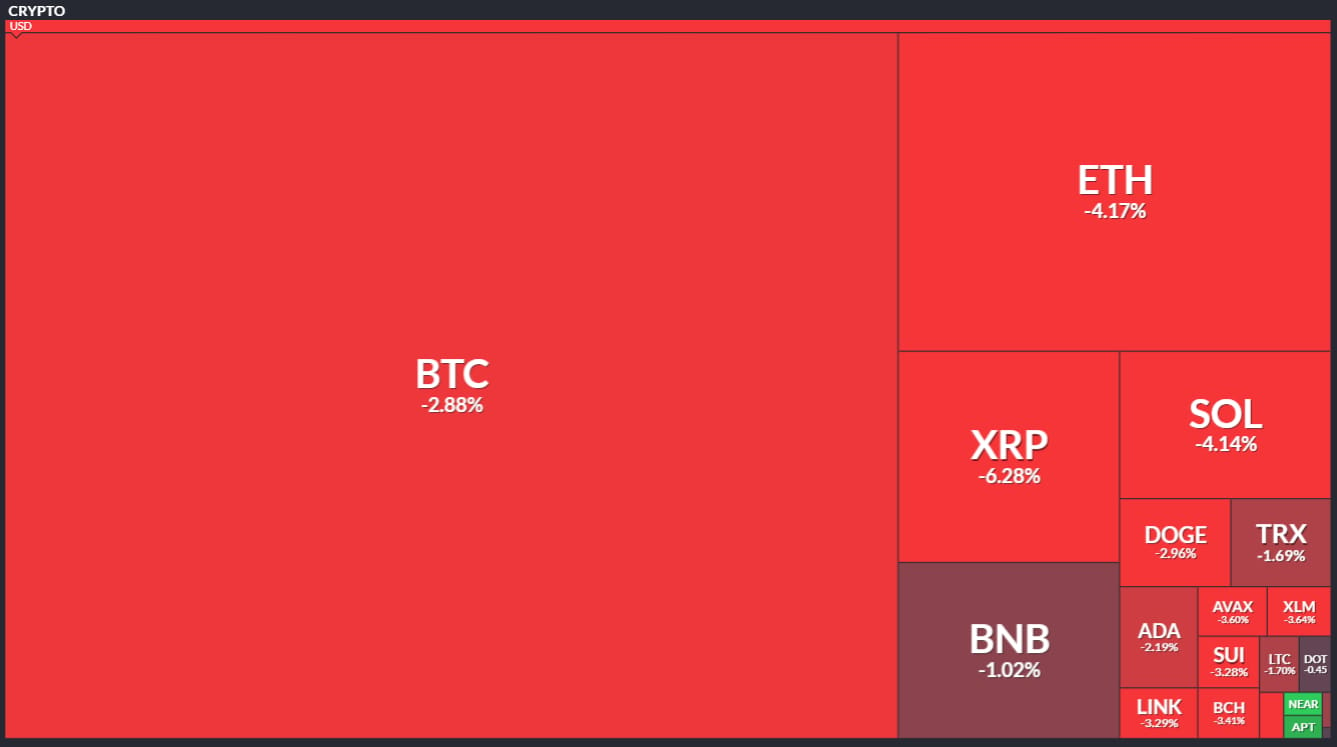

Before we dive in, here’s today’s crypto market heatmap:

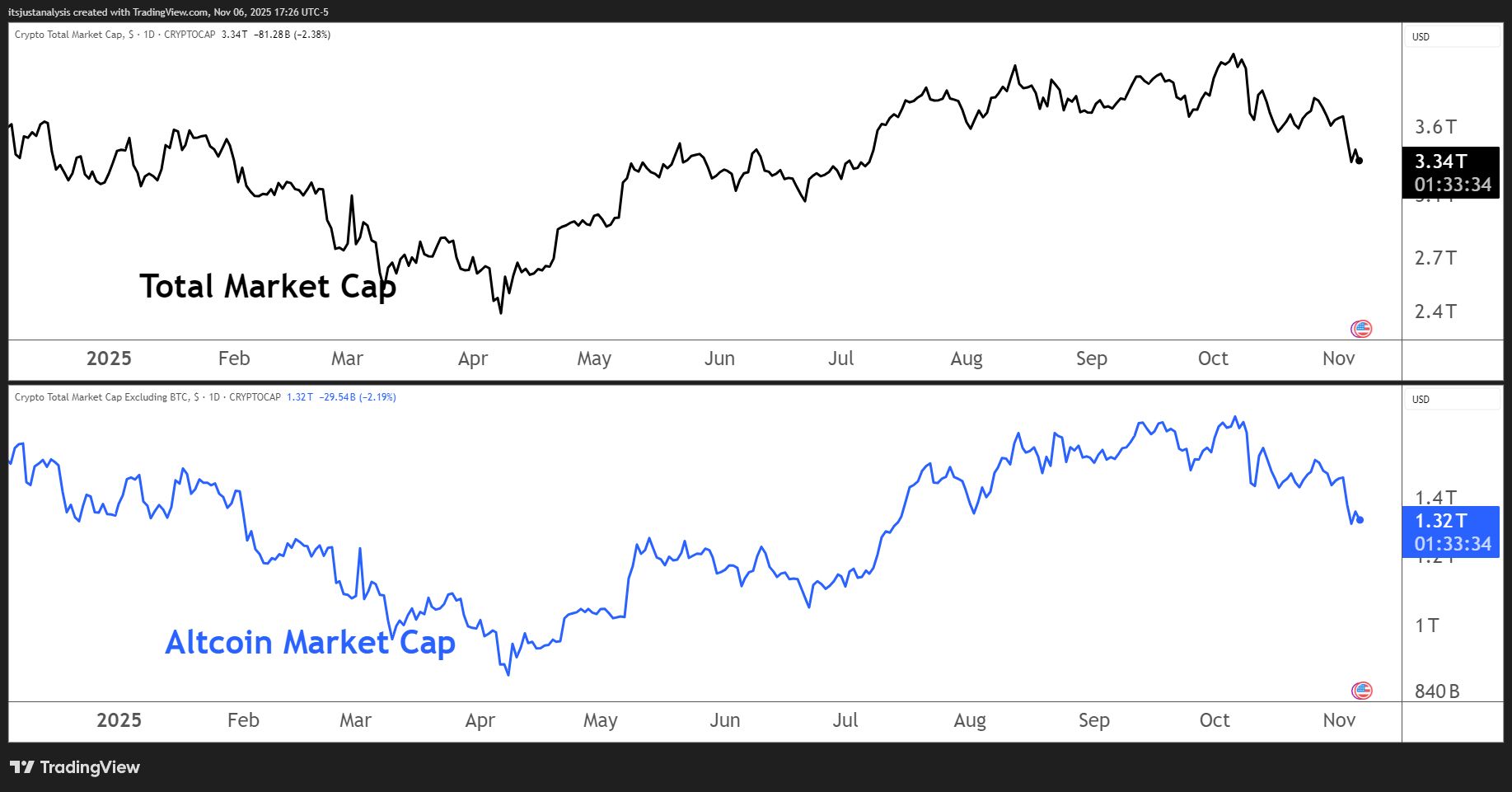

And here’s a look at crypto’s total market and altcoin market cap charts:

ON-CHAIN ANALYSIS

Is There Something More To Zcash’s Pamp? 🤔

Today’s newsletter is a kind of special edition focusing on, what I believe, is the beginning of a deliberate, quiet, and sustained rotation into not just $ZEC.X ( ▲ 3.57% ) , but privacy as a whole.

So while the focus of today’s newsletter is Zcash, much of what you’ll read could apply to another major privacy crypto, $DASH.X ( ▲ 7.31% ) and more recently tickers like $PIVX.X ( ▲ 6.39% ) and $SCRT.X ( ▲ 5.29% ) .

This study isn’t another “price went up, number go moon” post. It’s the culmination of months of cross-chain analysis, sentiment mapping, and on-chain forensics - the kind of work that turns coincidence into pattern and narrative into data.

Between September and November 2025, over 5 million ZEC - nearly one-third of the total supply - vanished from public ledgers into privacy vaults.

What follows is an evidence-based reconstruction of how and why it happened: a forensic anatomy of what might be the first large-scale defensive migration of digital capital away from transparency and toward cryptographic discretion.

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

ON-CHAIN ANALYSIS

The Setup 📕

The Push

Public ledgers looked noble in the brochure. Then regulators, chain data vendors, and a thousand subpoenas turned them into glass houses. 🏘️

Travel Rule went global. Centralized on-ramps are KYC choke points now. Counterparty due diligence, data hops, no de minimis threshold in the EU. Every door has a camera.

CBDCs are coming. Central banks want a native digital layer with a memory. Cash doesn’t snitch. Digital fiat does.

Result. The feature set that sold Bitcoin in 2013 became attack surface in 2025. Transparent, immutable, permanent. Good for history. Awful for privacy. If you run size, your balance sheet doubles as a public diary.

Sophisticated, principled, and idealized money is reading the room and stopped volunteering telemetry.

The Pull

Push without pull doesn’t rotate a dime. Zcash matured where it had to.

NU5 + Halo 2. Trustless proofs. The old trusted setup critique got retired. Orchard is the modern shielded pool and it’s where the big balances parked.

Zashi Wallet. Privacy by default. If funds land transparent, the wallet forces shielding before spend. UX stopped fighting the user.

CrossPay on NEAR Intents. Kind of a big deal for many cryptocurrencies. “Convert 1 ETH to shielded ZEC in my wallet.” Solvers do the messy route across chains. No CEX. No Travel Rule breadcrumb trail. The timing of that September 16 launch and the start of the rip was is suspiciously coincidental.

ON-CHAIN ANALYSIS

5 million ZEC Vanished Into The Dark 🥷

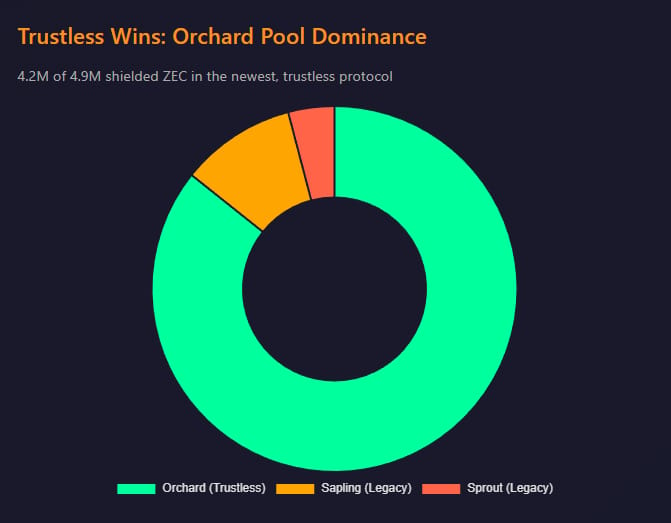

You can’t see individual shielded balances. You can see the pool they live in. 🔍️

Click to enlarge.

Shielded supply hit ~4.9-5.0M ZEC. About 30% of supply by early November. That’s up from the low teens in early 2024.

Orchard dominance. North of 4.2M ZEC rests in the trustless pool, not the legacy ones. That’s where careful money goes. And honestly, I can’t fathom why this isn’t more of a big deal in crypto social.

October acceleration. Shielded supply up double digits in a month. Daily shieldings hitting 40-50k ZEC at times during a 200-300% run. Normal market behavior is pump → deposit → sell. Zcash did pump → shield → sit.

People chose privacy while price screamed higher. That’s not flipper energy. ⛽️

ON-CHAIN ANALYSIS

Institutions: The Pressure Valve 🚂

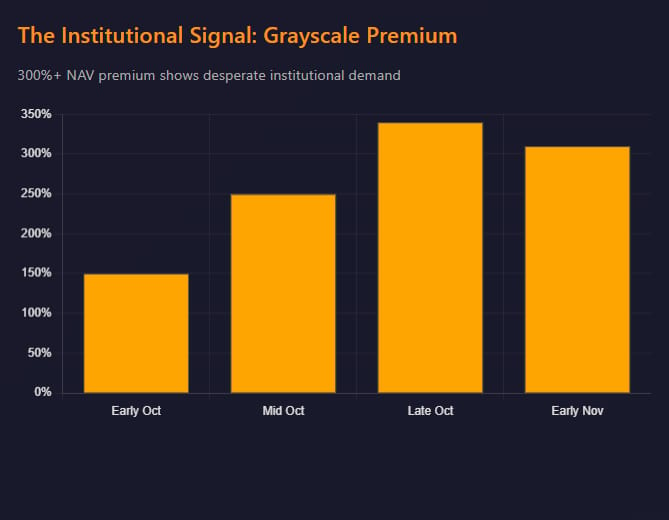

Not everyone can self-custody or touch CEXs without a compliance migraine. Enter the trust wrapper. 🎁

Grayscale Zcash Trust. AUM more than doubled in October. Premiums exploded to triple digits. That premium screams scarcity of compliant access more than it screams efficiency. Well, that’s my read at least.

Share of flow. Institutions looked like sub 20% of total during the run. The rest came from whales, family offices, and retail using the new rails. Distributed flows hide better than a single headline fund.

The premium was the signal. People were willing to pay over the odds to get exposure without blowing up their policy manual. 🧠

ON-CHAIN ANALYSIS

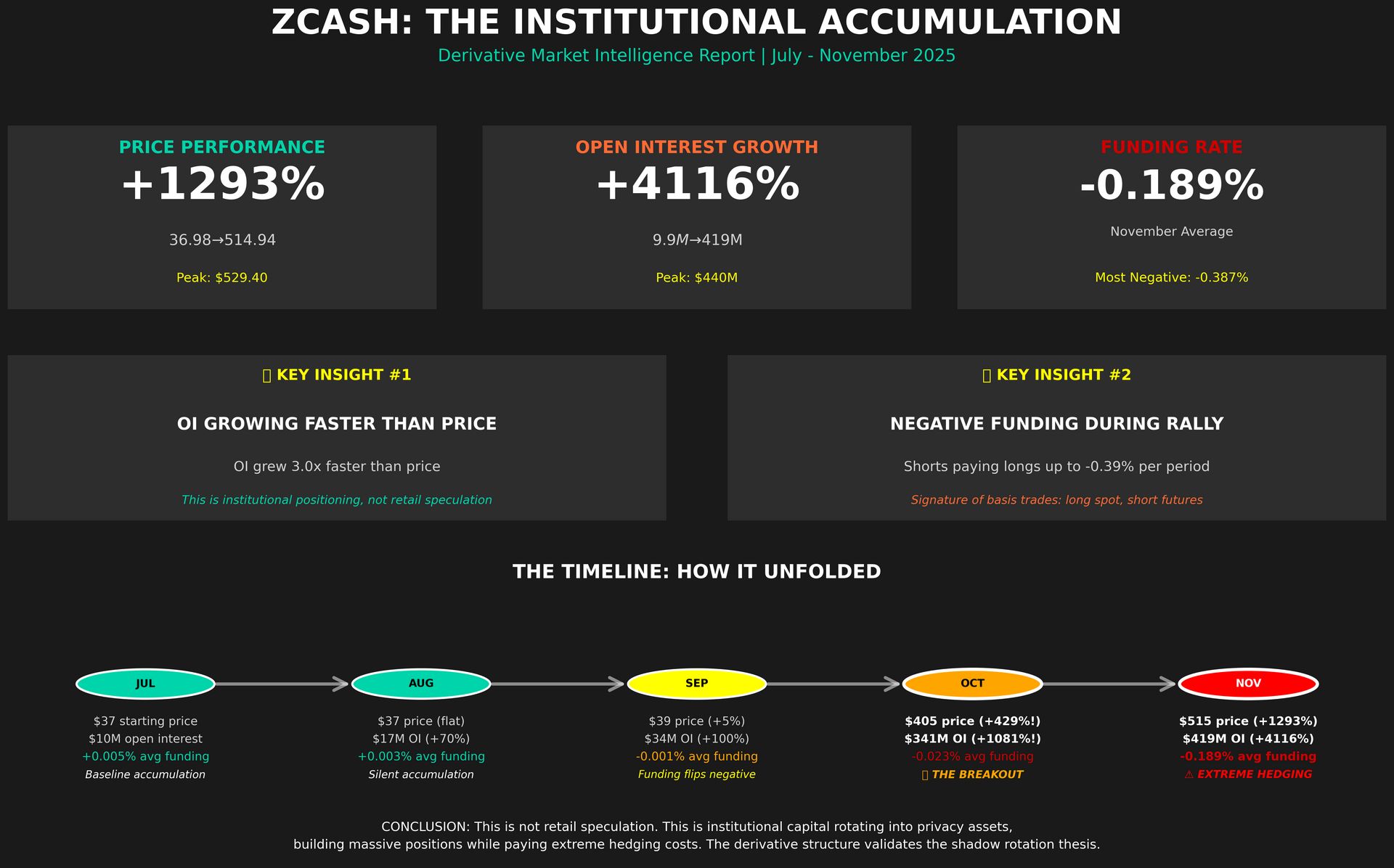

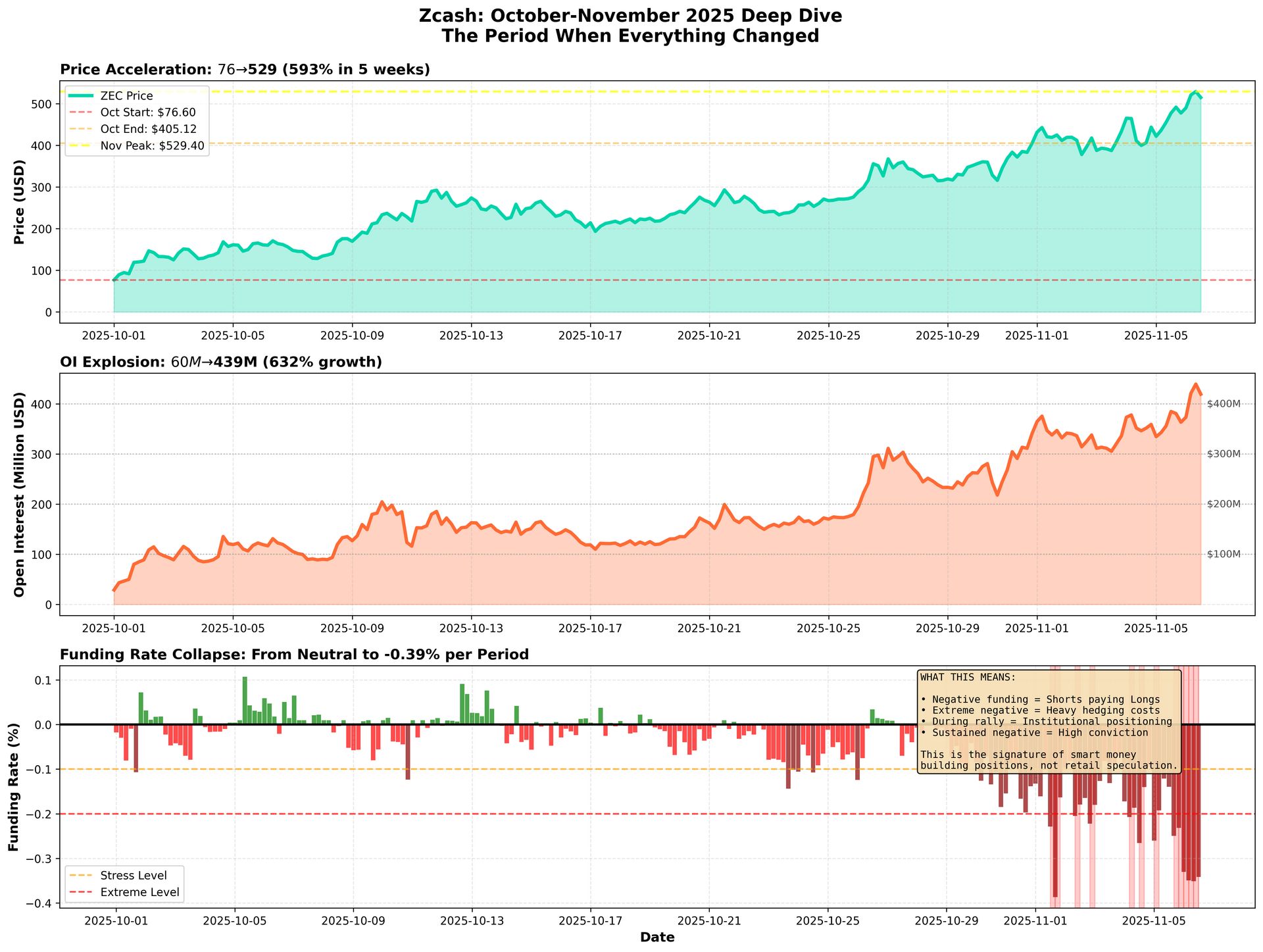

Open Interest and Funding Rate Analysis (July - November 2025)

Zcash just put up a 1,293% return from July through early November 2025, climbing from $37 to $515. But that's not the interesting part. 🤔

The interesting part is what's happening beneath the surface in derivatives markets, where open interest exploded 4,116% and funding rates went violently negative during the strongest part of the rally.

This is not normal behavior.

Open Interest: The Real Signal

This is where it gets interesting. There was an explosion in open interest.

July 1: $9.9 million

November 6: $419.4 million

Peak OI: $439.6 million (Nov 6, 8:00 UTC)

Growth Rate: 4,116%

Open interest grew faster than price.

Price went up 14x. Open interest went up 42x.

That's not retail FOMO. That's not crypto Twitter getting excited. That's institutional capital building massive positions in size, and the derivative markets scrambling to accommodate flows that dwarf the spot market.

Monthly OI Progression

July: Average OI ~$11M (baseline accumulation)

August: Average OI ~$17M (slow build)

September: Average OI ~$34M (momentum shift)

October: Average OI ~$109M (explosion phase)

November: Average OI ~$366M (parabolic acceleration)

The October-November period saw OI increase by 240% while price "only" went up 465%. Someone is hedging, arbitraging, or building positions that require massive derivative coverage.

Funding Rates: The Plot Thickens

Here's where the narrative gets really interesting. Normally, when an asset goes parabolic, funding rates go positive and stay positive. Longs pay shorts because everyone wants to be long.

Zcash did the opposite.

Funding Rate Evolution:

July Average: +0.000050 (0.005%, neutral/slightly positive)

August Average: +0.000025 (0.0025%, weakening)

September Average: -0.000009 (flipping negative)

October Average: -0.000233 (strongly negative)

November Average: -0.001891 (extremely negative)

Recent Period (Oct 23 - Nov 6):

Average Funding: -0.001135 (-0.11%)

Most Negative Rate: -0.003867 (-0.39% per 8-hour period)

Annualized Equivalent: -141% APR at peak negativity

Read that again: During Zcash's most explosive rally phase, funding rates hit -141% annualized. Shorts were/are paying longs nearly 0.4% every 8 hours to maintain their positions.

So, WTF Does This All Mean?

Negative funding rates during a rally indicate one of three scenarios:

Heavy Institutional Shorting: Large players are aggressively shorting into the rally, either because they think it's overextended or they're hedging other exposures.

Basis Trade Dynamics: Sophisticated players are long spot, short futures, capturing the negative funding as profit while remaining market neutral. This is actually bullish—it means smart money believes the rally has legs.

Supply/Demand Imbalance: There aren't enough shorts in the market, so the existing shorts are getting squeezed and have to pay up to maintain their positions.

Given the magnitude and persistence of negative funding combined with explosive OI growth, scenario #2 (basis trades) combined with scenario #3 (supply squeeze) seems most likely. 🤯

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋