- Cryptotwits

- Posts

- The Grinch Who Stole Volume: The Draining Of 5 Major Chains 🪠

The Grinch Who Stole Volume: The Draining Of 5 Major Chains 🪠

His heart isn't even two sizes two small, he doesn't have one at all

Presented by:

OVERVIEW

The Grinch Who Stole Volume: The Draining Of 5 Major Chains 🪠

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

ON-CHAIN ANALYSIS

Oh Come, All Ye Chart Freaks, Joyful And Not Drunk Yet 🧑🎤

Before we dig into the nitty gritty on-chain data, let's establish what we're actually looking at. Two metrics, both from Santiment, both measuring on-chain reality rather than price fantasy. 🧙

Daily Active Addresses (DAA): The count of unique addresses that participated in at least one on-chain transaction over a 24-hour period. This is your participation gauge - how many wallets are actually using the network, whether that's sending, receiving, or interacting with smart contracts.

Transaction Volume: The total amount of native tokens moved on-chain in a given day (measured in BTC, ETH, SOL, etc. - not USD). This captures the magnitude of activity. A chain can have lots of participants moving dust, or few participants moving whales. Volume tells you the latter.

One more thing: these metrics have nothing to do with price directly. A token can pump 50% on pure futures leverage while on-chain activity flatlines. That's exactly the kind of hollow move that tends to reverse.

Conversely, strong on-chain expansion that precedes a price move is the real deal - that's accumulation you can trust.

Now let's see what December 2025 is telling us... 👀

SPONSORED

Exposure to the Growth of Blockchain Finance

Grayscale Chainlink Trust ETF (ticker: GLNK) delivers exposure to LINK, the native token of Chainlink, a leading oracle that connects external data and information to blockchains and serves as middleware between on- and off-chain systems. Chainlink has many potential use cases. For example, if an insurance company automatically knew a storm happened through connections with local weather services, it could issue payment on a claim instantly.

As the underpinning for many modern blockchain applications, including decentralized finance (DeFi) and real-world asset tokenization, we believe Chainlink is poised to grow alongside the broader digital finance industry.

Sponsored by Grayscale, the world’s largest digital asset-focused investment platform1 with over a decade of expertise, GLNK allows investors to gain exposure to LINK for a 0% management fee2.

1 Largest crypto-focused asset manager based on AUM as of 10/31/2025. For other companies in this category, AUM is considered as of most recent public disclosure.

2 Gross expense ratio at 0% for 3 months or the first $1.0 billion of assets. After the fund reaches $1.0 billion in assets or after 3-month waiver period ending March 2, 2026, the fee will be 0.35%. Brokerage fees and other expenses may still apply.

Grayscale Chainlink Trust ETF (“GLNK” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GLNK is subject to significant risk and heightened volatility. GLNK is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GLNK is not a direct investment in Chainlink. Please read the prospectus carefully before investing in the Fund. Foreside Fund Services, LLC is the Marketing Agent for the Fund.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ON-CHAIN ANALYSIS

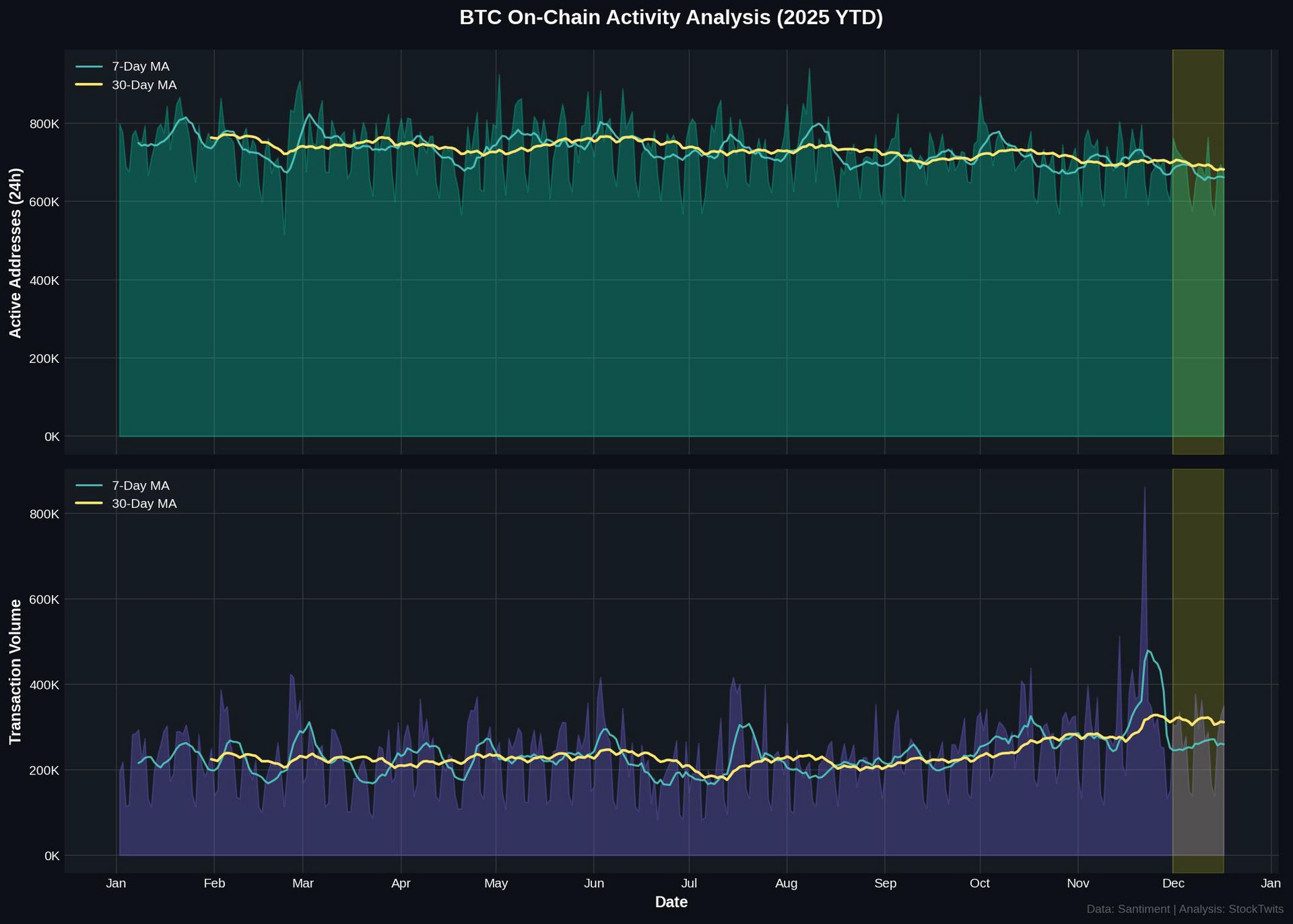

Bitcoin 🪙

Volume is bleeding faster than addresses. 🩸

That's a conviction problem and not a participation problem. People are still showing up, but they're transacting with smaller bags or less frequency. The August spike to 940K addresses came with the summer volatility - since then it's been a grind lower for $BTC ( ▼ 2.11% ).

December's looking like the quietest month of Q4 on the volume front. Weekends continue to show predictable drop-offs. Not bearish per se, but this isn't the on-chain profile of a market ready to rip higher.

My take: Volume/Address divergence = positioning is lighter than price action suggests. 🪶

ON-CHAIN ANALYSIS

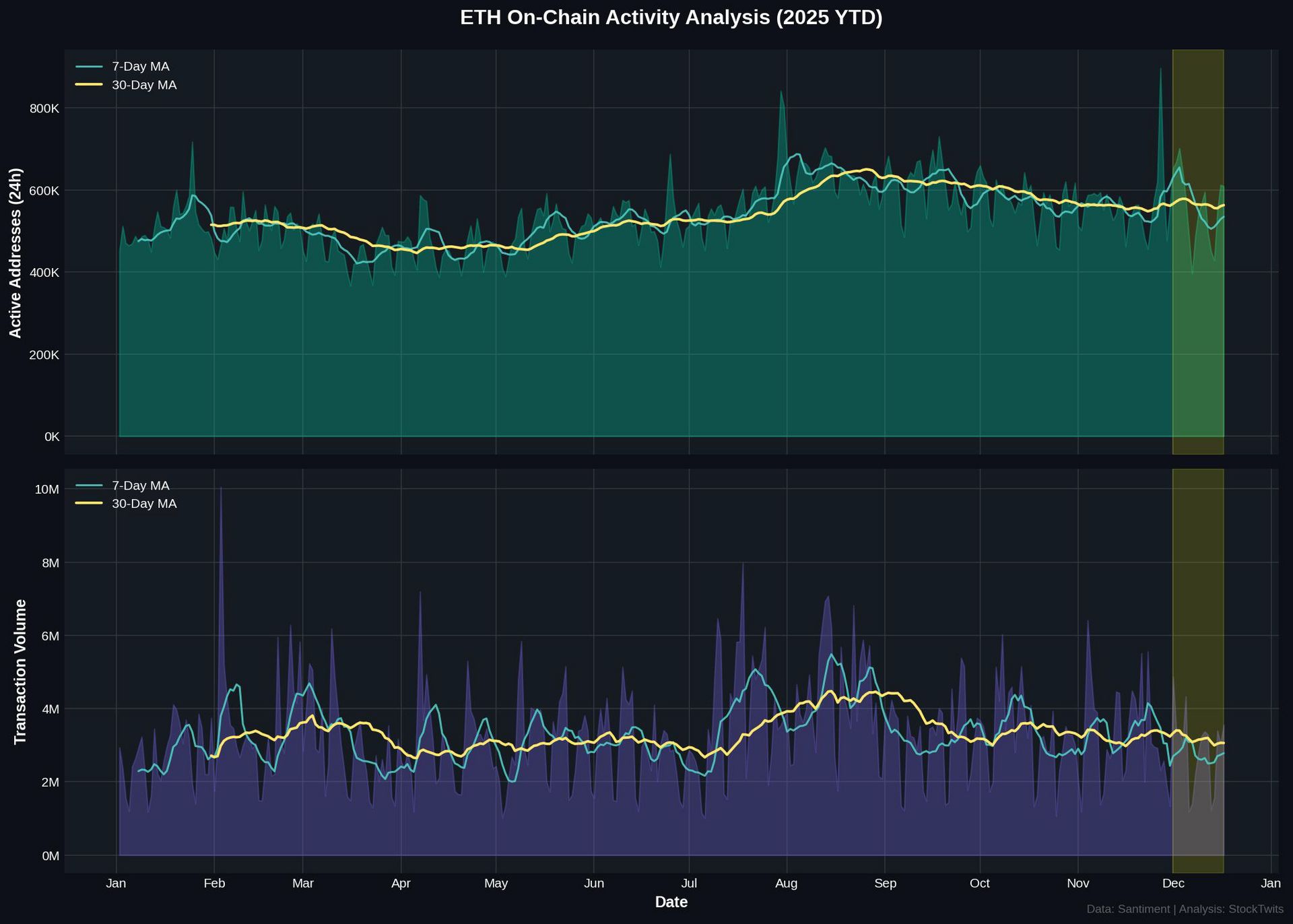

Ethereum 🥈

ETH is in zombie mode. 🧟

Addresses basically flat month-over-month while volume tanks 10%. That early-February spike (10M+ $ETH ( ▼ 3.71% ) volume) is a distant memory. There was a brief reawakening in July-August with addresses pushing toward 700-850K, but December's given all that back.

The narrative around "ETH is dead" crowd isn't supported by address data - people are still using the chain - but the transaction sizes have shrunk considerably. The November 27 address spike to 897K was a one-day wonder; context suggests end-of-month positioning, not organic growth.

My take: ETH is being held, not traded. Low volume + stable addresses = accumulation posture or apathy. Take your pick. 🤷

ON-CHAIN ANALYSIS

XRP 😨

This is the your biggest divergence between Daily Active Addresses and Transaction Volume in today’s newsletter. 🧠

Remember March? XRP exploded to 612K daily active addresses and 530K addresses in a single day during that insane run. That was the cycle peak for on-chain engagement. Now we're scratching around 40K addresses - a 93% collapse from March highs.

The early-December volume spike on the 2nd ($4B in $XRP ( ▼ 3.38% ) volume) was the last gasp of speculative energy, and it came without any meaningful address expansion. Classic "whales moving bags, retail asleep at the wheel" pattern.

My take: The XRP army showed up in Q1, declared victory, and largely left. Price holding up better than on-chain engagement suggests (remember one of the Cryptotwits newsletters near the beginning the month? XRP was the best performer of the bunch). That's either future support building quietly, or a distribution in progress. Keep an eye on whether addresses stabilize here or continue leaking. 🌊

SPONSORED

The First-Ever Chainlink Fund for Investors

Grayscale Chainlink Trust ETF (ticker: GLNK) is the first ETF to offer investors exposure to LINK.

GLNK trades on NYSE and is available through your brokerage account. In other words, you can access it alongside traditional assets, while avoiding the challenges of buying, storing, and safekeeping the token directly. 1

Sponsored by Grayscale, the world’s largest digital asset-focused investment 3 platform with over a decade of expertise, GLNK allows investors to gain exposure to LINK for a 0% management fee 4.

3 Largest crypto-focused asset manager based on AUM as of 10/31/2025. For other companies in this category, AUM is considered as of most recent public disclosure.

4 Gross expense ratio at 0% for 3 months or the first $1.0 billion of assets. After the fund reaches $1.0 billion in assets or after 3-month waiver period ending March 2, 2026, the fee will be 0.35%. Brokerage fees and other expenses may still apply.

Grayscale Chainlink Trust ETF (“GLNK” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GLNK is subject to significant risk and heightened volatility. GLNK is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GLNK is not a direct investment in Chainlink.

Please read the prospectus carefully before investing in the Fund.

Foreside Fund Services, LLC is the Marketing Agent for the Fund. Largest crypto-focused asset manager based on AUM as of 10/31/2025. For other companies in this category, AUM is considered as of most recent public disclosure.

Stakingrewards.com. The range observed is from 09/16/22 to 09/28/25 and the average over this period is 7.10%.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ON-CHAIN ANALYSIS

Solana 🥳

Out of the five tickers in today’s newsletter, Solana is the only chain showing address growth into December. 🏆️

Ya, ya, ya, it’s way off the January highs (6.86M addresses), but the trend since September's bottom at 1.83M has been a steady rebuild. Volume is still depressed - October's 200M+ $SOL ( ▼ 1.68% ) days are gone - but the address resilience suggests the ecosystem has sticky users who didn't just show up for the pump-and-dump on rug.pull.

My take: This is the cleanest "base building" chart of the group. Address growth + low volume typically precedes accumulation phases. If you're looking for relative strength in altcoin on-chain fundamentals, SOL is your horse. 💪

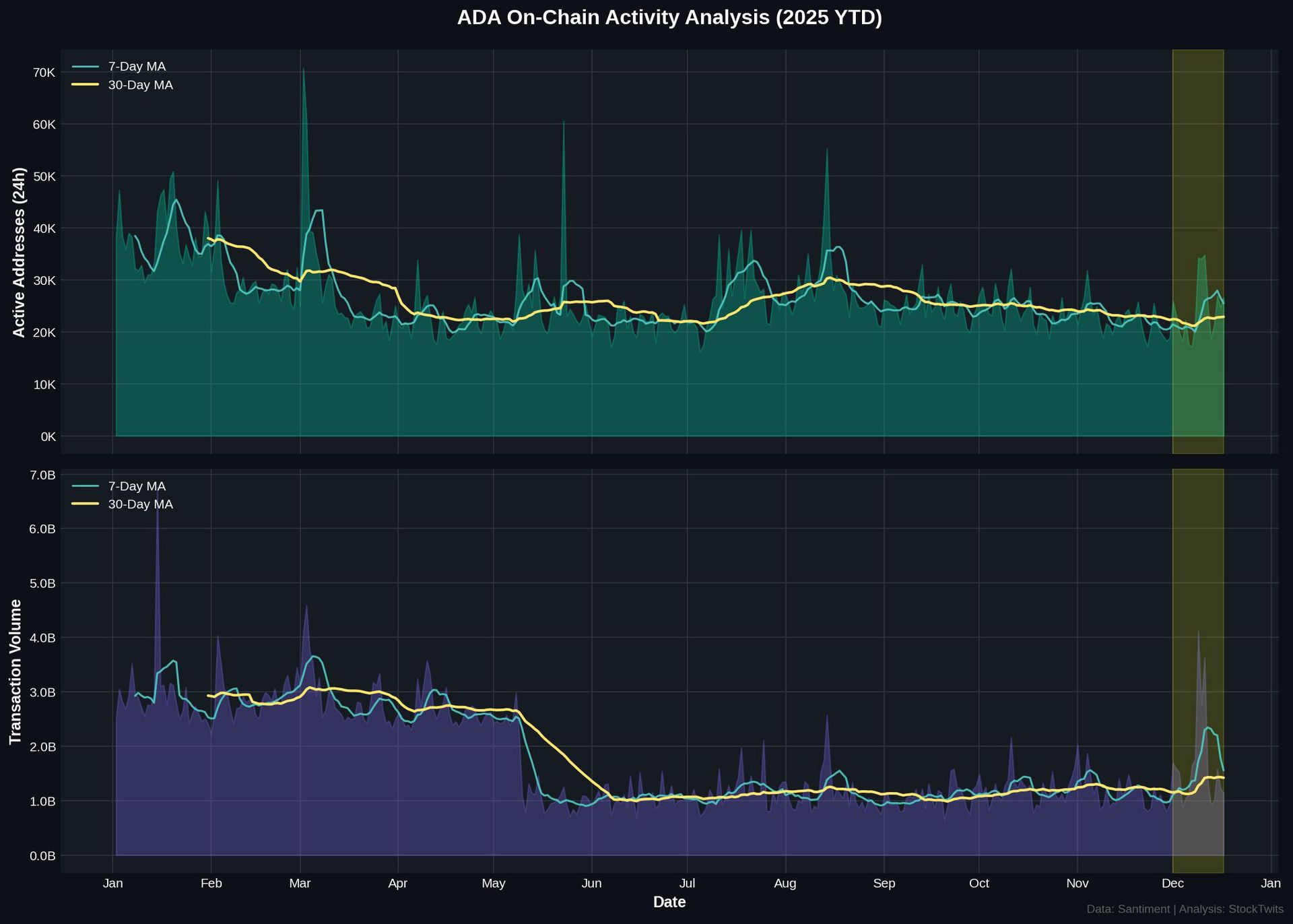

ON-CHAIN ANALYSIS

Cardano 😶

YUGE volume explosion in the first half of December. 🌋

December 9-11 had a monster volume explosion - 4.1B $ADA ( ▼ 0.37% ) moved on the 9th alone - lines up with the Midnight (NIGHT) token redemption going live on December 10.

The address uptick reflects users coming back to interact with wallets they may have set and forgotten since the June snapshot. The disproportionate volume-to-address ratio makes sense: redemption required wallet signatures and on-chain transactions, but many users were likely consolidating or moving ADA in preparation for claiming NIGHT.

My take: This volume spike is event-driven, not organic accumulation (at least, not according to these two metrics alone). With NIGHT tokens unlocking in 25% tranches over the next year (through December 2026), expect periodic ADA wallet activity around those vesting dates - next one hits in early March. Don't mistake airdrop mechanics for bullish on-chain signals. 🧠

ON-CHAIN ANALYSIS

Putting It All Together 🛞

Volume is compressing across the board while addresses tell different stories. 🔉

SOL's the quiet grinder building users, ADA's spike is airdrop mechanics not organic demand, and XRP is living proof that retail can abandon a trade faster than they piled in.

This isn't a market screaming "risk-on" - it's a market with traders waiting for something to trigger a pamp while larger players are, quite obviously, building their positions.

Participation is flat-to-down, conviction (measured by volume) is bleeding out, and the only real activity spike of the month was farmers collecting free tokens. 🧑🌾

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋

Grayscale Chainlink Trust ETF (“GLNK” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GLNK is subject to significant risk and heightened volatility. GLNK is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GLNK is not a direct investment in Chainlink. Please read the prospectus carefully before investing in the Fund. Foreside Fund Services, LLC is the Marketing Agent for the Fund.

1 Largest crypto-focused asset manager based on AUM as of 10/31/2025. For other companies in this category, AUM is considered as of most recent public disclosure.

2 Gross expense ratio at 0% for 3 months or the first $1.0 billion of assets. After the fund reaches $1.0 billion in assets or after 3-month waiver period ending March 2, 2026, the fee will be 0.35%. Brokerage fees and other expenses may still apply.