- Cryptotwits

- Posts

- So We Pumped. Now What?

So We Pumped. Now What?

Real or fake?

OVERVIEW

So We Pumped. Now What? 🤷

Before we dive in, here’s today’s crypto market heatmap:

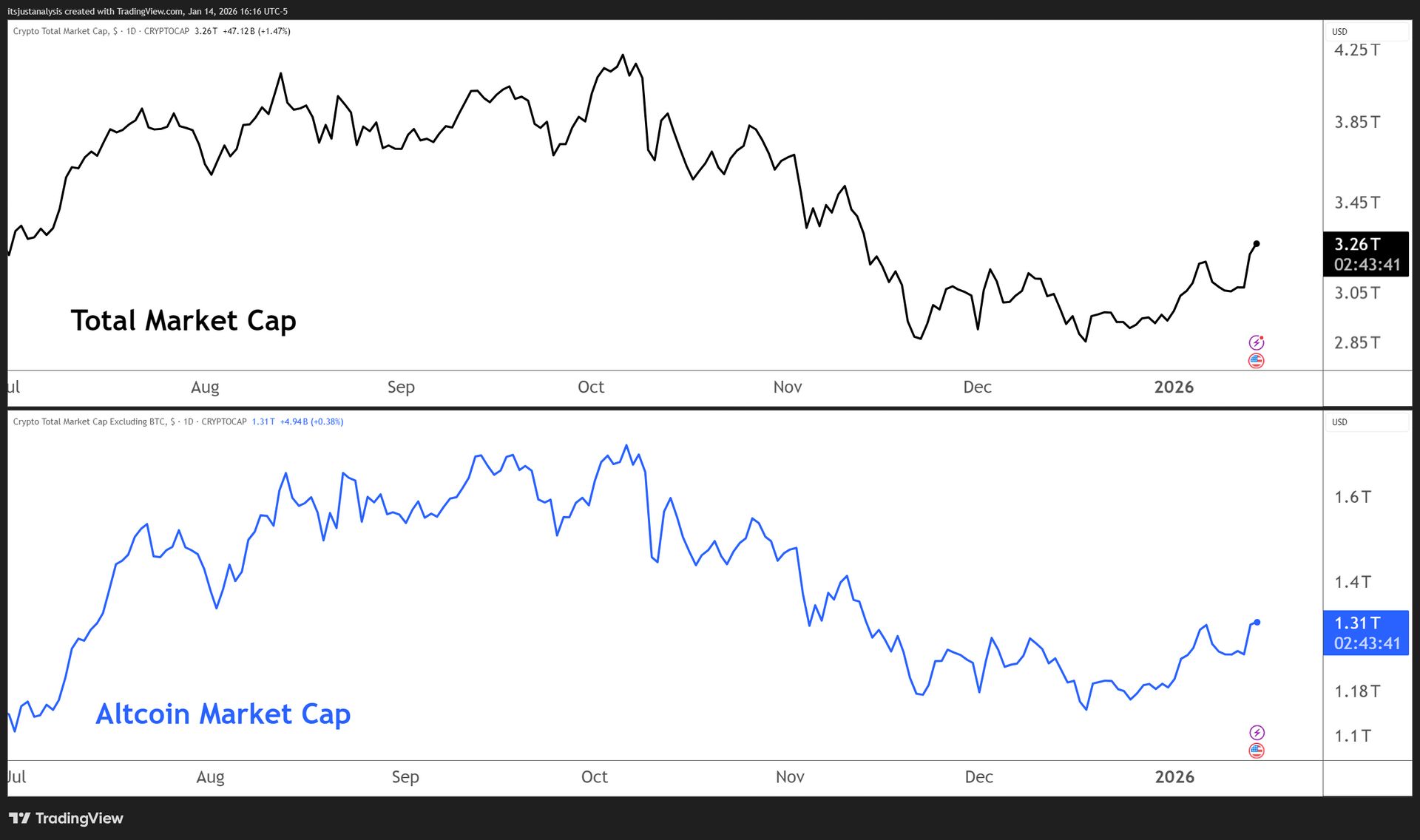

And here’s a look at crypto’s total market and altcoin market cap charts:

ON-CHAIN ANALYSIS

MVRV & Volatility Report For January 14, 2026 📜

Crypto has caught a bid this week. You noticed. Your Discord/Telegram/Group Text noticed. That guy from high school who last texted you in November definitely noticed. 🕵️

But we’ve all been here before: long periods of crypto in the red or in a range, plenty of false breakouts higher, emotions on their last leg.

So how do you cut through the noise? How do you figure out whether this week's rally has legs or if it's just another opportunity for early buyers to exit into your enthusiasm?

You look at who's actually making money - and who's about to tap out.

What We're Measuring

7-Day MVRV - tells you what the most recent buyers are sitting on. These are the tourists, the reactive capital, the "I saw it moving so I bought" crowd. Above zero, people are in profit, below zero, they’re underwater. This is your sentiment thermometer for the trigger-happy cohort.

30-Day MVRV - captures a wider swath-the people who positioned over the past month. This group has more conviction than the 7d crowd but less patience than the true long-term holders. When 30d MVRV is elevated, there's a cushion of unrealized profit that can absorb pullbacks. When it's negative or compressing toward zero, that cushion is gone and the next leg down gets uglier.

1-Week Volatility - adds context to the conviction. Expanding volatility during a rally means the move is aggressive but potentially unstable. Compressing volatility after a move means the market is digesting gains, the springs are coiling rather than exhausting.

Why We’re Focusing On This Right Now

This week's pump moved the needle across the board. Most of these tickers saw their 7d MVRV flip from negative or flat into positive territory. That's new buyers getting rewarded quickly-the exact dynamic that either builds into something bigger or sets up a rug pull when those same buyers rush for the exit.

The question isn't "did it go up?" It did. The question is: who's positioned to hold, who's positioned to sell, and does the current structure support continuation or reversal?

That's what we're about to find out. 👇️

ON-CHAIN ANALYSIS

BTC - Grinding, Grinding, & More Grinding 🪙

Short-term buyers of $BTC ( ▼ 0.99% ) are barely in the green, and the 30d cohort isn't exactly swimming in unrealized gains either. This is what a range-bound grind looks like in on-chain terms: nobody's euphoric, nobody's capitulating.

The Jan 13 spike brought 7d from flat to +4%, now +5%. That's absorption without overheating. The 30d expansion from near-zero to +7% suggests accumulation is happening, but it's patient capital, not FOMO.

Volatility compression after a move is typically bullish for continuation.

The Read: Market's digesting. Not overheated. Not dumping. Classic mid-cycle behavior. The lack of extreme readings either direction means the next directional move hasn't been decided yet.

Lean: Neutral to Bullish

ON-CHAIN ANALYSIS

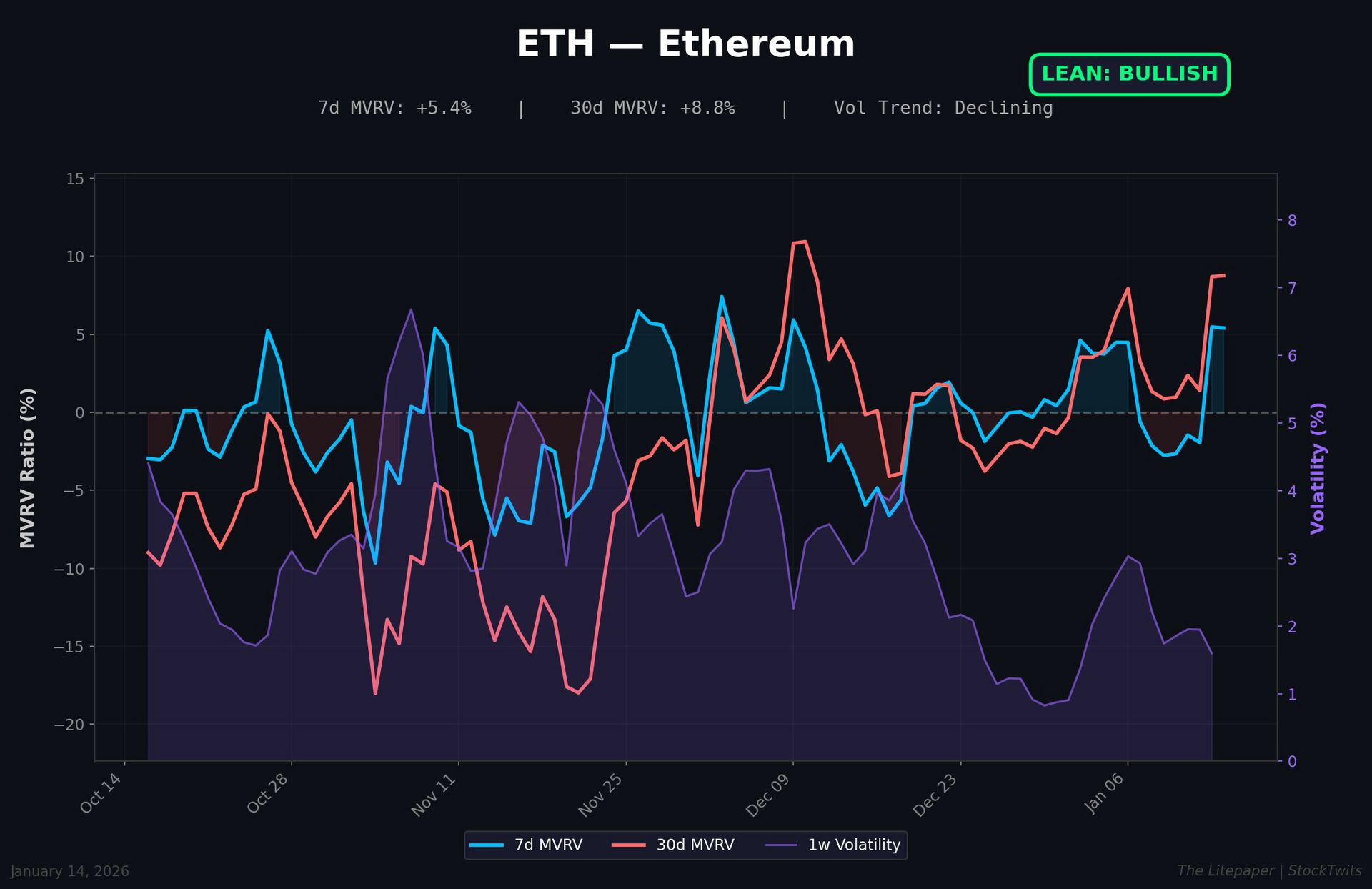

ETH - Healthier Than You'd Think 🧑⚕️

$ETH ( ▼ 2.53% ) ’s 30d MVRV is running hotter than BTC's. That's a subtle but important divergence. The Ethereum buyers over the past month are sitting on nearly 9% unrealized gains on average - enough to feel good, not enough to trigger mass distribution.

The 7d flipped positive on Jan 13 after spending most of early January underwater. That's the short-term pain getting absorbed. When 7d goes from negative to positive while 30d stays elevated, that's dip-buyers getting rewarded.

The volatility compression here is constructive. ETH tends to move violently when it moves - the fact that vol is bleeding off while MVRV expands is textbook accumulation behavior.

The Read: ETH's set up cleaner than the narrative would suggest. The ratio might still be ugly, but the on-chain structure says patient money is ready to park and bark.

Lean: Bullish

ON-CHAIN ANALYSIS

XRP - Somebody Call A Medic 🏥

Nope nope nope nope. A 7d MVRV of -26% means everyone who bought $XRP ( ▼ 1.73% ) in the past week is getting their face ripped off.

The 30d sitting at barely positive (+1.9%) tells you buyers over the past 30 days are mostly in a ‘please don’t crash’ mode. No cushion. Any further downside and you've got overlapping pain across multiple timeframes.

Looking back through the data, XRP hasn't seen 7d MVRV readings this negative since the August flush. The difference? August saw a recovery. The current trajectory is still pointing down.

Volatility coming off highs is the only mercy here - at least the bleeding is slowing.

The Read: Short-term holders are underwater and the 30d buffer is tissue-thin. Until 7d MVRV gets back above -10% minimum, this is dead money at best, falling knife at worst.

Lean: Bearish

ON-CHAIN ANALYSIS

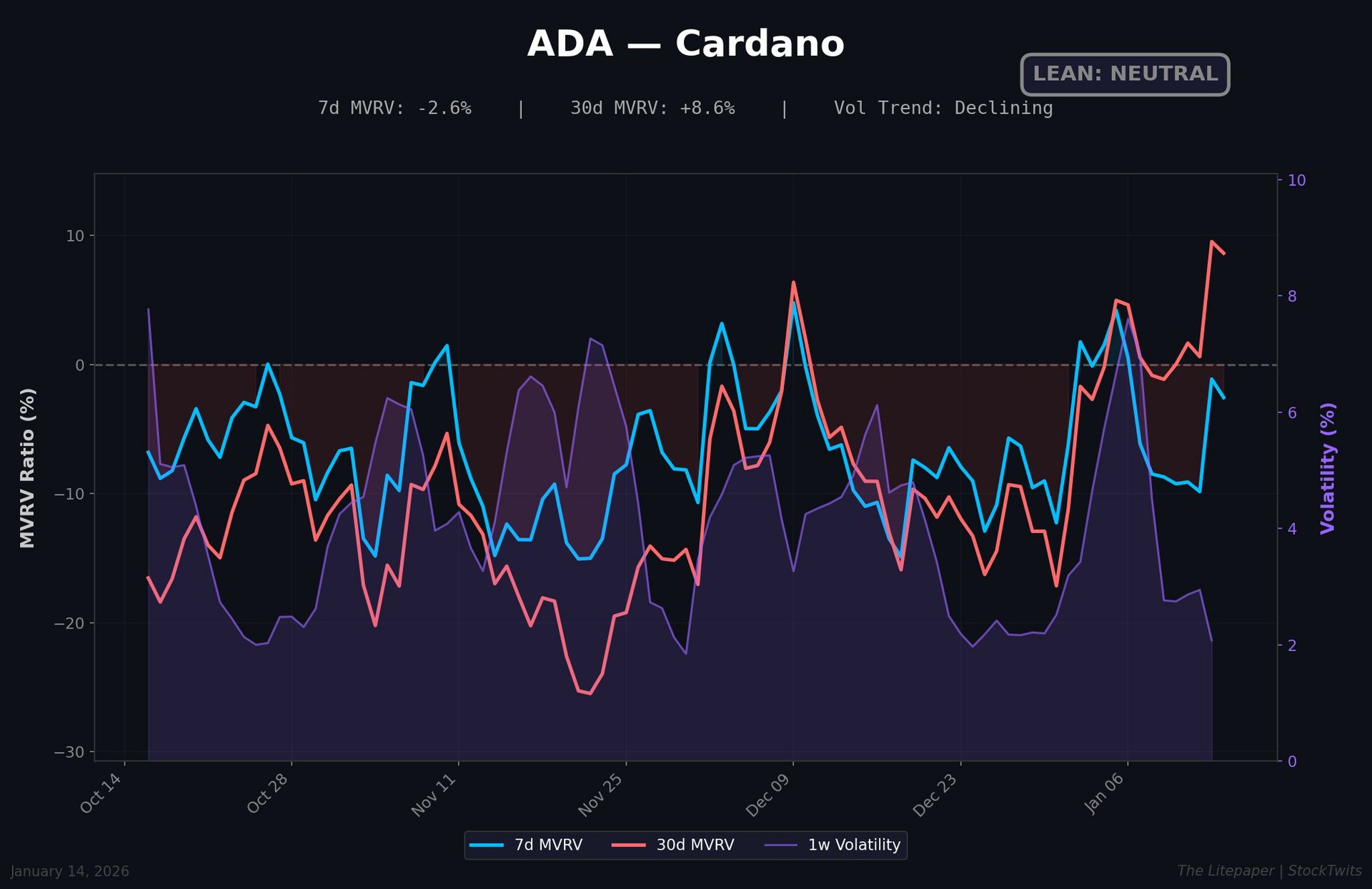

ADA - Stuck in Purgatory 😐️

$ADA ( ▼ 5.3% ) ’s in that annoying middle ground where it's not broken enough to be a screaming buy and not strong enough to ride with conviction. At least in the short term.

The 7d being slightly negative means recent buyers are underwater, but only marginally - this isn't XRP-level carnage. The 30d at +8.6% shows month-long holders still have breathing room.

The divergence between timeframes is worth watching. When 7d is negative but 30d is solidly positive, you're in a "shakeout" pattern - weak hands getting flushed while stronger hands hold. That can resolve bullishly if 7d bottoms and turns. But the opposite is also true.

The Read: Neither fish nor fowl. The data doesn't scream opportunity or danger - it screams wait for confirmation.

Lean: Neutral

ON-CHAIN ANALYSIS

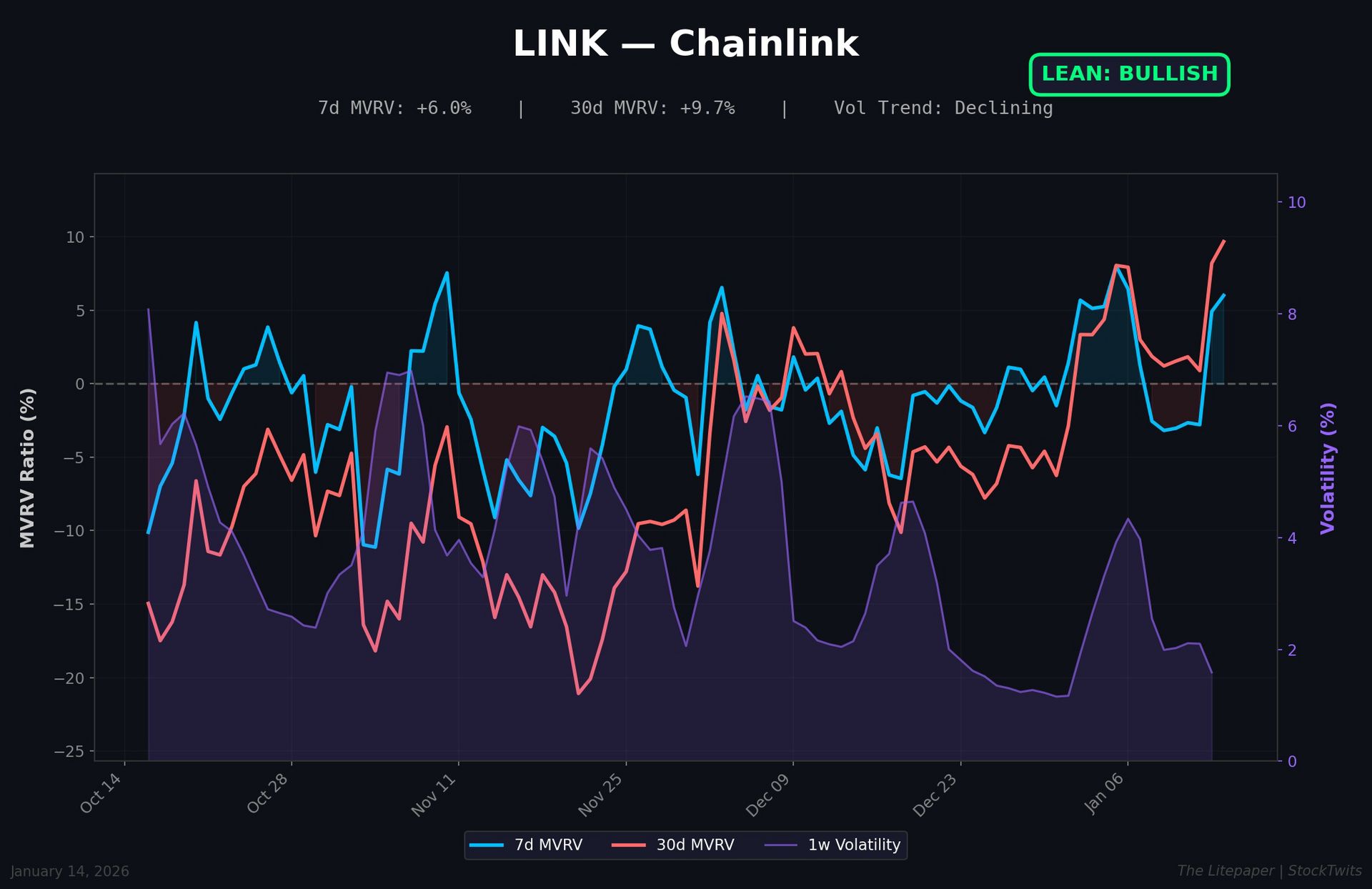

LINK - Shhh. If You Scare It, It Might Tank 🤫

$LINK ( ▼ 1.6% ) ’s running the cleanest setup of the bunch. Both timeframes positive, both expanding, volatility compressing. That's the trifecta.

The 7d flipped positive in late December after a mid-month flush and has been grinding higher since. The 30d has been positive throughout and is now pushing toward 10%. That's the kind of coordinated expansion you want to see.

No one's talking about LINK. That's usually a good sign. The on-chain isn't showing euphoria, but it's showing consistent, quiet accumulation.

The volatility is meh, LINK moves in spurts.

The Read: Best risk/reward setup on this list. Positive MVRV across timeframes, no overextension, vol compressing. Classic "coiled spring" look.

Lean: Bullish

ON-CHAIN ANALYSIS

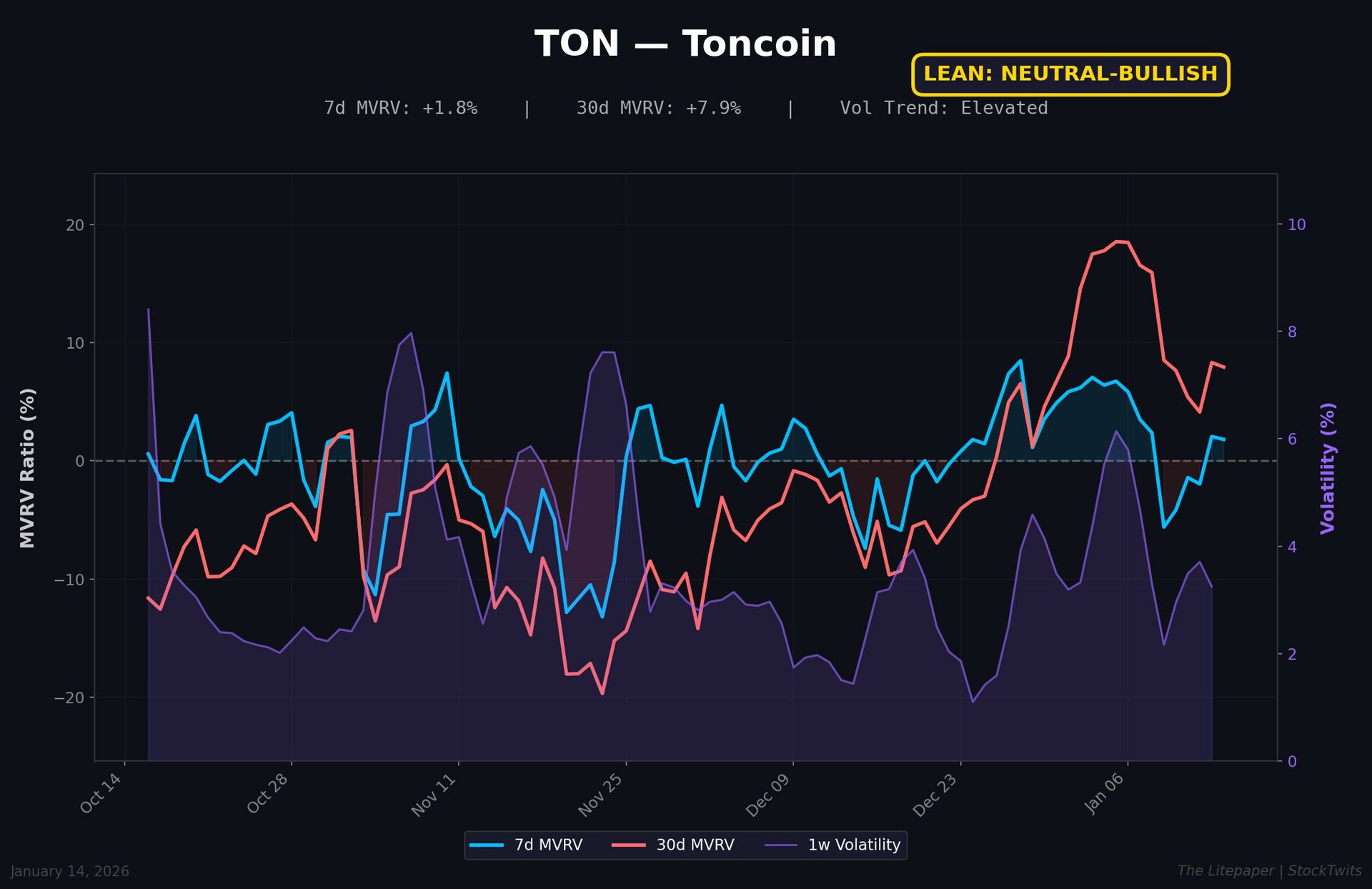

TON - The Wild Card 🦒

$TON ( ▲ 1.41% ) ’s the odd duck here. Both timeframes positive - good. But volatility is still running hot compared to peers, and the 7d MVRV is barely above water.

Looking at the path, TON had a rough mid-December (7d hit -7%, 30d hit -9%) before recovering sharply. The 30d is now approaching 8% - solid - but the 7d hasn't followed with conviction. That disconnect suggests the recent rally hasn't fully convinced short-term participants yet.

The elevated volatility is a double-edged sword. On one hand, it means opportunity for directional moves. On the other, it means risk of giveback. TON's been prone to violent swings both directions.

The Read: Constructive, but noisy. The 30d strength is real, but the 7d hesitancy and elevated vol mean this one requires more babysitting than the others.

Lean: Neutral to Bullish

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋