- Cryptotwits

- Posts

- Support Level Found: The Floor. Of Your Apartment. Where You're Lying. 😵

Support Level Found: The Floor. Of Your Apartment. Where You're Lying. 😵

Fetal position is a valid trading strategy now.

OVERVIEW

Support Level Found: The Floor. Of Your Apartment. Where You're Lying. 😵

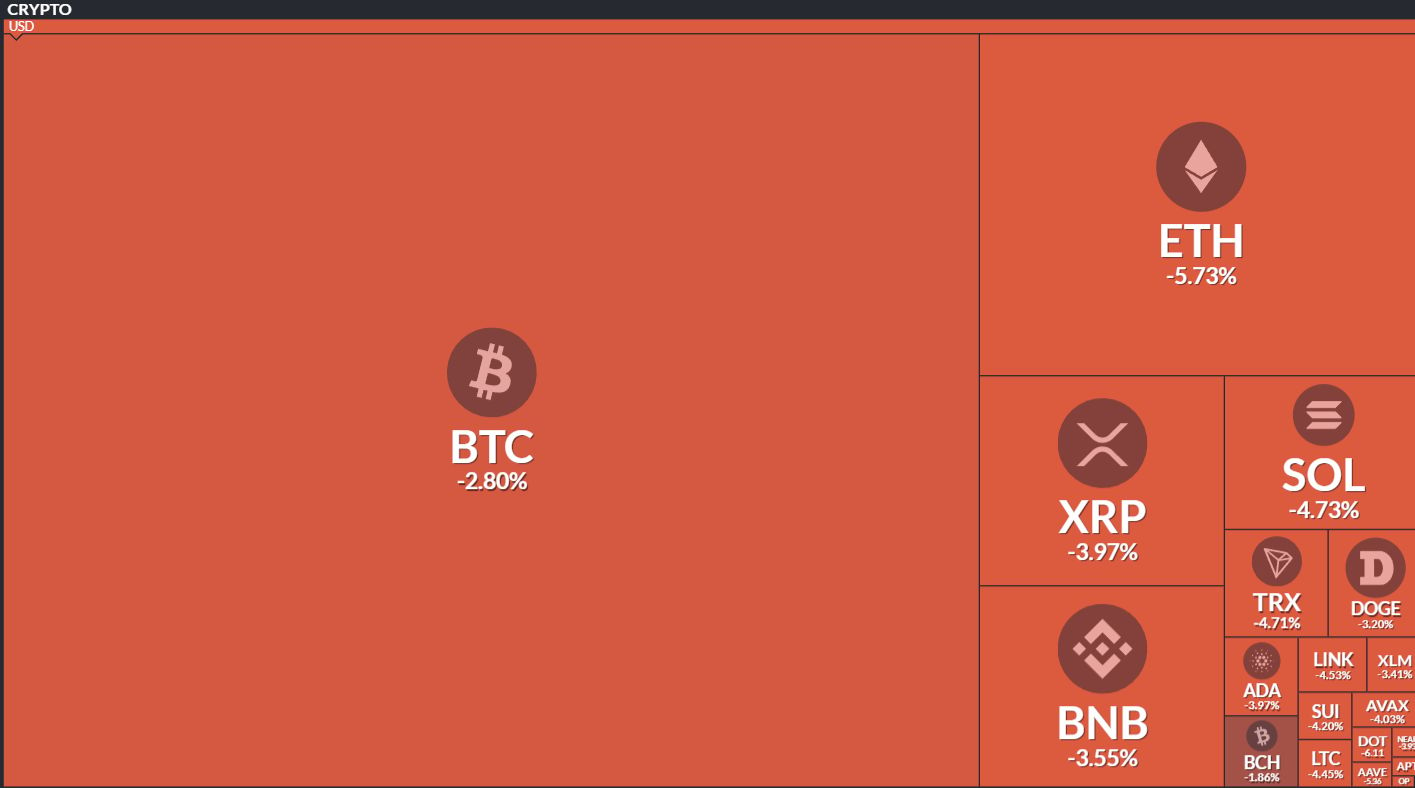

Before we dive in, here’s today’s crypto market heatmap:

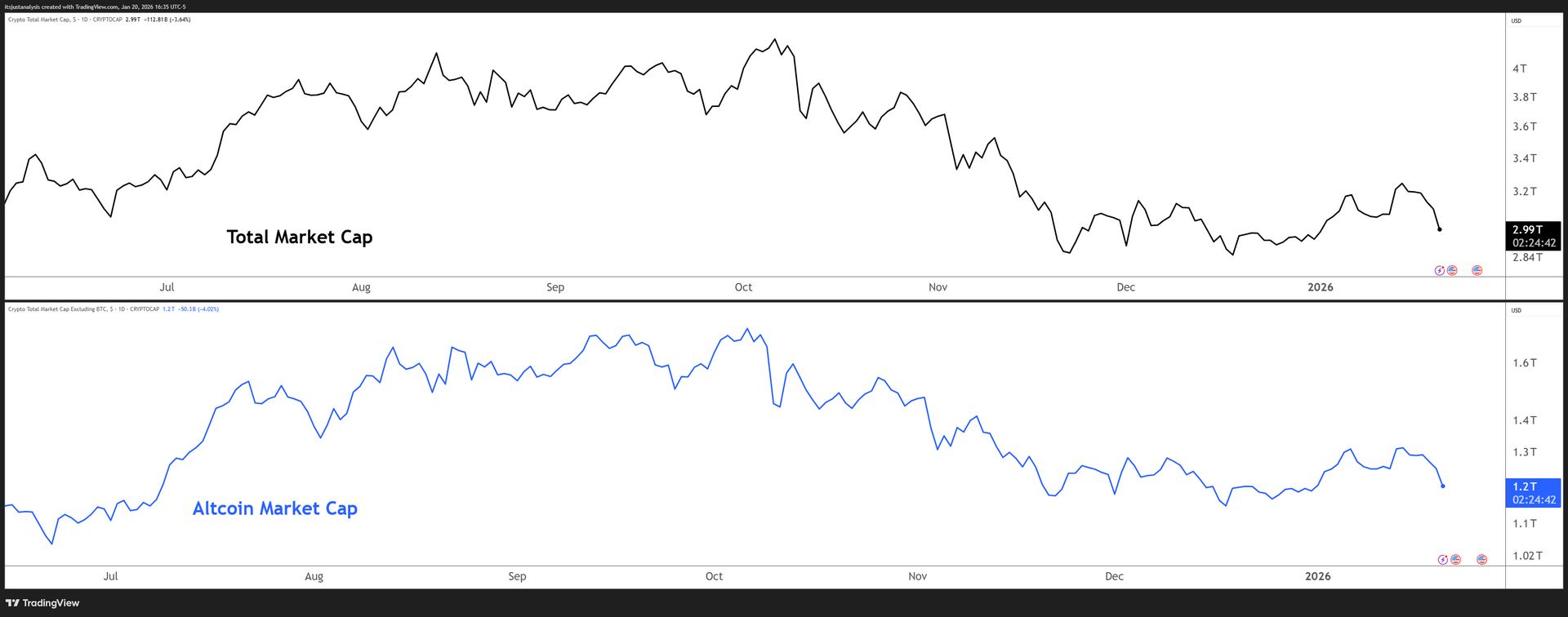

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

Just A Reminder: We’re In The Suck Zone 🚨

Do you feel like the market has been giving you false senses of hope and fake FUD? Does it feel like the pain, indecision, and general fookery has lasted a long time? Well, you’re not wrong. 🤔

For long time readers of this newsletter, you know where I’m going with this. For those that are new, prepare thine eyes and minds for the best reason I can find for crypto’s current price action bull shittery.

Welcome To The Cloud

One of the best things about the Ichimoku Kinko Hyo system isn’t the strategies that tell people when the best opportunities to go long or short occur, one of the best things about it is it shows you where and when not to do a god damned thing.

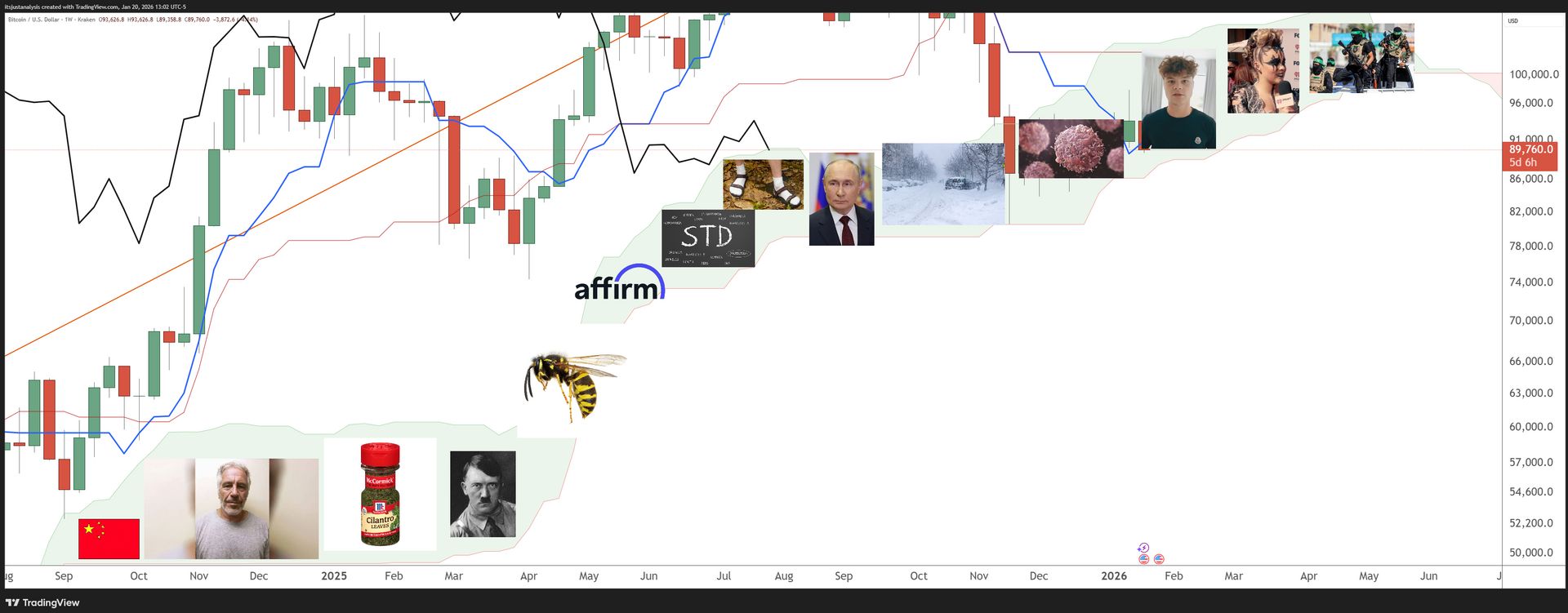

That no-go zone is called the Kumo, or The Cloud. And that’s where Bitcoin is currently at on its weekly chart:

Now, if you don’t know anything about the Ichimoku system, that’s cool. That’s fine. You might be looking at the blob of green and think, ‘so?’. Here’s the thing about that most horrible of places: everything bad in the world exists inside the Cloud.

Here’s proof:

Personally, this all feels like the majority of what 2023 felt like:

If you were in crypto at that time, then you know what I’m talking about. Lot’s of false breakouts, plenty of fake sell offs, and a general vibe of ‘meh’. And that’s where we are today. Bitcoin is now in it’s eleventh consecutive week of being exposed to the inside of this nightmare known as the Cloud. 🧠

NEWS

NYSE Goes On-Chain: 24/7 Stock Trading Is Coming (But Don't Ask Which Blockchain) 🤫

The New York Stock Exchange announced it's building a platform for trading tokenized securities with 24/7 operations, instant settlement, and stablecoin-based funding. 😱

What the press release/news it doesn't include: which blockchains NYSE is using.

The announcement mentions "multiple chains for settlement and custody" without naming a single one. NYSE is staying chain-agnostic while regulators figure out which networks get the institutional stamp of approval.

Here's what we do know about some of the plumbing.

ICE is working with BNY Mellon and Citi to support tokenized deposits across its clearinghouses.

BNY launched its tokenized deposit capability earlier this month on a proprietary private blockchain, using Fireblocks and Chainalysis for custody.

Citi built its infrastructure on Hyperledger Besu through its CIDAP platform.

DTCC received SEC approval in December to tokenize U.S. Treasury securities on Canton Network.

ICE has also been busy building adjacent partnerships. $LINK ( ▼ 4.76% ) started providing ICE's FX and precious metals data on-chain last August.

$CRCL ( ▼ 3.62% ) signed an MOU in March to explore $USDC ( ▲ 0.01% ) integration across ICE's exchanges and clearinghouses - likely the foundation for that stablecoin funding mechanism.

If this launches as described, you'd be able to trade tokenized $AAPL ( ▼ 1.09% ) at 2 AM on a Sunday, settle instantly, and fund your account with stablecoins. Now TradFi gets to experience 24/7 ruggings and shenanigans like crypto. 🤣

NEWS

Hoskinson vs. Garlinghouse: Crypto's Soul Is on the Table 🥄

Charles Hoskinson just spent 29 minutes on Sundar torching Brad Garlinghouse on and it wasn't about market cap or tech specs. It was about whether crypto should take a deal - any deal - or keep fighting. 🥊

Garlinghouse endorsed the Senate's CLARITY Act draft on January 14th, calling it "a massive step forward." Four days later, Hoskinson responded with a video rant accusing the Ripple CEO of "dangerous capitulation" and handing the keys to the same regulators who spent years trying to destroy the industry.

Can they both be right in their own way.?

Personally, I think Garlinghouse is dead wrong, but I also didn’t spend $150 million and four years fighting the SEC. He earned his pragmatism the hard way. When he says "clarity beats chaos," that's coming from a guy who watched his company get dragged through regulatory hell while competitors operated freely offshore.

His position is simple: imperfect rules beat no rules.

Hoskinson's counter is that, as it stands, the CLARITY Act defaults new tokens to SEC jurisdiction. You have to prove you're not a security. The same agency that sued Ripple, Coinbase, and Kraken now gets to decide who lives and who dies.

And as Hoskinson pointed out, we haven't meaningfully changed securities law since 1933. What passes now stays forever.

The timing made everything worse. Coinbase pulled support over DeFi restrictions and stablecoin yield bans the same day Garlinghouse endorsed the bill. The Senate indefinitely postponed its markup.

Polymarket gives the CLARITY Act 40% odds of passing in 2026. 🎰

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🤖 AstraSync Launches on SKALE to Give AI Agents Digital Passports

AstraSync went live on SKALE on Base, building identity and trust infrastructure for AI agents - think Know Your Agent verification so autonomous bots can prove they're legit. With AI agents now outnumbering human users 45:1 in enterprise environments, someone had to build the passport system. SKALE Network.

🧠 Theta EdgeCloud Hits RapidAPI So 3 Million Devs Can Access Decentralized AI

Theta's on-demand AI inference APIs - Whisper, FLUX, Llama 3.1, and 20+ more - are now live on RapidAPI with pay-as-you-go pricing and zero account setup. Subscribe, copy a code snippet, run inference in under a minute. The real kicker: API demand routes to community-run edge nodes earning TFUEL, which finally closes the loop between developer usage and network rewards. Theta Network.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🌱 VeChain Gets a CNBC Documentary Because Saving the Planet Needs Good PR

VeChain landed a feature in a Global Sustainable Trade Initiative documentary with CNBC as media partner, showcasing how its VeBetter platform tokenizes everyday green actions into B3TR rewards. In just over a year, 5.5 million users joined and the network claims 300,000 kg of plastic diverted, 5,000 tons of CO₂ prevented - all blockchain-verified. VeChain.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🟣 Uniswap Slides Into OKX's Chain Like It Owns the Place

Uniswap just went live on X Layer - OKX's chain - with zero Uniswap Labs fees on every swap. Same app, same liquidity game, new network in the dropdown. LPs and swappers can start immediately with USDG and major stables already there. Uniswap.

📚 Win Merch by Reading Something?

1inch’s DeFi Academy Quest kicked off today and runs through January 24, dropping a new scenario daily that you answer using, you know, the actual blog posts. Daily winners snag T-shirts and bucket hats; reply all five days and you're in the running for a 1inch skateboard. 1inch.

📈 Bancor's 2025: Carbon DeFi Crossed $170M Volume and Institutions Started Calling

Carbon DeFi hit over $170 million in cumulative trading volume across Celo and Sei, while the Arb Fast Lane broke five performance records in three months and ranked #1 in gas consumption on TAC at launch. Token projects like GVNR started using Carbon as primary market infrastructure, and Aureus licensed it for regulated RWA execution. Bancor also filed a 150-page provisional patent with 550 equations. Bancor.

NEWS IN THREE SENTENCES

Protocol News 🏦

⚠️ Sei Is Dropping Cosmos Weight to Hit 200k TPS - Move Your Stuff

Sei accepted SIP-3 last May, which means the network is going EVM-only and deprecating CosmWasm plus native Cosmos transactions by mid-2026. If you're holding USDC.n or other IBC assets, migrate now or risk losing access once inbound transfers get disabled. Sei.

📦 Filecoin Quietly Became a Programmable Cloud and Nobody Noticed

After five years of decentralized storage, Filecoin hit a pivot point in 2025 - transforming into a composable developer platform with over 100 teams already building on Filecoin Onchain Cloud. The network's third RetroPGF round wrapped up, distributing over 500k FIL across 91 projects. Meanwhile, Storacha launched Forge and Akave Cloud added a Filecoin-powered archival tier, because apparently everyone wants verifiable warm storage now. Filecoin.

🔗 STRK Lands on Solana Without the Usual Bridge Drama

Starknet's STRK token is now live on Solana, powered by NEAR Intents - a solver-based system that handles cross-chain execution so users don't have to think about it. You tell it what you want, it figures out how to get there. Liquidity lives on Meteora and Jupiter, which means STRK holders can finally play in Solana's DeFi sandbox without the usual five-step bridging headache. Starknet.

🚀 Stellar's Fund Got a Glow-Up With Actual Accountability

SCF v7.0 splits Build Awards into three tracks - speed, differentiation, and fit - with milestone-based payouts that hold back 40% until your mainnet launch is actually usable. Referrals from trusted ecosystem actors now boost your application, and local ambassador chapters can incubate early projects with up to $15K Instawards. Stellar.

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋