- Cryptotwits

- Posts

- Swift Rip Beats Slow Bleed 🩸

Swift Rip Beats Slow Bleed 🩸

Just do it already *looks away* *holds breath*

OVERVIEW

Swift Rip Beats Slow Bleed 🩸

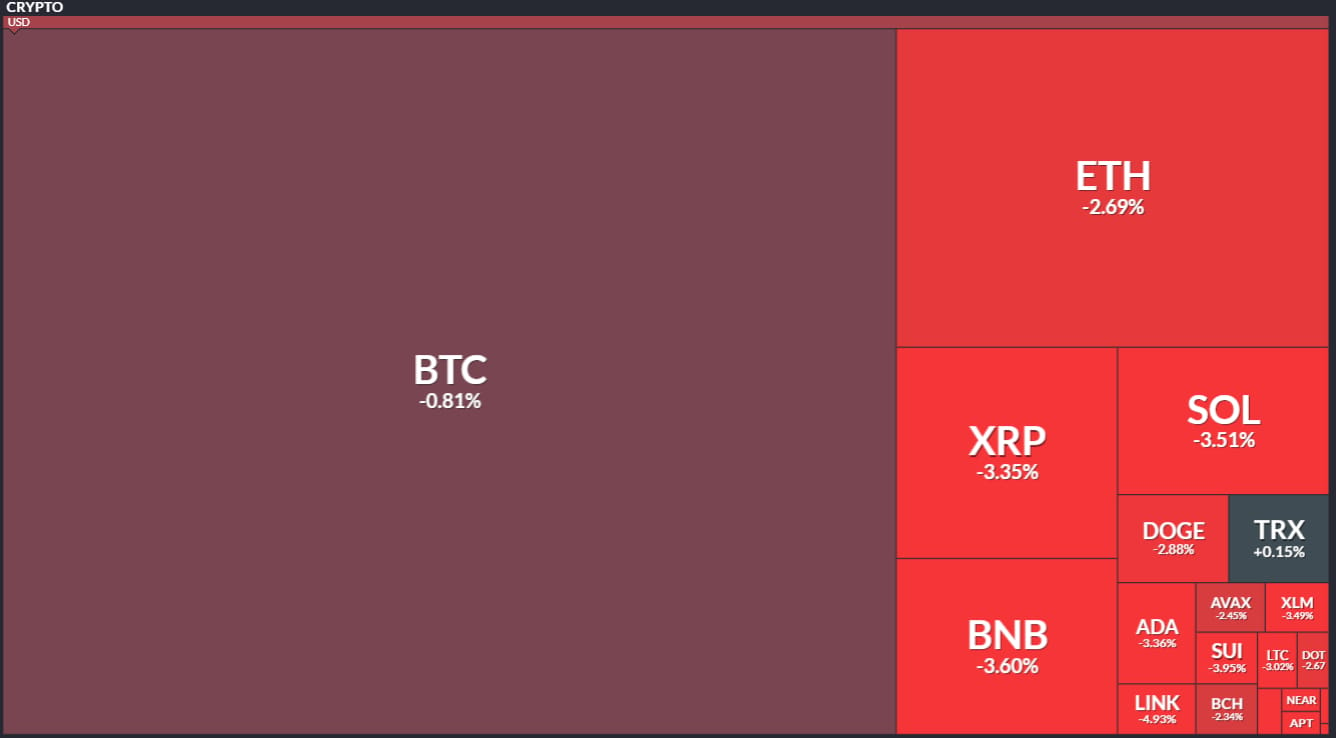

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

Please No 😐️

$AVAX.X ( ▲ 1.83% )’s daily chart is a pretty good stand in for the majority of the crpyto market - they all look very similar to this:

There’s a lot of smart people posting on Stocktwits and on X about another 30-ish% drop. If you’re wondering where that value comes from, one way is probably the Fibonacci extension I drew in the screenshot above.

If it does happen, let’s hope its like a swift band-aid removal - just rip, burn and it’s over. What no one wants is a two to three week long infection building up. That just sucks. 👎️

PRESENTED BY STOCKTWITS

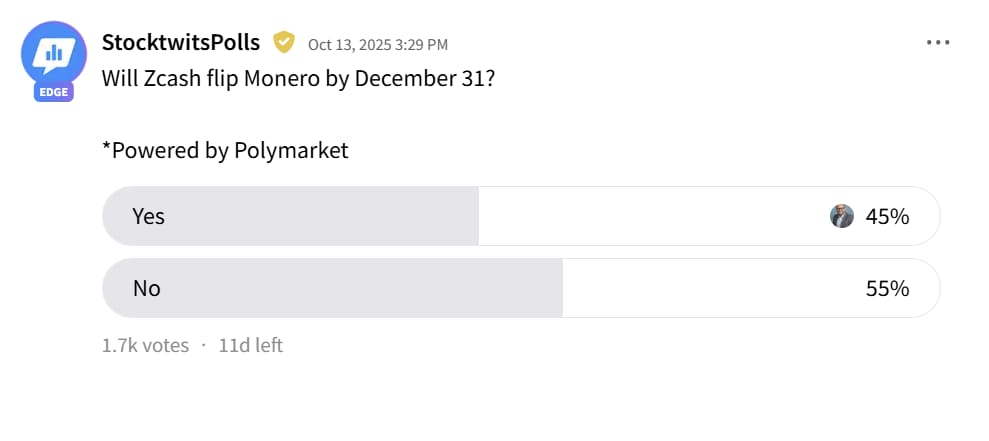

Take This Poll: Will Zcash Flip Monero? 👇️

What do you think? 🤔

This is really starting to tighten up, it’s one of the closer polls we’ve had in a while. 🧠

DEFI

Never Lose Your DeFi Position To A Sleepy Liquidation Again? 🙏

$AAVE.X ( ▼ 1.82% )’s Unified Protection automates the two things that actually stop liquidations: add collateral or repay debt. You pick the strategy. It watches your health factor nonstop and fires before you slip under 1. 🧠

After the Oct 10 leverage wipeout that nuked roughly $19B in positions, tools like this are the difference between a red candle and a wrecked account.

More Of This, Please

Liquidation risk stalks borrowers. When your health factor gets too low, the protocol lets someone sell your collateral at a discount, plus fees. That is how the system stays solvent.

Unified Protection sits on top of that reality and acts early. It monitors your threshold, then automatically:

Adds collateral to boost your health factor if you want to keep the position.

Repays debt to delever when the market goes feral.

Runs both in a priority order you set, so it adapts to what you actually have in your wallet.

It is built around $REACT.X ( ▼ 5.14% )’s Smart Contracts. No babysitting your dashboard all night. 💤

What This Could Have Fixed On Oct 10

Leverage met gravity on Oct 10 and the market coughed up the biggest liquidation cascade on record. If you were anywhere near max size with a thin buffer, you paid. Hard. 🤕

Now picture the same day with Unified Protection switched on (hypothetically):

You set a threshold at, say, 1.20 with a target at 1.50.

Price gaps down. Health factor slips toward the line.

The system tops up collateral from your pre-approved stash or repays a chunk of debt.

Your HF bounces before it kisses 1.

You avoid the forced sale and the liquidation fee.

You live to fight the next candle. That is the whole point.

DeFi needs fewer klaxons and more airbags. Automated, user-defined protection that adds collateral or repays debt before liquidation is the airbag. The Oct 10 flush was the wake-up call. If you plan to borrow, plan to automate protection. Otherwise you are betting your PnL on your sleep schedule. 😴

SPONSORED

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

PRESENTED BY STOCKTWITS

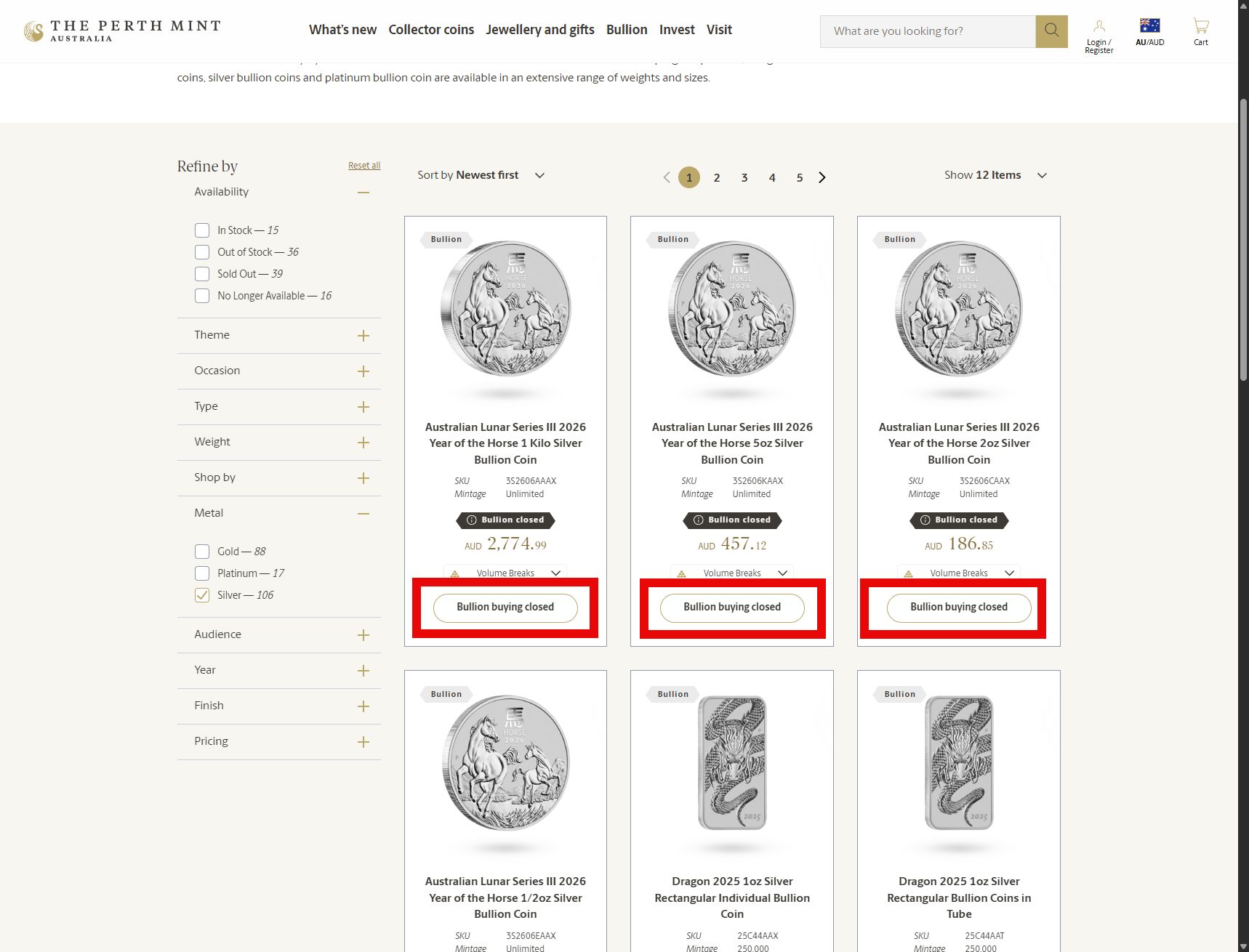

I Had To See It For Myself 👀

The Perth Mint (basically Australia’s version of the U.S. Mint) is not letting anyone buy silver. I heard that, but I had to check it out. And holy Sarah Conner fighting a Terminator it’s true:

Cryptotwits readers are huge fans of precious metals - bullion and crypto go hand in hand. So when crazy stuff like this happens, it’s gonna make the final draft. But the Perth Mint door slam isn’t the big deal - it’s what Jesse Colombo of The Bubble Bubble Report wrote today:

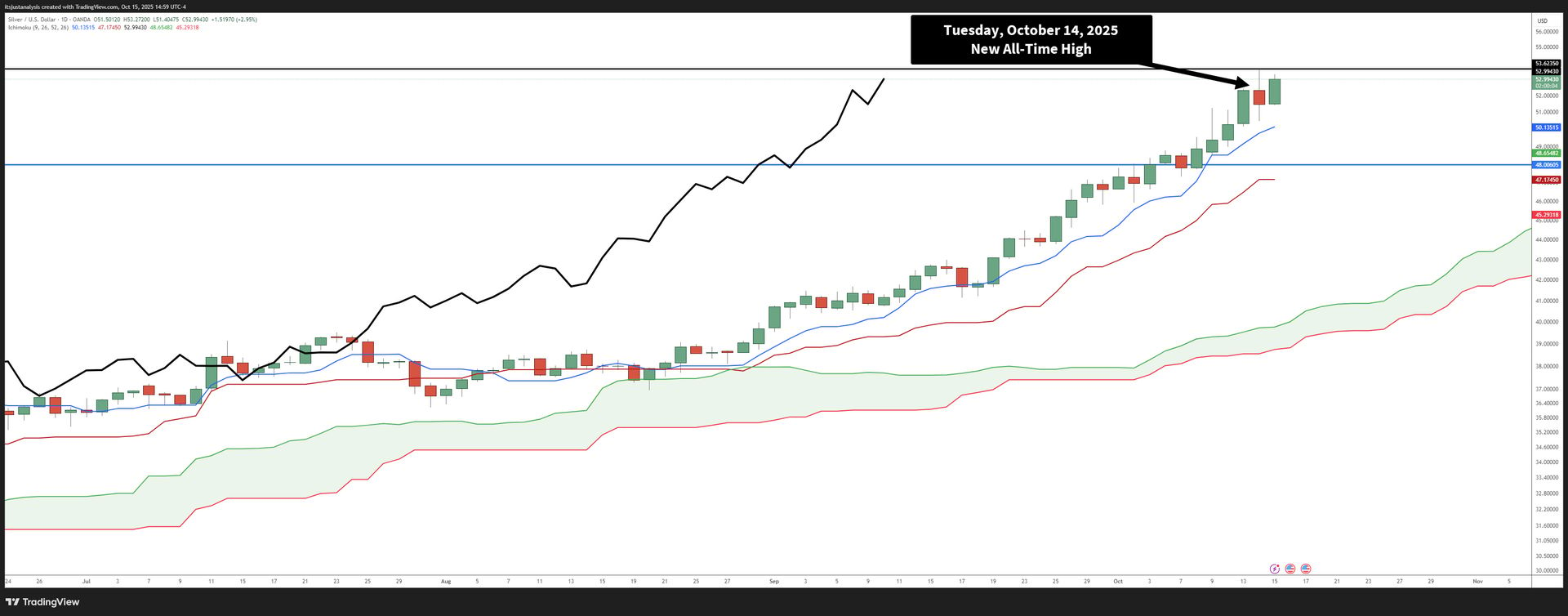

“… a sudden and aggressive price slam occurred starting at roughly 1:20 AM (Tuesday) New York time. This occured well outside of regular trading hours, when most traders were asleep and liquidity was very thin."

He continues, and this is the nucking futs part:

“At that moment, at least 20,000 silver futures contracts were dumped onto the market. This triggered a sharp sell-off that drove the price below the key $50 level, with silver sinking as low as $48.75 within just one hour.

That volume of contracts represents 100 million troy ounces of silver, or nearly 12% of global annual production.” 🤯

Spoiler: it didn’t work:

Not only did silver make a new all-time high yesterday (the day of the 20k dump), but it’s looking like today the squeeze is going to keep going. And it could very well do it again today. 😨

NEWS

Figure’s YLDS Goes Live On Sui. Regulated Yield With Actual Teeth 🪥

Straight from Sui’s official blog: Figure Certificate Company is issuing YLDS natively on Sui after Figure’s recent Nasdaq debut under FIGR. 🤔

Wut’s A YLDS?

YLDS is a registered debt security. Backed by T-bills and repos on T-bills. Pays SOFR (secure overnight financing rate) - 0.35%, accrues daily, pays monthly. Retail and institutions can hold it. Transfers are instant.

If stablecoins are the checking account of crypto, this is the insured-sounding-but-not-actually-insured savings account vibe, minus the marketing lies. 🥷

Fiat Access & Roadmap

Figure and Sui are exploring direct fiat rails so users can on/off-ramp USD without relying on the usual exchange circus. There’s also talk of using SUI as eligible collateral inside Figure’s lending platform.

If that lands, SUI picks up fresh utility and a cleaner path into real-world credit flows. 🫢

It’s The Grown Up In The Room

U.S.-friendly DeFi needs products that pass compliance sniff tests and still feel like crypto. YLDS checks boxes most “stable-yield” ideas dodge:

Registered security with public-company level reporting.

Backed by short-duration sovereign risk and repos.

Onchain issuance, instant transfers, 24/7 liquidity.

Composable with margin infra on day one.

The part that matters is the cash flow and the routing. This gives builders a safer base layer than “trust me bro” yields and a way for institutions to step in without playing regulatory Twister. 🌪️

PRESENTED BY STOCKTWITS

Stonks Climb Wednesday: PZZA Buyout Buzz 🍕

Here’s a quick hit on what’s happening with stonks from our very own Kevin Travers - who authors the stonkmarket newsletter we have, The Daily Rip. 🧦

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🔒 ZCash vs COTI: Privacy, But Make It Programmable

ZCash kicked off crypto privacy in 2016, proving you could hide transactions using zero-knowledge proofs. But COTI’s new garbled circuits tech doesn’t just hide data - it lets multiple parties compute on encrypted data together, meaning private DeFi, AI training, and even audits without exposing a thing. Think of it like ZCash whispered your secrets; COTI builds a private group chat that never leaks. Coti Network.

🤖 Qtum’s Ally Is the AI That Actually Does Stuff

Well, this is a surprise, Qtum actually has a website working and an active blog post. Anyway, Qtum’s new agent, Ally, connects AIs like GPT or Claude to real apps via the Model Context Protocol (MCP) - basically a universal plug for AI tools. You can ask it to fetch data, automate tasks, or run workflows across platforms instead of just chatting. If ChatGPT answers questions, Ally’s the version that books the meeting, fills the form, and hits “send.” Qtum.

💵 Ethena’s USDtb Becomes First Federally Regulated Stablecoin

For crypto, this like watching DeFi finally get a banking license. Ethena handed smart contract control of USDtb to Anchorage Digital, making it the first stablecoin officially regulated under the U.S. GENIUS Act. Anchorage now handles minting and redemptions, turning what was once offshore into fully compliant onshore money. Ethena.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏠 Landshare v2 Turns Real Estate Into Clickable DeFi

Imagine buying into a rental property the same way you stake tokens - no brokers, no paperwork, just rent money hitting your wallet. Landshare’s upgrade brings tokenized houses, rental yields, and full DeFi integration under one roof - literally. Its three pillars - Real Asset Vault, Tokenization Hub, and DeFi Suite - let users deposit USDC and earn yield from on-chain real estate without touching a single lease. LandShare.

💎 Lympid Goes Live on MANTRA Chain, Fractionalizing Luxury

Picture buying one share of a Ferrari instead of the whole car - still brag-worthy, far cheaper to maintain. From Porsches to Rolexes to racehorses, Lympid now tokenizes high-end assets on MANTRA Chain so anyone can invest with as little as $30. The platform already has $100M in RWAs committed and $16M processed. MANTRA,

PRESENTED BY STOCKTWITS

Chart Art: Top Ideas From The Stocktwits Community 📺️

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

💫 mXRP Becomes Midas’s Fastest-Growing Yield Token

In just two weeks, Midas’s mXRP vault hit $30M in deposits, outpacing all prior launches. The token turns XRP into a yield-bearing asset via delta-neutral trading - earning returns without betting on price swings. It’s like staking XRP but with a Wall Street risk desk quietly compounding it in the background. Axelar.

📊 Band Goes Live on Kasplex to Power DeFi With Real Data

Band Protocol integrated with Kasplex (Kaspa’s Layer 2) to feed real-world price data to Zealous Swap’s Fervent platform. Validators fetch and verify prices, ensuring DeFi apps run on truth, not vibes. It’s the oracle making sure DeFi math adds up before you stake your savings. Band.

NEWS IN THREE SENTENCES

Protocol News 🏦

🏛️ NEAR Launches House of Stake: Governance Grows Up

NEAR’s new governance platform lets users lock NEAR for veNEAR (oh the puns that were avoided) power and vote on proposals via a curated committee structure. It’s an evolution from DAOs that often devolved into token-whale playgrounds, now with AI tools planned to guide policy decisions over time. NEAR Protocol.

🧮 Cardano’s Smart Contracts Can Now Be Verified at Machine Level

Developers can finally prove Cardano contracts are bug-free at the actual bytecode level - no guesswork, no compiler trust falls. The new Lean4-based tool verifies Untyped Plutus Core directly, finding bugs and even generating counterexamples automatically. In plain English: it’s like checking not just your essay but the ink on the paper to make sure every letter means what you intended. Cardano.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋