- Cryptotwits

- Posts

- I'm Ready To Get Hurt Again, But Like, Festively 🎄

I'm Ready To Get Hurt Again, But Like, Festively 🎄

When technicals, sentiment, and macro all align, you either trust the process or remember what happened last time you trusted the process.

OVERVIEW

I'm Ready To Get Hurt Again, But Like, Festively 🎄

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

CARDANO

Cardano's Midnight Drops the Largest Airdrop in Crypto History 🤯

Cardano rallies nearly +12% intraday. Wipes out 22 days of losses. Stocktwits users are bullish AF (well, technically, Extremely Bullish). 🚀

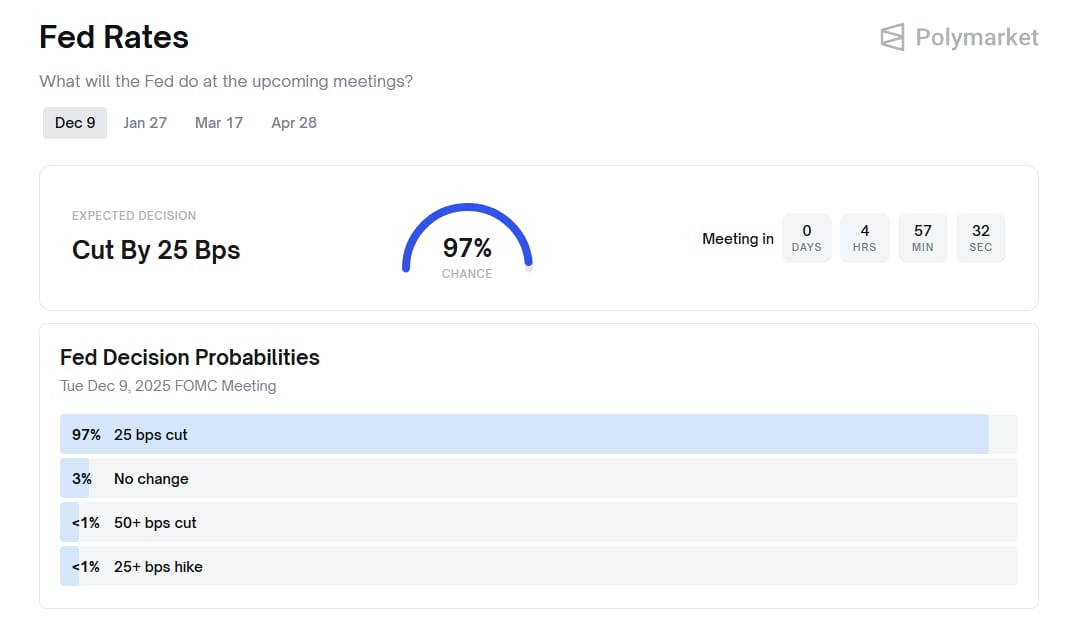

Why? Well, there’s been a broader market rally today. Maybe something to do with technicals sitting at levels screaming this was happening? Maybe because there’s a 97% chance of a rate cut tomorrow according to Polymarket?

But for Cardano, you could add one more factor/reason: Midnight is out.

And $NIGHT ( ▲ 3.14% ) the largest airdrop in history. 😨

What Midnight Is: Privacy Infrastructure For Every Chain

Midnight isn't trying to compete with other Layer 1s. It's positioning itself as the privacy layer for all of them.

Users on Bitcoin or Ethereum could eventually access Midnight's privacy features and pay fees in their native tokens. That's the vision, anyway. Cross-chain privacy infrastructure with zero-knowledge proofs that still allows selective regulatory disclosure.

Meaning it's designed to survive the delisting waves that kill pure privacy coins across Europe, Dubai, and major exchanges.

Most privacy tokens have been getting nuked by regulators because they offer total anonymity with no compliance pathway. Midnight's dual-token system (NIGHT and DUST) attempts to thread that needle: privacy when you want it, disclosure when regulators require it. 🤫

Crazy Ass Numbers

8 million wallets across 8 blockchains claimed tokens

4.5 billion NIGHT tokens distributed via Glacier Drop

24 billion total NIGHT supply minted

5,000 TPS with sub-second block times

The tokenomics include a randomized "thaw" unlock schedule that prevents all 4.5 billion distributed tokens from hitting the market simultaneously. Smart move - airdrops have a tendency to become exit liquidity for recipients who immediately dump. 💩

Is It Really A Big Deal?

Setting aside the marketing, there's a legitimate gap in the market here.

Privacy coins like Monero face regulatory pressure. It got delisted left and right because it offers no compliance pathway (well, more to it than that, but its one primary reason). Meanwhile, institutions and enterprises need privacy features - for payroll, healthcare data, supply chain confidentiality - but can't touch anything that'll get them flagged by regulators.

Midnight's selective disclosure model theoretically solves this. You get zero-knowledge proof privacy by default, with the ability to reveal specific information when required. If a business needs to prove a transaction happened without revealing the amount, or verify identity without exposing personal data, that's the use case.

The cross-chain angle is what makes it interesting beyond Cardano maxis. If Ethereum or Solana developers can plug into Midnight's privacy layer without leaving their ecosystem, that's genuine utility.

But let’s see how much and how quickly NIGHT and DUST get adoption and users before we start any parades. 👀

STOCKTWITS

Stocktwits Widgets for Your Website!

Stocktwits has just launched the Trending Widget! The Stocktwits Trending list is one of the most popular data points retail users like to follow, and now it’s available to embed anywhere, for free.

Publishers, creators, and platforms can now embed real-time trending data directly into their websites, dashboards, and newsletters with a single line of code.

It’s lightweight, fast, and designed to fit naturally into any layout.

Perfect for:

Blogs and market commentary sites

Creator landing pages

Fintech dashboards

Newsletter sections

Brokerages and research platforms

Give your audience live visibility into what’s moving today.

ETHEREUM

ETH’S Best News Week in Months: A Corporate Whale & BlackRock Walk Into A Bar 👬

$ETH ( ▼ 0.2% ) bulls finally have something to talk about. Two major developments dropped within days, and together they're building a bullish AF institutional narrative for ETH. 🐂

The Corporate Whale

BitMine Immersion now holds 3.86 million ETH - over 3.2% of total supply - with a stated goal of 5%. Chairman Tom Lee (yes, Fundstrat's Tom Lee) says they ramped weekly purchases 156%, from 54,156 to 138,452 ETH. Total holdings: $13.2 billion. Institutional backers include Cathie Wood, Founders Fund, Pantera, and Galaxy Digital.

BitMine is the #1 Ethereum treasury globally and the 37th most traded stock in America. More daily volume than Goldman Sachs. For a company that just buys and holds ETH.

The BlackRock Play

And for the passive income crowd, the world's largest asset manager filed with the SEC for a new staking-enabled Ethereum ETF. Not a modification to their existing $11 billion ETHA - an entirely separate product.

The iShares Staked Ethereum Trust plans to stake 70-90% of holdings, distributing 3-5% annual yields quarterly. This exists because SEC big wig Paul Atkins clarified that protocol staking isn't a securities offering. Grayscale already activated staking in October.

Kind Of A Big Deal, Er, Deal(s)

BlackRock's ETHA already dominates spot ETH ETFs with 60%+ market share. Add a yield-generating product, and Ethereum offers something Bitcoin ETFs can't - passive income on top of price exposure. Analysts estimate staking could boost inflows 15-30%.

Now combine that demand channel with BitMine removing 3%+ of supply and gunning for more.

Supply squeeze plus institutional demand plus yield generation. That's not hopium - that's just how markets work. 🧠

BITTENSOR

Bittensor’s First Halving Hits This Week 👊

$TAO ( ▼ 0.36% )’s first halving arrives around December 12th, and if you're not paying attention to the biggest market cap AI play in crypto, now's a decent time to start. 🔰

A new 49-page investment thesis from Unsupervised Capital makes the case that TAO at current prices is one of crypto's more asymmetric opportunities. Their targets: $4,800 base case by December 2027 (16x from today), $10,800 bull case.

What Is Bittensor, Actually?

Think of Bittensor as a decentralized AI company factory. Instead of one company building AI products, it hosts 128 mini-companies called "subnets" - each tackling different AI problems.

These subnets compete for funding (TAO emissions) based on performance. Worst performer gets kicked out when someone new wants in.

Anyone can contribute work to earn TAO. That's "mining" here - not solving useless math problems like Bitcoin, but actual AI work: hosting models, training algorithms, providing computing power. ⚡️

By The Numbers

$3B current market cap vs OpenAI's $40B single funding round

128 subnets competing - lowest performer gets replaced

$1B+ annually distributed to best-performing teams

Subnets Already Making Real Money

Chutes (AI hosting service): $5.8M annualized revenue

Targon (secure cloud computing): $10M annualized revenue

Lium (GPU rental marketplace): $5.3M annualized revenue

Ridges (coding assistant): Built a coding AI that beat Anthropic's Claude - with just one founder and three interns

Unsupervised Capital's new thesis projects $4,800 TAO by December 2027 (16x from today). Their logic: if even four or five subnets become breakout successes, the whole ecosystem wins. More than ten are already approaching real traction. 👟

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

⚡ The Graph Launched a Database That's 100x Faster Than Your Current One

Financial institutions get verified on-chain data without the brittle ETL pipelines. Amp is the first blockchain-native database built for enterprise scale; 5.9x faster than BigQuery, 4,300x faster backfills, and 4 million events per second. It supports SQL queries across chains with full data lineage for audits and compliance. The Graph.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🐉 QuickSwap Brings Its Whole Dragon to MANTRA

DragonFi is now live on MANTRA Chain with concentrated liquidity AMM infrastructure built on Algebra v4 - swaps, LPs, and farming all ready for RWA trading. The deepest liquidity pool for mantraUSD lives there now, so that's where you should probably be looking. Connect wallet, bridge via Hyperlane, start swapping. MANTRA.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

⏸️ Enjin Delays Sentosa Upgrade by One Day, Nobody Panic

Final pre-deployment checks caught a non-critical behavior affecting some infrastructure setups, so the mainnet upgrade got pushed 24 hours. User funds are safu, the blockchain runs fine, and node operators get extra time to align monitoring. A responsible kind of delay. Enjin.

STOCKTWITS

Stonkmarket News 📰

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🔴 OKX Ditched Polygon CDK for the OP Stack

XLayer migrated to Optimism's infrastructure, joining the framework that now powers 70% of Ethereum L2 activity. OKX handles billions in daily volume, so this is an enterprise bet on shared, production-ready rails. Nearly 60% of Fortune 500 companies are chasing blockchain initiatives now. Optimism.

🚀 Polygon Just Got 33% Faster Without Breaking Anything

Speaking of Polygon (total coincidence), the Madhugiri hardfork brings adjustable blocktimes, 1,400 TPS throughput, and a path to 5K TPS all without requiring future hardforks to keep scaling. Polygon could've handled all 33.6 billion ACH payments from 2024 and still had 25% capacity left over. Revolut, Stripe, BlackRock, and MasterCard are already on the chain, so I guess OKX can suck it? Polygon.

NEWS IN THREE SENTENCES

Protocol News 🏦

🥓 Truflation Now Tracks the Price of Your Breakfast

The new Breakfast Index monitors daily price movements across coffee, tea, cocoa, OJ, milk, sugar, oats, wheat, and bacon; because inflation hits different when you can't afford eggs. It's designed as an early warning system for food cost pressures that eventually show up in CPI. Crypto investors can use it for inflation hedging, or just to feel bad about grocery bills with data. Truflation.

🎮 Injective Will Pay You $30K to Post About Injective

For people who were going to shill Injective anyway, this is just getting paid for the hustle. The MultiVM Ecosystem Campaign with Bantr runs through January 4th. Track your social and on-chain activity across 20+ dApps and compete for a 5,000 INJ prize pool. Top 100 participants split the rewards, and individual projects might throw in extra. Injective Protocol.

🧩 Reactive Network Says Every Blockchain Trilemma Take Is Marketing

The final article in their Performance Race series breaks down why no chain has actually "solved" the trilemma - they've just made different tradeoffs and called it innovation. SWIFT partnered with Linea for blockchain settlement, Plasma launched with $2B in stablecoin liquidity, and infrastructure is specializing fast. Honest projects acknowledge their tradeoffs; less honest ones use buzzwords. Reactive Network.

LINKS

Links That Don’t Suck 🔗

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋