- Cryptotwits

- Posts

- It Could’ve Been Worse, But I’m Not Sure How. ☠️

It Could’ve Been Worse, But I’m Not Sure How. ☠️

Correction is what we were looking for, not extinction

OVERVIEW

It Could’ve Been Worse, But I’m Not Sure How. ☠️

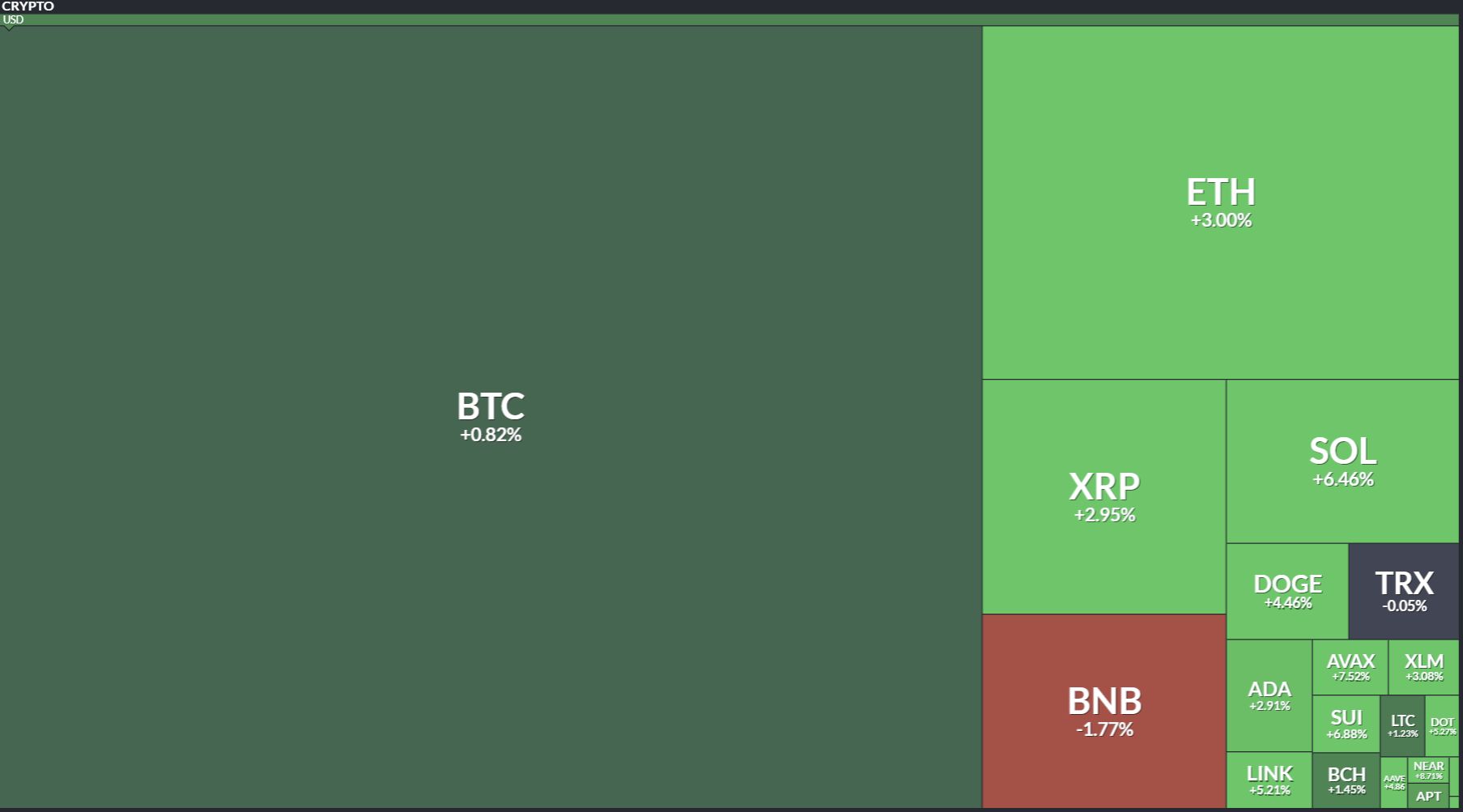

Before we dive in, here’s today’s crypto market heatmap:

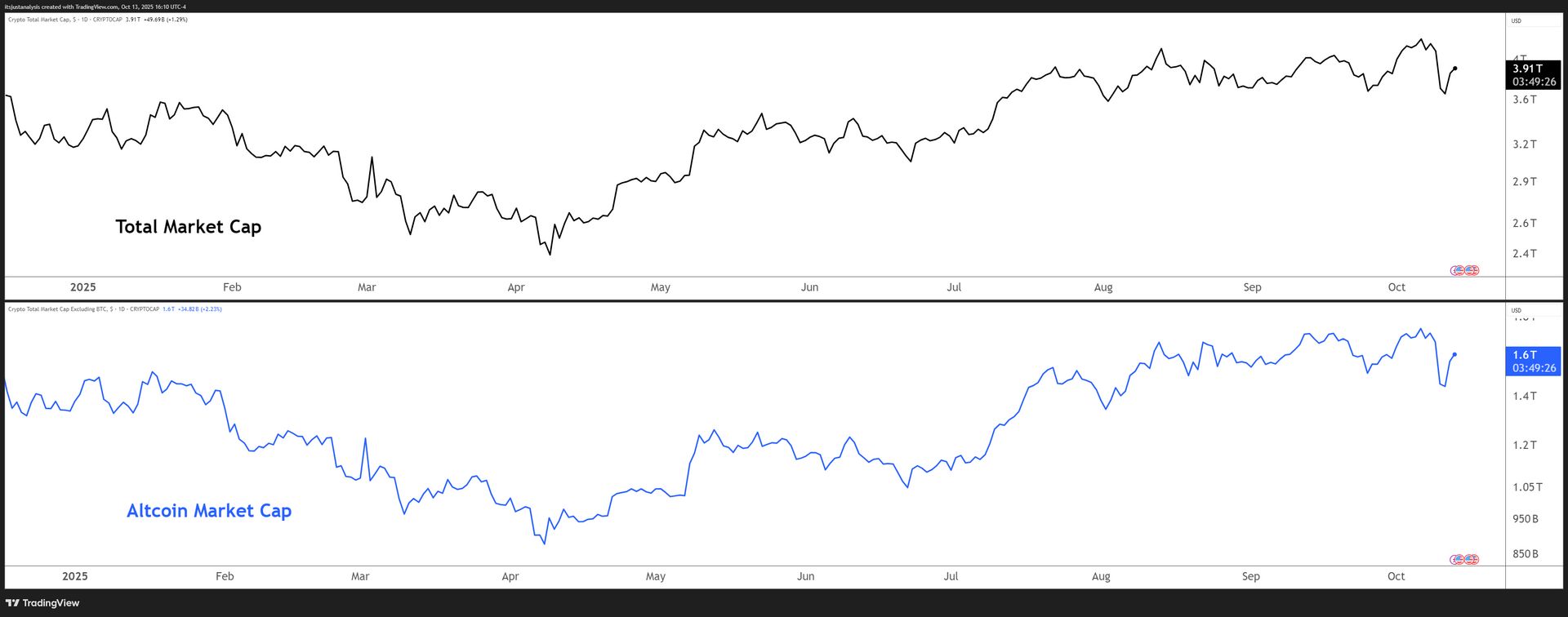

And here’s a look at crypto’s total market and altcoin market cap charts:

POLL

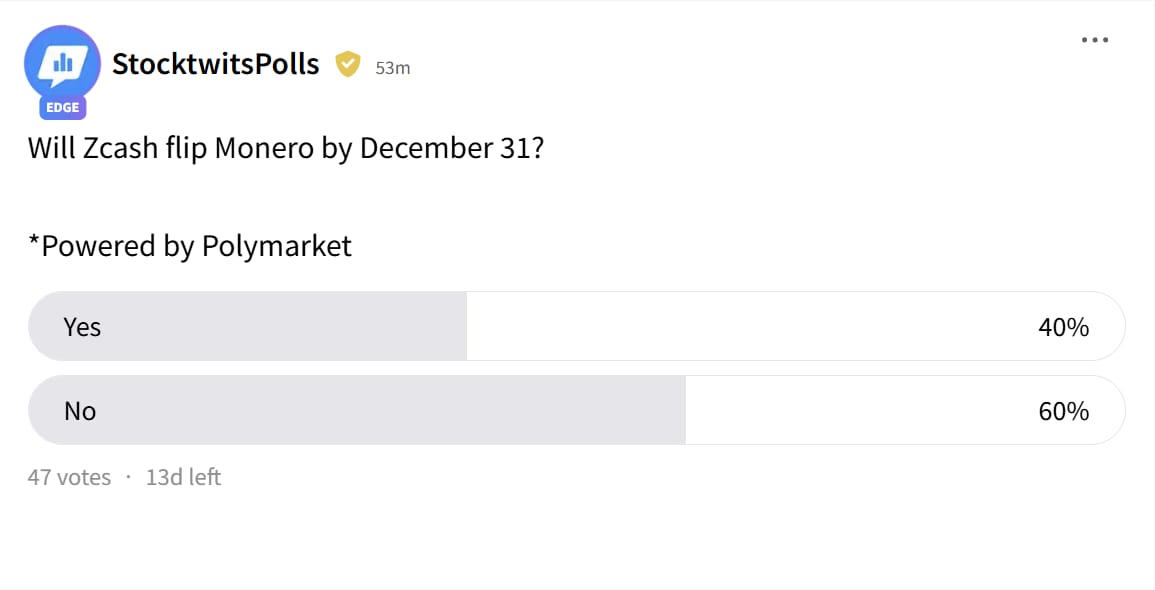

Take This Zcash & Monero Poll 👇️

There’s a lovers tiff going on between $ZEC.X ( ▼ 2.93% ) and $XMR.X ( ▼ 5.76% ) - especially now that Zcash is the closest it’s been to flipping Monero. ❤️🔥

This hasn’t even been up for an hour yet and already the ‘No’s are in the lead. ✅

NEWS

WTF Happened? 🤔

No preface/intro needed here. I mean, unless you’re brand spanking new to crypto and this newsletter (hi and welcome), you’ve already heard and/or experienced the shitestorm of the past 3.5-ish days. 😐️

I thought about a timeline, but that’s going to be difficult because there’s so much rumor and not a lot of hard facts yet - teams of experts are still dissecting last Friday, and the fallout is still happening.

But let’s hit on the big points:

The Trigger: Trump’s 100% Tariff Bomb 💣️

At 5ish PM EST Friday, Trump posted on Truth Social threatening 100% tariffs on all Chinese imports starting November 1. The announcement came minutes after China said it would restrict exports of rare earth metals vital for chipmaking.

Within 30 minutes, Bitcoin dropped from $122K to as low as $105K, and Ethereum plunged 12% to $3,500.

Solana cratered 45%, Sui fell over 70%, and Dogecoin briefly lost half its value before clawing back.

Stocks fell too, but crypto got wrecked hardest - leveraged to the hilt and running thin liquidity into the weekend.

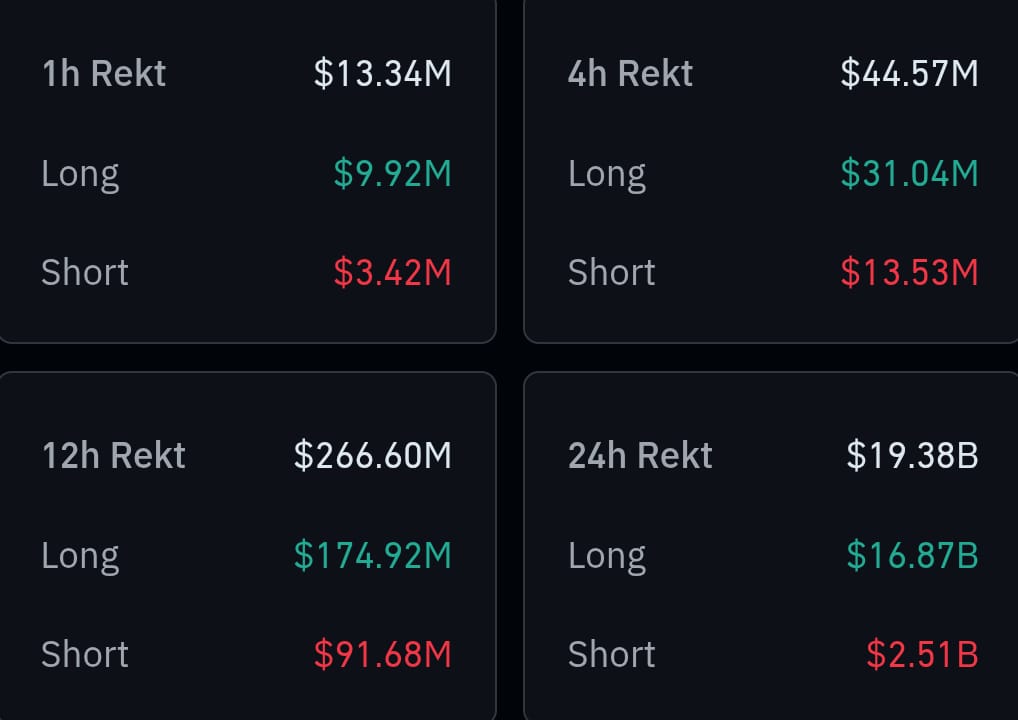

The Cascade: 1.6M Traders Obliterated 😨

The selloff hit during the most illiquid window of the week - late U.S. Friday when Europe and Asia were offline. Once futures began cascading, exchanges’ liquidation engines went nuclear.

More than 1,000 wallets on #Hyperliquid were completely wiped out in the market crash — losing everything.

In total, 6,300+ wallets are in the red, with combined losses exceeding $1.23B.

205 wallets lost over $1M

1,070+ wallets lost over $100K

Data based on Hyperliquid

— Lookonchain (@lookonchain)

1:41 PM • Oct 11, 2025

$19.13 billion in positions vaporized in 24 hours.

I took this screenshot at roughly 9:04 AM EST on Saturday.

1,618,240 accounts liquidated, with 16.7B of that in long positions.

For comparison: COVID-19 panic in 2020 and FTX’s collapse in 2022 each triggered about $1.5B in liquidations. This was 10 times bigger. A record wipeout.

The Systemic Cracks: Leverage, Liquidity, And The ADL Nightmare 😱

By Saturday, traders were furious - not just because they lost, but because even winners got clipped.

Auto-Deleveraging (ADL) kicked in across Binance, Bybit, and Hyperliquid - the “break glass” failsafe that forcibly closes profitable short positions to cover blown-up longs when insurance funds can’t keep up.

In simple terms: you won your trade, but the exchange used your profit to patch someone else’s hole.

ADL queues fired as market depth vanished and insurance buffers drained.

Binance later confirmed that “extreme market conditions” forced ADL activation between 5:20 PM and 521 P{M.

The Flashpoints: USDe, Hyperliquid, And Whale Games 🐋

Ethena’s USDe stablecoin depegged to $0.65 on Binance amid cascading liquidations. Ethena Labs said the asset stayed over-collateralized, blaming “secondary market volatility.” Binance later paid $283M in compensation to users holding USDe, BNSOL, or WBETH as collateral.

Hyperliquid saw its biggest stress test yet. A single whale’s $735M BTC short and $200M ETH liquidation drove a feedback loop through perpetual markets.

LookOnChain has a good thread about this going all the way to October 8.

On-chain investigators later tied the whale behind the moves - holding over 100,000 BTC - to Garrett Jin, the former BitForex CEO accused of faking volumes and vanishing with user funds in 2024.

The Bitcoin OG who previously sold 35,991 $BTC($4.43B now) to buy 886,371 $ETH($3.99B now) just sold 3,000 $BTC for 363.87M $USDC today — at an average price of $121,291.

intel.arkm.com/explorer/addre…

hypurrscan.io/address/0x757f…

intel.arkm.com/explorer/addre…— Lookonchain (@lookonchain)

11:32 AM • Oct 8, 2025

Binance’s Post-Mortem: “It Wasn’t Us (This Time)” ☠️

Binance released a multi-page statement denying it caused the crash.

The exchange claimed its systems “remained operational” while global macro events triggered extreme volatility.

Compensation: $283M for users affected by the depegs and internal transfer delays.

The company blamed old limit orders dating back to 2019 for the bizarre sub-penny prints on pairs like IOTX and ATOM, and promised UI and risk-parameter upgrades.

Analysts Split: “Healthy Reset” or “Coordinated Attack”? 🤔

Like I said at the beginning, this is still being investigated and very, very new and active.

The Kobeissi Letter called it a “perfect storm of leverage, tariffs, and bad timing,” arguing the correction has no long-term bearish implications.

Swan Bitcoin’s Cory Klippsten said the wipeout “cleanses weak hands and reloads the next rally.”

Others weren’t buying it - calling out suspiciously timed whale shorts and algorithmic flash triggers that made the market move too cleanly to be natural.

Adding fuel, a trader opened an $88M Bitcoin short just 30 minutes before Trump’s tariff post, closing for a near $90M profit. The account was created that same day.

The Leverage Bubble Finally Popped 🎈

By October 9, open interest had ballooned to absurd levels:

BTC OI up 374% YTD, ETH up 160%, SOL up 205%.

Leverage was everywhere - retail chasing perpetuals, whales stacking longs, and exchanges feeding the frenzy.

The crash was inevitable; Trump’s tariff was just the match - so some say.

CoinGlass data confirmed $3.7B in BTC long liquidations and $600M in shorts within a single hour. Even stablecoins wobbled, with USDC slipping below $1 and USDT briefly trading at a premium.

Aftermath And Rebound 🪙

By Sunday, the dust began to settle. Bitcoin bounced to $112K, Ethereum hovered near $3,800, and BNB miraculously (suspiciously) rallied +11%.

Total crypto market cap recovered from $3.7T to $3.9T.

Fear & Greed Index swung to “Extreme Fear.”

Zcash - of all things - led the recovery charge, surging +500% so far in October as traders rotated into privacy coins.

We’ll keep you updated as this develops. Case in point:

BREAKING: TRUMP INSIDER WHALE IS NOW SHORT $340M $BTC

The HyperUnit Bear Whale who shorted $700M of $BTC and $350M of $ETH right before Friday’s market crash (making ~$200M total) just deposited $40M USDC to HL and shorted another $127M $BTC.

He is now short $300M $BTC and has

— Arkham (@arkham)

2:54 PM • Oct 13, 2025

SPONSORED

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

NEWS

Some Alts Dropped Faster Than A New Bride’s Enthusiasm After The DJ Started Playing ‘Gold Digger’ ⏺️

The great majority of the altcoin market looked something like Polkadot $DOT.X ( ▼ 0.87% )’s daily chart on Friday. 📆

DOT tanked over 70% to $1.17. That’s a new all-time low for Polkadot.

And it wasn’t the only one. Going through my charts, the bloodbath, while temporary, was till a bloodbath with many high market cap alts hitting historical lows. Here’s just some of the tickers and the lows that occurred:

New Two Year Lows

eCash, Worldcoin, Tellor, Reserve Rights, Near Protocol, Chainlink, Floki, FetchAI, BONK, Avalanche, and Cardano

New Four Year Lows

THORchain, Ontology, Decentraland, Loopring, Gala Games, and Ethereum Classic

New Five Year Lows

Cosmos, Band, COTI, MultiversX, Iota, Kyber Network, Lisk, Neo, The Sandbox, VeChain, Tezos, and Yearn Finance

New All Time Lows

ApeCoin, Arbitrum, Axelar, Compound, Curve Finance, Polkadot, DyDx, Enjin, Filecoin, Internet Computer, Flow, The Graph, Icon, Immutable, Kava, Mask Network, Mina Protocol, Sei, SKALE Network, Stax, Celestia, UMA, dogwifhat, and 0x

PRESENTED BY STOCKTWITS

Yay, We’re Green! 🟢

LINKS

Links That Don’t Suck 🔗

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋