- Cryptotwits

- Posts

- Naughty List: Every Altcoin I Own

Naughty List: Every Altcoin I Own

We've all been very, very bad this year

Presented by:

OVERVIEW

Naughty List: Every Altcoin I Own 📔

Before we dive in, here’s today’s crypto market heatmap:

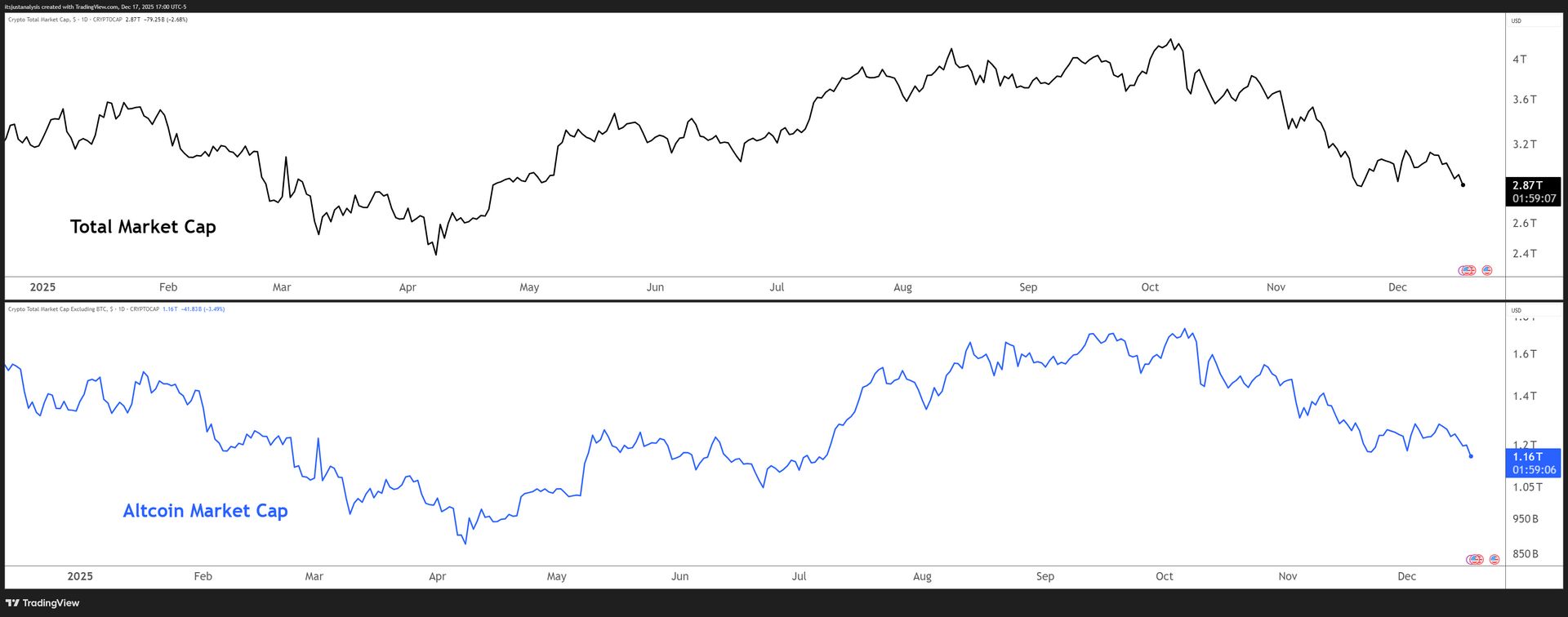

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Chainlink Had a Monster 2025. The Chart Just Didn't Get the Memo. 🗒️

Let's talk about cognitive dissonance. 🧠

$LINK ( ▼ 3.83% ) spent 2025 doing what 99% of crypto projects claim they're doing but aren't: shipping product, landing institutional deals, and quietly becoming the default plumbing for tokenized finance.

The Coinbase Deal - December 11th. Coinbase selected CCIP as the exclusive bridge infrastructure for all Coinbase Wrapped Assets. $7ish billion in aggregate market cap.

The FTSE Russell integration - $18 trillion in benchmarked AUM. The same indexes your 401(k) probably tracks. Now publishing on-chain via Chainlink's DataLink.

The U.S. Department of Commerce - GDP data. On-chain. The Bureau of Economic Analysis.

Mastercard's 3.5 Billion Cardholders - $MA ( ▼ 0.52% )’s got a Chainlink-powered onramp. J.P. Morgan's Kinexys ran cross-chain settlement tests. $UBS ( ▼ 0.43% ) adopted the Digital Transfer Agent standard at Sibos.

Other Winner Winner Stats

75% oracle market share

$100B+ in total value secured

65+ chains on CCIP

ISO 27001 and SOC 2 certified by Deloitte - first oracle platform to clear that bar.

Stocktwits Take

Stocktwits users are pretty much on par with the rest of the market: bearish AF.

Despite that, here’s the deal: the only thing bearish about Chainlink in 2025 was the price action.

Sometimes the market is efficient. Sometimes it's just not paying attention yet. 🤔

TECHNICAL ANALYSIS

Welcome To Hell. Also Known As: The Cloud ☁️

The Cloud is dark and full of terrors and you just need to not look at it. When you look into the Cloud, the Cloud looks back and bitch slaps you with your own foot but backwards. Ya. Backwards.

You don't need to know anything about the Ichimoku Kinko Hyo system for this part of the newsletter. We're only looking at one piece: that blob of green on the screen that looks like one of my toddler's placemats at IHOP.

The Cloud is bad. Everything bad in the world exists inside the Cloud. Here's a screenshot from one of the slides I use to teach the Ichimoku system showing some of the bad things:

Nope. That’s not the slide. That slide is just to remind you the Cloud is bad. Here’s the slide that shows some of the bad things that exist inside the Cloud:

I have, in the past had questions about three of those images and why they’re in there.

Cilantro - It tastes like soap.

Peanut butter and Mayo - I have nothing against either, I like both. But if you put them together you are a special kind of evil.

Wasps - they don’t pollinate, they don’t make honey, they just eff shite up wherever they go and God probably thinks they’re hilarious.

The Cloud represents indecision, volatility, fakeouts, shakeouts, and just overall ass hattery and dickish price action that makes you want to put a fist through a screen.

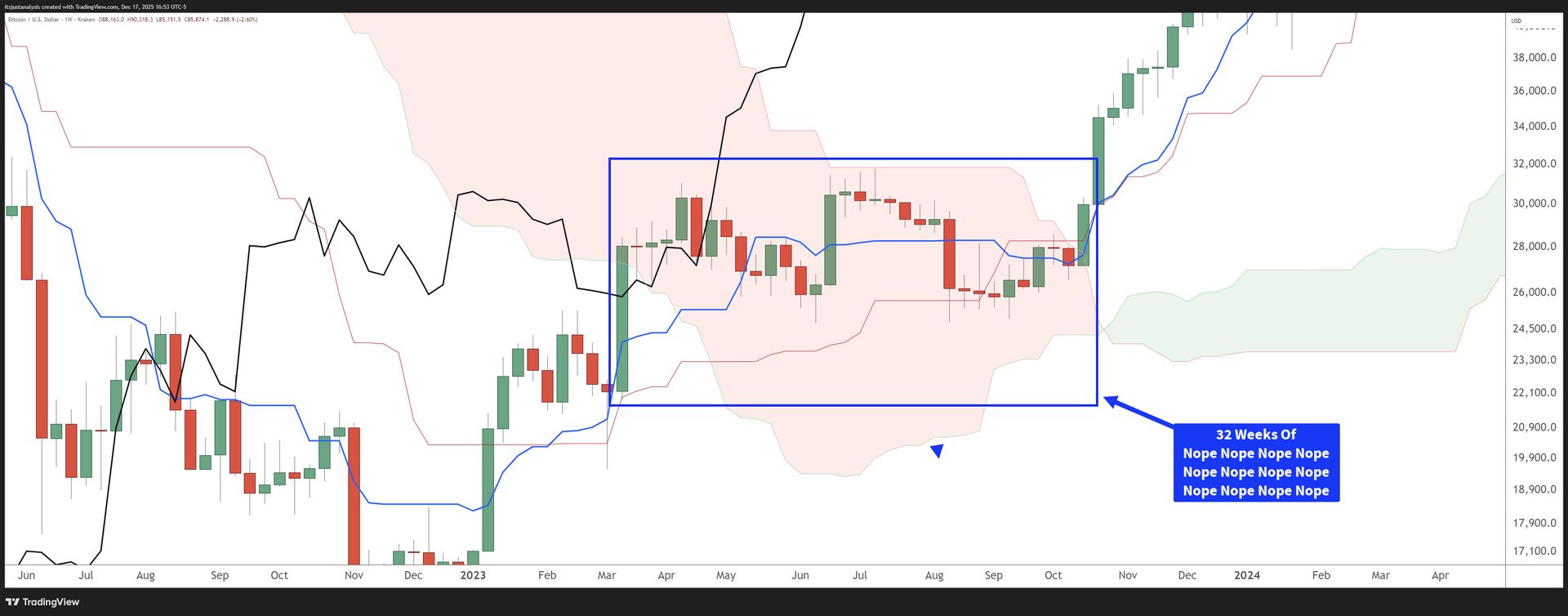

If you want an idea of what that is like, I introduce to you the hellscape that was the weeks of March 13, 2023 to October 16, 2023:

32 weeks is what we suffered through. Will that happen again? I hope not - but my point is to just highlight the absolute suck that happens whenever you see an instrument inside the Cloud. Sometimes it’s best just to walk away for a bit. 🚶♂️

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🥇 Swiss-Vaulted Gold Just Landed on Base via Aerodrome

DGLD, backed by 60 years of MKS PAMP precious metals heritage, launched on Base with Arrakis managing liquidity around real-world gold prices. Each token represents legally enforceable ownership of physical PAMP gold, redeemable for as little as 1 gram. The tokenized gold market hit $2.57 billion by Q3 2025, and now Base's 8 million monthly users have direct access. Aerodrome.

🌱 Hashgraph Group Launched EcoGuard for the Trillion-Dollar Carbon Market

The platform automates carbon credit creation, verification, and retirement on Hedera with cryptographic proof at every step. Unlike fixed ESG reporting platforms, EcoGuard uses workflow orchestration and decentralized identity to adapt to specific regulatory contexts. The carbon market is projected to hit $5 trillion by 2035, and someone had to build compliant infrastructure. Hasgraph.

NEWS IN THREE SENTENCES

Protocol News 🏦

📈 Tezos Q3 Data Says the Narratives Were Wrong

L1 activity grew 21.5% quarter-over-quarter with July hitting 4.7 million transactions - the busiest month of the period. Etherlink TVL reached a new all-time high of $84.4 million despite incentive programs cooling off, and daily active addresses rose 33.8%. Tezos.

🔥 Astar's Burndrop PoC Lets You Test Supply Discipline With 2,026 ASTR

The proof of concept runs from today (Dec 17) through January 18, walking participants through a deposit, lock, and burn cycle that ends with minting a soulbound Burndrop Passport. All ASTR deposited gets permanently burned - no refunds, just on-chain proof of conviction. Astar Network.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋

Grayscale Chainlink Trust ETF (“GLNK” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GLNK is subject to significant risk and heightened volatility. GLNK is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GLNK is not a direct investment in Chainlink. Please read the prospectus carefully before investing in the Fund. Foreside Fund Services, LLC is the Marketing Agent for the Fund.

1 Largest crypto-focused asset manager based on AUM as of 10/31/2025. For other companies in this category, AUM is considered as of most recent public disclosure.

2 Gross expense ratio at 0% for 3 months or the first $1.0 billion of assets. After the fund reaches $1.0 billion in assets or after 3-month waiver period ending March 2, 2026, the fee will be 0.35%. Brokerage fees and other expenses may still apply.