- Cryptotwits

- Posts

- Thanos Works At X Now: InfoFi Tokens Didn't Even Get a Goodbye ☠️

Thanos Works At X Now: InfoFi Tokens Didn't Even Get a Goodbye ☠️

Snap And 100% Of InfoFi Went Poof

OVERVIEW

Thanos Works At X Now: InfoFi Tokens Didn't Even Get a Goodbye ☠️

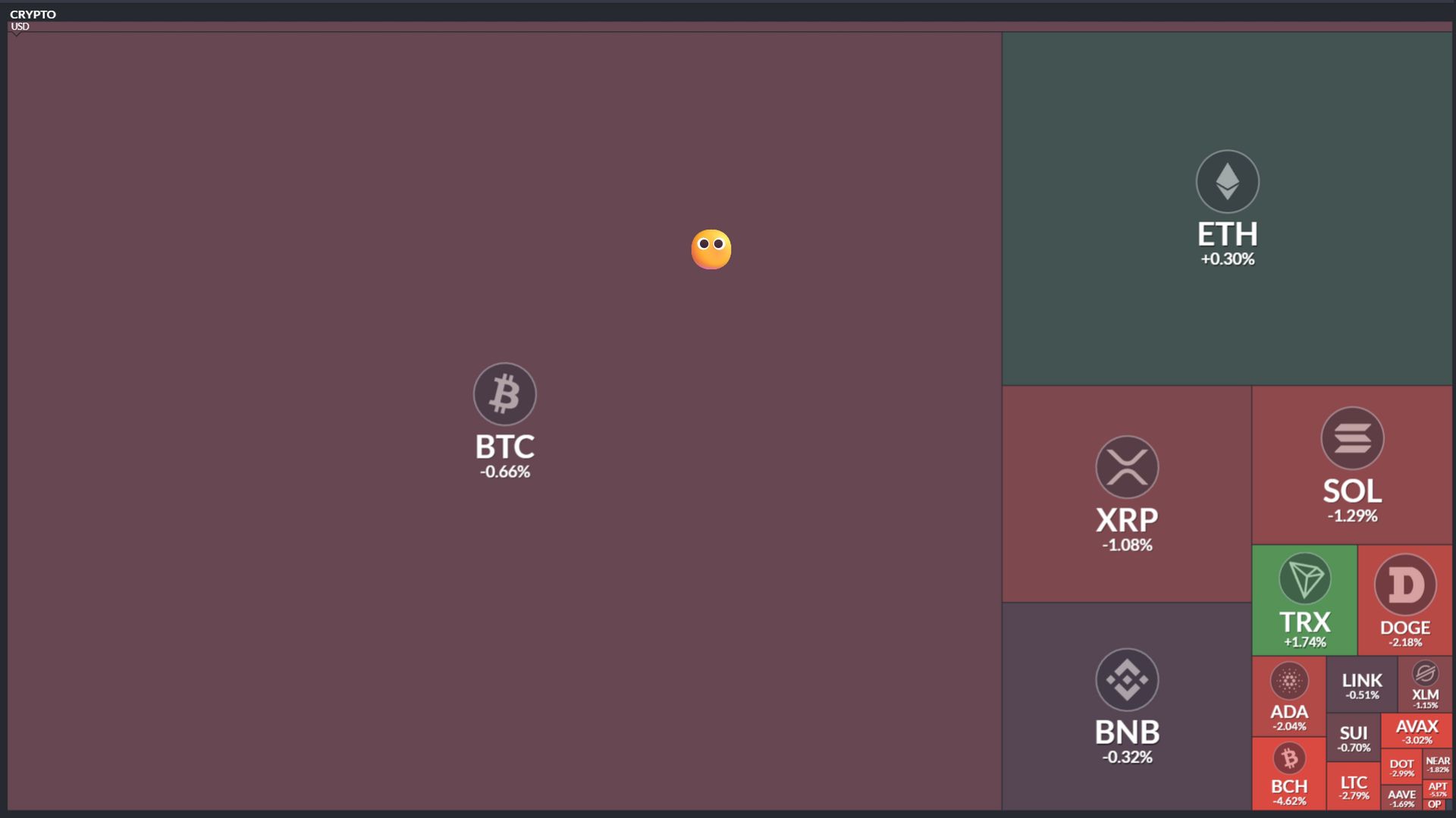

Before we dive in, here’s today’s crypto market heatmap:

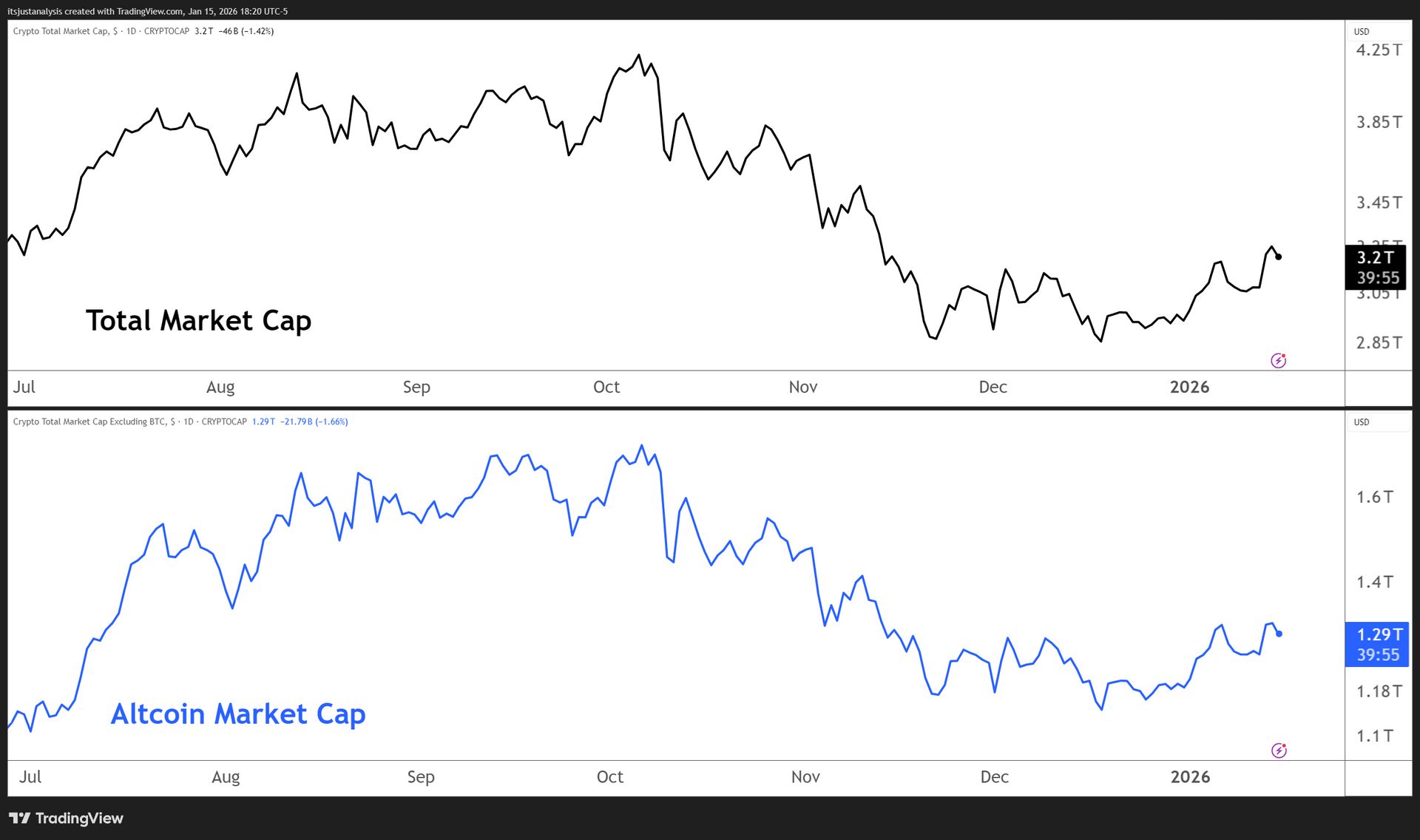

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Breaking: Decentralization Advocates Shocked Their Centralized Platform Can Do Whatever It Wants 😐️

One man snapped his fingers and half of SocialFi just turned to dust. 🤌

X Head of Product Nikita Bier casually announced Wednesday that the platform would no longer tolerate "infofi" apps - crypto projects that paid users to post.

No warning. No negotiation. Just snap. API access revoked. Tokens vaporized. Founders left staring at their screens wondering if this was all a bad dream.

$KAITO ( ▲ 8.81% ) dropped 20% in thirty minutes. COOKIE melted. $LOUD ( ▲ 0.74% ) went quiet. The entire InfoFi sector shed $40 million in market cap faster than you can say "maybe we shouldn't have built our entire business on someone else's platform."

But the real tragedy? Noise - another InfoFi project - had just posted this:

One day later: Bier deleted their entire industry.

Somewhere, a VC is staring at a term sheet wondering if there's a "acts of Nikita" clause. Pour one out for whatever poor soul led that round. They didn't even get 24 hours to celebrate.

Bier's reasoning was simple: bots were running wild. When asked if projects could pay more for API access, he delivered the kill shot: "They were already paying us millions. We don't want it."

His parting gift to affected developers? "Please reach out and we will assist in transitioning your business to Threads and Bluesky." That’s nice. 🤯

NEWS

Chainlink Gets Its Own ETF. TradFi Discovers Oracles 🧞

Bitwise just dropped a Chainlink ETF on NYSE Arca. Ticker: $CLNK ( ▼ 3.07% ). 👀

If you're wondering why Chainlink specifically, it’s because, well, it’s Chainlink. If Aave is the ‘Bitcoin’ of the lending space in crypto, Chainlink is the Bitcoin of oracles.

Blockchain’s can't talk to the outside world on their own. No price feeds, no weather data, no "did this shipment actually arrive" verification. Chainlink's oracle network pumps real-world information into smart contracts (price feeds, weather data, etc) and they’ve pretty much become the default infrastructure for basically everything in DeFi that needs external data.

The numbers back it up. Chainlink has facilitated $27 trillion in transaction value across 70+ blockchains since 2017. Aave and Polymarket run on it. More than $100 billion in smart contracts depend on its price feeds not lying. And the TradFi partnerships read like a Davos guest list - JPMorgan, Mastercard, SWIFT - all using Chainlink for tokenization and cross-border payment projects.

This is Bitwise's latest altcoin ETF play after their recent filings, and it signals something broader: the "picks and shovels" thesis is going mainstream. Chainlink isn't a flashy L1 or a memecoin casino. It's infrastructure. Plumbing. The unsexy middleware that makes DeFi actually work. 💪

NEWS

Ripple Pays $150M to Get RLUSD on Institutional Desks 💸

Ripple just wrote LMAX Group a $150 million check to integrate RLUSD across their trading infrastructure. 💴

LMAX isn't some nobody. They moved $8.2 trillion in institutional volume last year - banks, prime brokers, the kind of shops that still use Bloomberg terminals and fax machines. So Ripple paying nine figures to embed their stablecoin as collateral, margin funding, and settlement currency across that infrastructure? It's a distribution deal with a very large number attached.

The actual value proposition buried in the corporate-speak: 24/7 collateral movement. If you're an institution needing to reposition on a Sunday night, fiat rails are closed. Stablecoins aren't. $RLUSD ( ▲ 0.01% ) as margin for perpetuals and CFDs means no waiting for Monday's wire to clear.

Whether that's worth $150 million to Ripple is their problem. But RLUSD clawing into top 5 USD-backed stablecoin territory suggests they're playing the long game on market share - and they're willing to pay for shelf space. 🏪

NEWS

All 100 Sui Validators Agreed on One Thing: Crashing 💀

$SUI ( ▼ 1.98% ) ’s blockchain went completely offline Tuesday for nearly six hours. No blocks. No transactions. Just $1 billion in TVL sitting there, frozen, while all 100 validators crashed simultaneously. 😱

The network stopped producing checkpoints at 2:22 PM UTC and didn't come back until 8:44 PM. Every DeFi protocol on Sui - Suilend, NAVI, Cetus, Bluefin - just stopped working. Users couldn't touch their funds. The Sui Foundation called it a "network stall," which is a polite way of saying the entire chain bricked itself.

This is Sui's second major outage in 14 months. There was also a 2.5-hour crash in November 2024 and degraded performance in December. For a chain that marketed itself as the reliable alternative to Solana's early chaos, that's not a great look, because, well, it makes the old jokes about Solana always breaking seem repetitive.

No funds were lost. SUI actually pumped slightly during the outage - because crypto. 😶

NEWS

SEC Drops Zcash Investigation After Two-Year Fishing Expedition 🎣

The SEC just closed its investigation into Zcash Foundation. No charges. No enforcement action. No recommended changes. Just a quiet notice saying "we're done here" after dragging this out for nearly two and a half years. 👍️

On August 31, 2023 - peak Gensler era - the Foundation got a subpoena tied to one of those ominously vague SEC probes labeled "In the Matter of Certain Crypto Asset Offerings."

The investigation never specified what exactly they were looking for. Privacy coin doing privacy things? Possible unregistered security? Who knows. The SEC kept fishing.

Then the regime changed. Paul Atkins took over as SEC chair. Hester Peirce started running a crypto task force. Suddenly the agency began dropping cases faster than they filed them - Coinbase, Kraken, Robinhood, Uniswap, OpenSea, Gemini.

Add $ZEC ( ▼ 0.72% ) to that list. 📜

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

⛏️ Lisk-Backed SigraFi Is Lending to Small Gold Miners Because Banks Won't

MSME gold producers generate 20% of global output but face a $6.5 billion annual funding gap because traditional lenders can't justify the due diligence costs. SigraFi structures financing around gold offtake instead of balance-sheet lending - they take a fixed percentage discount on production rather than charging cash interest. The loan notes are issued on-chain for efficient capital formation, and 50% of net profits go into acquiring physical gold for the collateral treasury. Lisk.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🇮🇹 World Network Launched in Rome Because Italy Has a €181 Million Online Fraud Problem

The Orb-based proof of human verification is now available in Italy, making it the fifth EU country after Austria, Germany, Poland, and Portugal. One in five Italians have fallen victim to online shopping scams, rising to one in three among 25-34 year olds - Worldcoin is proving you're human without revealing who you are. Ticketing, financial services, dating apps, and gaming all get use cases where distinguishing humans from bots actually matters. Worldcoin.

🐾 Axie Infinity and Moku Are Doing a Crossover Event With Accessories You Can Actually See

Moku Minis are limited-edition accessories you get by purchasing and opening Grand Arena Booster Boxes - supply ranges from 444 Moku Ratz Sacks to 2,888 Moki Coins. The ultra-rare Ratz Fairy requires a three-step process: buy a booster box, purchase 500 gems in Grand Arena, and complete seven Bounty Board quests across two snapshot phases. Axie Infinity.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

💰 Core's 2026 Roadmap Is Basically "Make Everything Generate CORE Buybacks"

It’s a fairly basic strategy: expand Bitcoin yield sources through AMPs, LSTs, and Dual Staking Marketplaces, then ensure every revenue stream feeds into CORE token demand. SatPay is a neobank where you borrow stablecoins against yield-bearing BTC, spend them on a debit card, and let ongoing yield repay the loan - self-repaying Bitcoin loans as consumer product. Core.

🔧 NEAR Infrastructure Committee Spent 2025 Making Chain Abstraction Actually Work

The year's highlights: all native wallets integrated with NEAR Intents for cross-chain swaps, Tachyon won the chain-abstracted relayer RFP, and Goldsky plus The Graph now handle indexing for a blockchain with sub-second blocks and multi-sharding. 2026 focus: scaling MPC networks, sharded RPC nodes, and privacy-focused infrastructure for "user-owned AI." Near Protocol.

NEWS IN THREE SENTENCES

Protocol News 🏦

⛽ Hedera Finally Figured Out Gas Shouldn't Be Both the Billing and the Bottleneck

HIP-1249 replaces the conservative 15 million gas-per-second throttle with precise operations-per-second measurement, since testing showed Uniswap actually runs at 150 million gas/sec on Hedera - ten times the limit. The 80% minimum charge rule is gone too, so you pay for what you use instead of getting billed for 12 million gas when you used 2 million. Hedera.

📚 Cardano Published 24 Papers in 2025

Input Output Research exceeded their target with peer-reviewed work across Ouroboros improvements, tokenomics, governance, and zero-knowledge proofs: Leios got handed to engineering with a CIP submission, and anti-grinding protections are ready for deployment. The reports cover everything from fast settlement protocols to UC-secure state channels to game-theoretic models of block-minting incentives. Cardano.

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋