- Cryptotwits

- Posts

- Saylor Has Spent Enough On BTC This Year To Buy Every NFL Stadium 😶

Saylor Has Spent Enough On BTC This Year To Buy Every NFL Stadium 😶

Strategy Has Bought So Much This Year

OVERVIEW

Saylor Has Spent Enough On BTC This Year To Buy Every NFL Stadium 😶

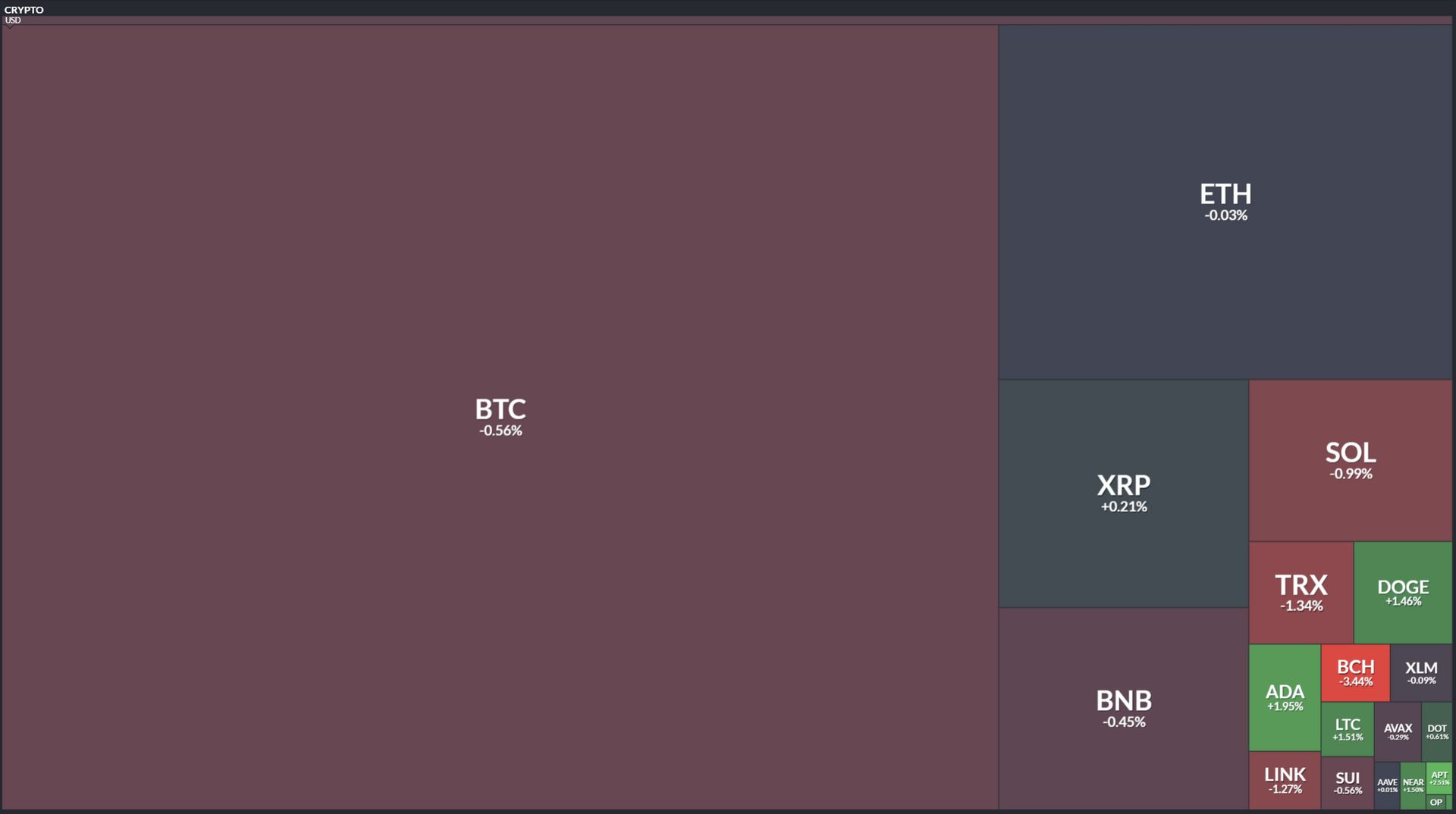

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

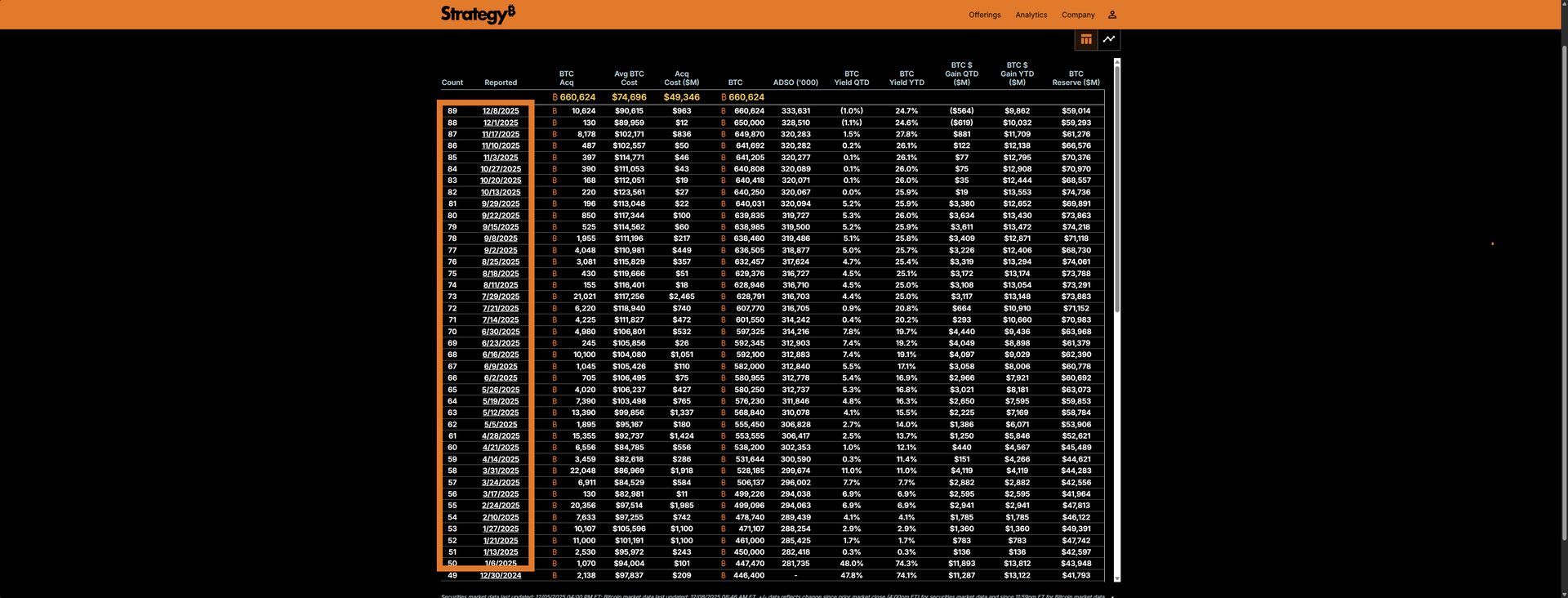

Strategy's Latest Billion-Dollar Bitcoin Buy Isn't Even Top Five This Year 💸

$MSTR ( ▼ 4.56% ) bought another billion dollars worth of $BTC ( ▼ 0.9% ) today, and my first reaction was: yeah, and? 🤔

The stock chart looks beaten up - because it is - but StockTwits sentiment?

Unfazed. Users have seen this movie forty-five times this year alone.

Here's the thing though: when you actually add up what Strategy has spent in 2025, the number gets stupid. This latest billion isn't even top five. It's the ninth largest purchase of the year. 🤯

Out of 89 total Bitcoin purchases Strategy has ever made, 45% happened in 2025.

Total damage for the year: approximately $21.5 billion.

Twenty-one and a half billion dollars is a metric crap ton of money. Let me put it in perspective.

Things $21.5 Billion Buys

The Yankees AND the Dallas Cowboys.

They could have purchased every single NFL stadium.

Manchester United? Three times over.

They could have snagged 14 Burj Khalifas,

110 million new iPhones, or roughly

A quarter million Tesla Model S Plaids.

Enough Nvidia H100 chips to build an army of AI demons.

Two hundred fifty tons of gold.

Eighty thousand average US homes - whatever fantasy number "average" means these days.

The entire US Space Force budget with change left over.

All the farmland in Delaware.

Instead, they bought Bitcoin. And they're not slowing down. 🏇

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

NEWS

Elf on the Shelf Didn't Dump 9 Million Tokens, But Somebody's Elf Sure Did 🧝

'Twas the season for elves, but this one wasn't sitting on anyone's shelf. 😡

Nearly 9 million $ELF ( ▼ 0.53% ) tokens (8.9M to be exact) got dumped through $UNI ( ▼ 1.67% ) on December 4th, and aelf's community naturally asked the obvious question: was this you guys?

The team's response? "We honestly have no information about this."

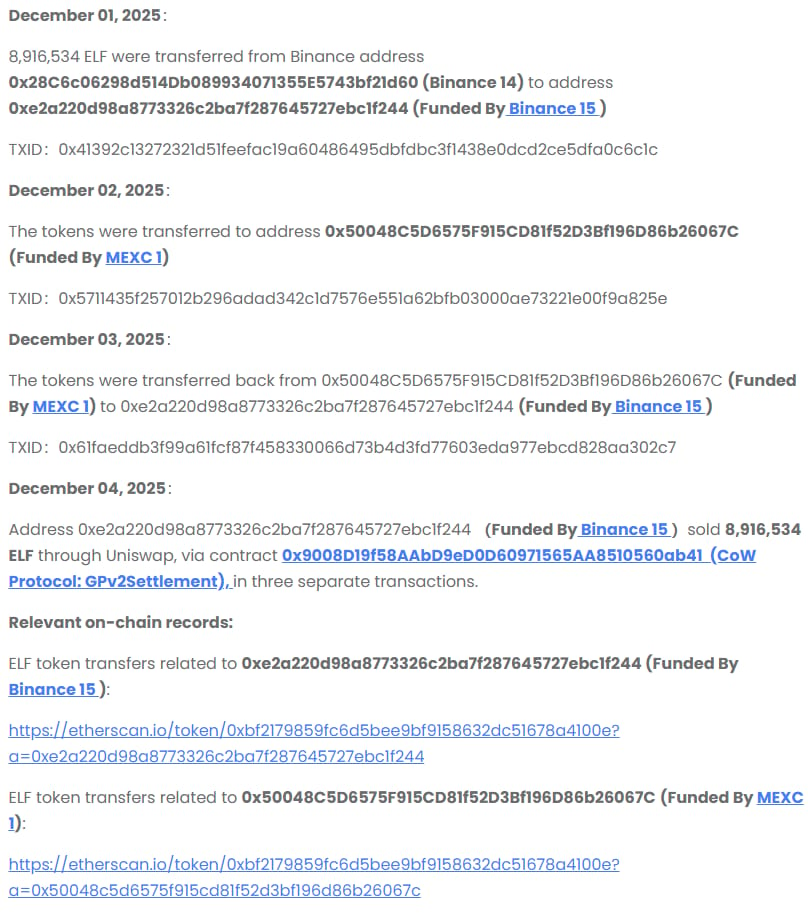

It wasn't that elf, you see. It was one of those elfs - the mysterious kind that withdraws tokens from Binance, shuffles them over to MEXC for a day, shuffles them back, then liquidates everything through CoW Protocol in three separate transactions. Just elf things.

To aelf's credit, they did the right thing by posting the on-chain moves:

The trail shows tokens moving from Binance 14 to a wallet funded by Binance 15, a brief vacation at a MEXC-funded address, then back again before the December 4th fire sale.

The team says it's not connected to any official or official aelf action. The blockchain says somebody decided 9 million tokens needed to become liquidity right before the holidays. 🎅

NEWS

NEAR’s TravAI Promises Seamless Travel Booking; Spirit Airlines Will Probably Ruin It Anyway ✈️

Look, I'm as tired of "AI + blockchain = revolution" news as you are. But $NEAR ( ▲ 1.05% )’s new TravAI partnership with ADI Chain actually does something that doesn't make me want to throw my laptop out a window. 💻️

NEAR’s TavAI is an AI agent that handles your entire travel booking - flights, hotels, ground transport - and settles everything on-chain without you needing to juggle six different wallets and figure out which chain has gas.

You tell it where you want to go, it handles the rest. Pay with whatever crypto you're holding, and NEAR Intents converts it to stablecoin settlement on ADI Chain automatically.

The cross-chain payment friction is real, and abstracting it away so corporate finance teams get clean, auditable records is the kind of boring utility that actually gets adopted.

ADI Chain brings some institutional weight here - they're backed by Sirius International, the digital arm of UAE's IHC ($240B market cap). So there's real money betting this isn't vaporware.

But no amount of AI concierge magic is going to stop American from canceling your connection or Marriott from "osing your reservation. The airlines will still find creative ways to nickel-and-dime you into oblivion.

But if the AI booking and settlement layer actually works as advertised? That's genuinely one less headache. 👍️

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🔐 Digital ID Is Great Until It Becomes a Leash

COTI published a reality check on centralized digital identity systems - pointing to China's social credit drift and India's Aadhaar mission creep as warnings. Their pitch: privacy should be user-controlled, not system-controlled, and their Garbled Circuits run 3000x faster than fully homomorphic encryption. COTI Network.

🔐 PIVX Gets Android Privacy and Loses 17% in Price

Vector launched Android support with an encrypted SQLite backend for faster, more secure messaging - plus PIVX listed on Swapter with 2,200+ trading pairs. Masternodes climbed to 2,071, up nearly 3% week-over-week. Price dropped to $0.17 anyway because crypto gonna crypto. PivX.

💵 Aave's USDC Supply Just Hit $5 Billion

That's a 138% growth year-to-date on Ethereum V3 alone, plus USYC is now live in Horizon for institutional RWA exposure. USDC is quietly becoming the collateral layer for basically everything in DeFi. Aave.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

✨ RWA Yield Finally Has a UX That Doesn't Hurt

First time tokenized yield feels like Web2-simple? Glider integrated Plume's Nest vaults so users can access real-world yield in one click - no gas, no signatures, no bridging headaches. The platform handles allocation, rebalancing, and chain abstraction automatically. Plume Network.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎄 Your GeoCities Snowfall Was Just Training for the Metaverse

Decentraland traced how holiday traditions went from pixelated e-cards and AIM font changes to livestreamed concerts and virtual world celebrations. Online holiday shopping now hits $282 billion in the U.S. alone, with $229 billion of that influenced by AI recommendation engines. Honestly, decorating your avatar's virtual apartment was always the logical next step after HTML snowfall. Decentraland.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🦊 Prop Trading Without the Hazing Ritual

Foxify integrated dYdX Chain to offer instant funded accounts - up to $10K in real USDC with no evaluations, no KYC, and no waiting around. Trade perpetuals however you want: bots, news trading, weekends, multiple accounts. Profits withdraw instantly on-chain because manual review is so TradFi. dYdX.

⚡ eCash Made Proof-of-Work Fast, Which Wasn't Supposed to Be Possible

Avalanche Pre-Consensus went live on November 15th, bringing instant transaction finality to a PoW chain for the first time. The network also launched Marlin Wallet with NFC payments, a blockchain gaming app, and saw its highest transaction count of the month. Honestly, eCash has been quietly shipping while everyone else argues about memecoins. eCash.

NEWS IN THREE SENTENCES

Protocol News 🏦

🏦 Ethena Holders Can Now Earn at an Actual Bank

Anchorage - the only federally chartered crypto bank - now offers in-platform rewards for USDtb and USDe holders. No staking, no lockups, just compliant institutional infrastructure doing its thing. Ethena.

🏛️ Morgan Stanley Picked Canton, So That's Settled

Big win. Morgan Stanley Wealth Management adopted iCapital's Canton-based DLT solution to modernize its alternatives business. We're talking automated subscription docs, better data quality, and way less manual reconciliation. Canton Network.

📹 Your Gigabit Upload Was Never the Problem

Storj says centralized cloud storage chokes your bandwidth before it ever hits line speed - so they built a distributed architecture that actually saturates your connection. The platform encrypts, splits, and uploads files in parallel across hundreds of global nodes instead of funneling everything through one congested region. DITs and editors (the people who've been shipping drives because uploads take forever) might finally get to stop doing that. Storj.

🤖 Virtuals Protocol Had Another Week of Shipping Everything

The Base-Solana bridge is live, all machine-to-machine payments now settle through x402, and the ecosystem logged 500K+ real-world robotics tasks through SeeSaw. Reppo raised $1M+ via automated capital formation, PRXVT launched privacy-preserving payments, and Ethy became the first agent to hit $100M in aGDP. Virtuals Protocol.

LINKS

Links That Don’t Suck 🔗

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋