- Cryptotwits

- Posts

- The Great Unclenching Of 2025 🗜️

The Great Unclenching Of 2025 🗜️

An On-Chain Story Of Bitcoin's 2025

OVERVIEW

The Great Unclenching Of 2025 🗜️

Today’s Cryptotwits Newsletter goes 1,000% nerd mode. 🥸

Today, we’re going to dissect a structural shift that happened to Bitcoin this year, revealing a definitive transfer of ownership from vintage long-term holders to new institutional capital.

The on-chain data shows a market that moved through three distinct phases:

Early-year retail exhaustion.

A quiet institutional accumulation period during the summer months.

And a massive, coordinated distribution event in November.

We witnessed one of the largest capitulation events on record in November, where over a million BTC moved at a loss, clearing out the supply overhang.

Simultaneously, long-dormant coins (aged 1–5 years) flooded the market, absorbed by a surge in high-value whale transactions. As of December, these metrics have reset, signaling that the weak hands have been flushed and the transfer to high-conviction holders is complete.

Maybe. Probably. Hopefully. 🔚

ON-CHAIN ANALYSIS

Act I: The False Start 💨

We start our story with the "upper middle class" of Bitcoin - transactions valued over $100,000. These are your high-net-worth individuals, active trading desks, and smaller funds. 🧠

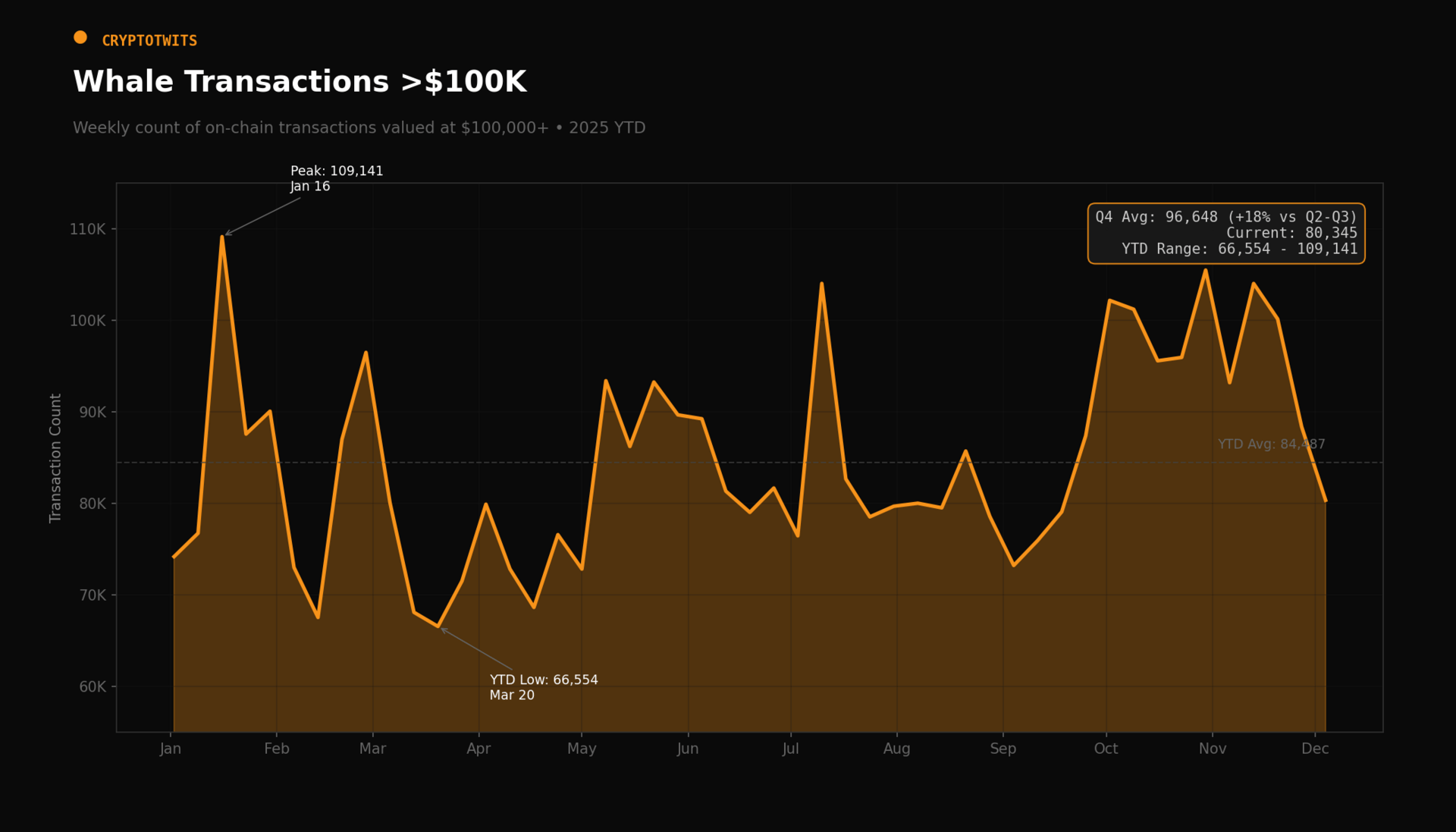

Whale Transaction Count (>$100k USD)

This metric aggregates the number of on-chain Bitcoin transactions exceeding $100,000 USD.

2025 opened with a roar for this group. January 16th saw a buying frenzy of 109,141 transactions - the highest peak we’d see all year. The narrative then was pure euphoria.

But the market humbles early enthusiasm. By mid-March, that activity had cratered to annual lows of 66,500ish. For the next six months - through the long, grinding summer of Q2 and Q3 - this metric flatlined at around 81,000 weekly transactions.

They finally woke up again in October, with activity surging 18% to chase the autumn volatility. But as we look at the December opening print of 80,345, it’s clear they have stepped back again.

They are hesitant. They are uncertain.

But while the $100k crowd was busy second-guessing the market, a much larger, quieter beast was waking up in the deep water. 🐳

ON-CHAIN ANALYSIS

Act II: The Institutional Awakening 🐋

To see what was really happening, we have to filter out the noise and look at the whales - transactions exceeding $1 million. This is the domain of corporate treasuries, sovereign funds, and institutional allocators. Truly rich bishes. 🤑

Whale Transaction Count (>$1M USD)

The institutional heartbeat. Transactions north of $1 million filter out almost everyone except the heavyweights: corporate treasuries, major hedge funds, exchange cold wallet rebalancing, and sovereign-scale wealth.

While the $100k crowd was frantic in January, the $1M+ giants were asleep, posting their lowest activity of the year in Q1.

Then, the strategy shifted. Throughout the quiet summer - while retail was bored and price action was chopping - the institutions began a stealth accumulation campaign. Q2 volume ticked up. Q3 volume climbed higher.

This culminated in October, the institutional coming-out party. Weekly averages skyrocketed to nearly 30,000 transactions, peaking at 32,053 on October 23rd. That’s one-day shy of two weeks after Fooktober 10th.

The ratio of mega-transactions to smaller ones hit year-highs. And now? December volume has cooled by 30%. They’re not selling, but it’s clear (to me at least) their position is close to being built.

If institutions were buying billions of dollars worth of Bitcoin in October and November, who on earth was selling it to them? 🤔

STOCKTWITS

Stocktwits Widgets for Your Website!

Stocktwits has just launched the Trending Widget! The Stocktwits Trending list is one of the most popular data points retail users like to follow, and now it’s available to embed anywhere, for free.

Publishers, creators, and platforms can now embed real-time trending data directly into their websites, dashboards, and newsletters with a single line of code.

It’s lightweight, fast, and designed to fit naturally into any layout.

Perfect for:

Blogs and market commentary sites

Creator landing pages

Fintech dashboards

Newsletter sections

Brokerages and research platforms

Give your audience live visibility into what’s moving today.

ON-CHAIN ANALYSIS

Act III: The Great Flush 🚽

This brings us to the bloodiest chapter of our story: Capitulation. 😨

Daily On-Chain Transaction Volume in Loss

This on-chain metric is the measurement of pain. This metric tracks the volume of Bitcoin (in BTC terms) moving on-chain at a price lower than its acquisition cost. It is on of the clearest signals of capitulation - investors throwing in the towel and realizing losses.

To understand the magnitude of the November crash, and that’s where the image above comes in. That chart shows us the amount of Bitcoin moving on-chain at a price lower than where it was bought.

November 2025 was a liquidation event. On November 13th and November 20th, we witnessed back-to-back weeks where over 1.1 million Bitcoin moved at a loss.

Leveraged traders were wiped out. Late entrants who bought the Q3 hopium threw in the towel. It was a total reset of the hodler base.

But look closely at the aftermath. By early December, this metric collapsed to 137,000ish BTC - an 87% drop from the peak. The selling looks like it’s exhausted and the fuel all burned up.

However, we all know it’s pretty damn easy to find something else to fuel another burn. Ya. I’m that guy. Not trying to pee in anyones Cheerios, it’s just the nature of the beast.

Anyway.

1.1 million Bitcoin is too much volume to come just from panicked retail traders. There was another source of supply - a much older, much deeper source. 😶

ON-CHAIN ANALYSIS

Act IV: The Old Guard Exits 👵

The final piece of the puzzle reveals who provided the liquidity for the institutional whales. It wasn't just day traders; it was the "Diamond Hands." 💎

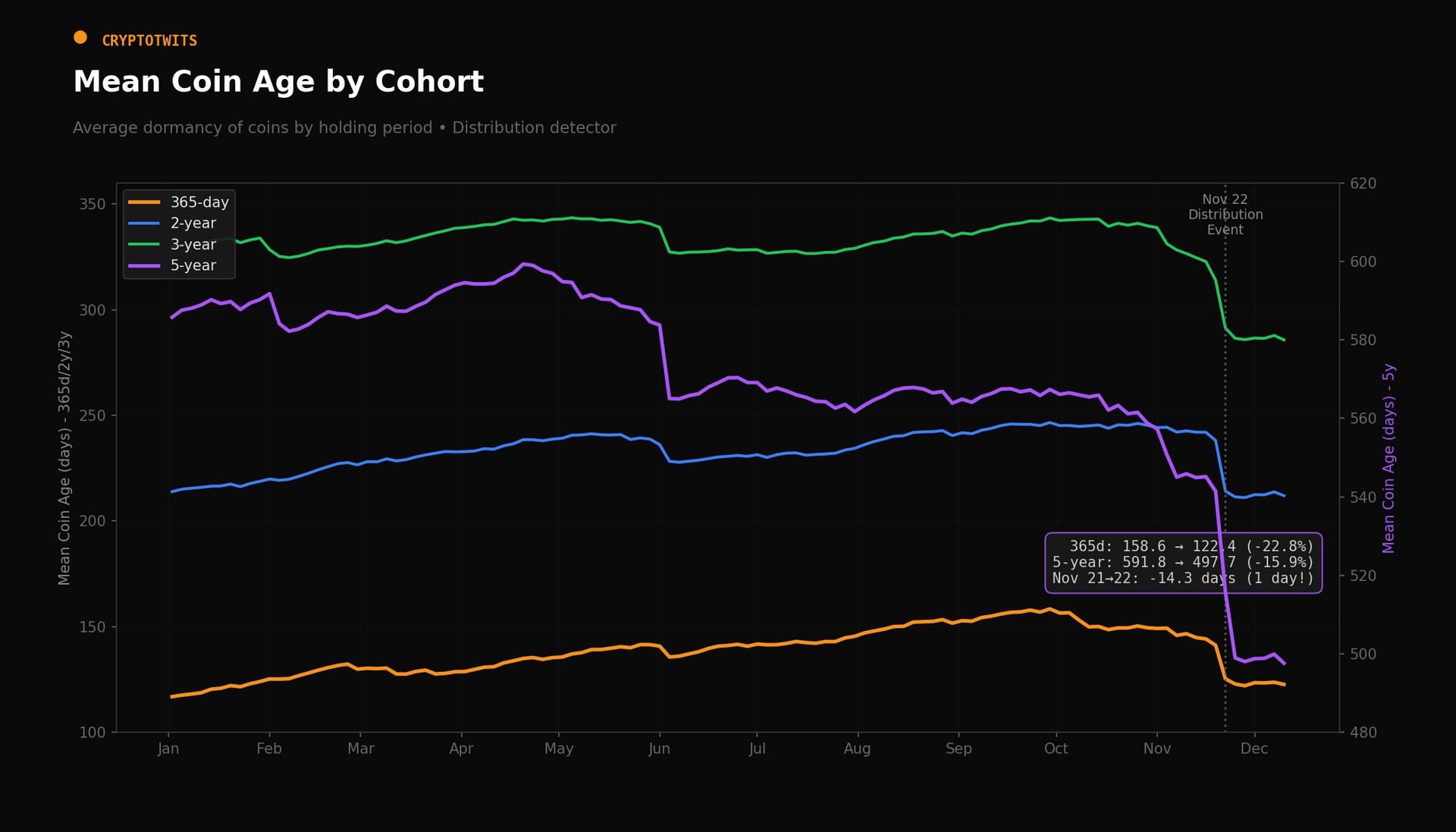

Mean Coin Age (365-Day to 5-Year Cohorts)

For the first nine months of the year, Mean Coin Age trended upward. Coins were maturing. The 2020 and 2021 cohorts were sitting tight.

Then, in November, the dam broke. We saw a synchronized collapse in Mean Coin Age across every single cohort. The 5-year Mean Coin Age plummeted by over 60 days in a single month. The 3-year cohort dropped by 54 days.

This is the "smoking gun" of distribution. It tells us that coins sitting dormant in wallets since the COVID era finally moved. The Old Guard saw the institutional liquidity entering the market and used it as an exit liquidity event. They transferred their vintage coins (at a massive profit, likely offset by the losses of the later entrants) into the waiting hands of the new institutional class. 🚢

ON-CHAIN ANALYSIS

Putting It All Together 🤝

Looking at just these pieces of on-chain data, the narrative of 2025 becomes clear. 👀

Well, maybe more like being nearsighted and forgetting to wear your glasses. You don’t know exactly what that blurry blob is up ahead but you know you don’t want to keep driving into it.

2025 was the year of The Great Unclenching, or, The Great Handover.

We saw a changing of the guard. The "Younger-Old-Whales" (2019–2021 vintage) distributed their supply. The "Weak Hands" (2024–2025 entrants) capitulated in a historic flush.

And absorbing it all - almost every single sat - was a new class of Institutional Whales who spent the summer and autumn aggressively building positions.

Has the market has been cleansed?

Sellers look like they are at or near exhaustion, the leverage is wiped, and the supply is now locked in the vaults of the highest-conviction buyers we have seen in years.

It’s possible, for Bitcoin at least, the worst of the storm may be over. 🙏

NEWS

Tether Gets Red Carded By Old Money 🟥

Money talks but a century+ of history screams louder. The Agnelli family just unanimously rejected Tether’s €1 billion ($1.17 billion) all-cash bid to buy Juventus Football Club. ⚽️

Tether tried to flex its massive balance sheet to take majority control of the "Old Lady" of Italian football, but the door was slammed shut before it even opened.

The Offer: A binding proposal for Exor's controlling 65.4% stake.

The Prem: The bid implied a 21% premium to Friday's close, sending shares pamping 12% on Monday morning.

The Pitch: CEO Paolo Ardoino tried to play the nostalgia card, citing his childhood fandom and promising "stable capital" for the long haul.

Exor didn't even say no. They just refused to even negotiate. The holding company cited their 102-year ownership legacy, with CEO John Elkann stating bluntly that the club's values "are not for sale".

Tether Has Been Active Everywhere

Tether is on a diversification rampage, fueled by a projected $15 billion in profit this year. They are already lending billions in oil and cotton markets and holding over $12 billion in gold. But while private equity firms like RedBird and Oaktree are gobbling up European teams, the Agnellis proved that some legacy institutions still aren't ready to let crypto sit at the grown-ups' table. 🥄

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🏦 Paxos Just Became the First Federally Regulated Stablecoin Issuer That Matters

The OCC approved Paxos to convert from a New York trust charter to a national one, putting all US activity under federal supervision. PYUSD becomes the largest dollar stablecoin issued by a federally regulated entity, and PAXG becomes the only institutional-grade gold token with federal oversight. Ten years of building credibility finally pays off with actual regulatory clarity. Paxos.

🔍 Story and EigenCloud Want to Make AI Actually Verifiable

TL;DR: They’re making agents that can transact, verify, and get paid without asking permission.. The joint vision is programmable provenance from Story handles licensing and attribution, while EigenCloud's verifiable compute proves the work ran correctly. AI today is a black box where nobody knows what data went in or who holds the rights - this fixes that with proofs instead of trust. Story.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏛️ VEXI Villages Launches Its First Crafting Event With Actual Strategy

The Rise of Vexhotep runs December 18-22 - gather resources, craft construction bundles, and contribute to shared Wonders for leaderboard points and rewards. Better bundles mean more contribution value but cost more resources and time, so you actually have to plan. Top competitors get $GALA, costumes, and the satisfaction of out-optimizing everyone else. Gala Games.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

💰 Revolut Listed INJ With Zero-Fee Staking, Which Is Actually Insane

Most platforms take 5-30% commission on staking rewards - Revolut takes nothing, passing the full 12.64% APR directly to users. The integration spans Revolut Retail, Business, and the X trading platform across 39 countries and 65 million customers. Injective just got a direct line to one of Europe's most valuable fintechs. Injective Protocol.

🔵 Optimism Picked Ether.fi for Its Liquid Staking Treasury

After evaluating all RFP submissions on liquidity, yield, alignment, and risk, weETH came out on top for OP Mainnet's institutional DeFi ambitions. The selection is designed to be additive, not exclusive - Optimism still wants a multi-protocol LST ecosystem. But for now, Ether.fi gets to be the core building block. Optimism.

NEWS IN THREE SENTENCES

Protocol News 🏦

🤖 Khorus Brings 4,500 AI Agents to SKALE's Gas-Free Playground

The ERC-8004 agent launchpad is launching on SKALE on Base, combining tokenized autonomous agents with private, gas-free execution. Khorus already accounts for roughly 10% of all ERC-8004 agents in circulation, and now they get BITE encryption plus Base liquidity. You know, infrastructure that actually makes sense for things that need to run 24/7. SKALE Network.

🗺️ Algorand's 2025 Roadmap Is Basically a Checklist of Wins

P2P networking went live, xGov moved grants on-chain, TypeScript 1.0 shipped for smart contracts, and they executed the first post-quantum transaction on mainnet using Falcon signatures. Online stake doubled to 2 billion ALGO and validators increased 121% to nearly 2,000. Rocca wallet and AlgoKit 4.0 are coming in 2026. Algorand.

🏗️ MultiversX Wants Builders to Shape What Comes After Supernova

Build Wars is a $50K+ hackathon running December 16 to January 13, focused on DeFi, gaming, and infrastructure that takes advantage of the upcoming network upgrade. The emphasis is on AI-native applications - autonomous agents, decision engines, and tooling that operates at Supernova speeds. Projects built here become the reference implementations everyone else copies. MultiversX.

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋