- Cryptotwits

- Posts

- I'm So Damanged I Don't Trust Anything That Isn't Actively Rugging Me 🥹

I'm So Damanged I Don't Trust Anything That Isn't Actively Rugging Me 🥹

Good feelings officially feel suspicious

OVERVIEW

I'm So Damanged I Don't Trust Anything That Isn't Actively Rugging Me 🥹

Before we dive in, here’s today’s crypto market heatmap:

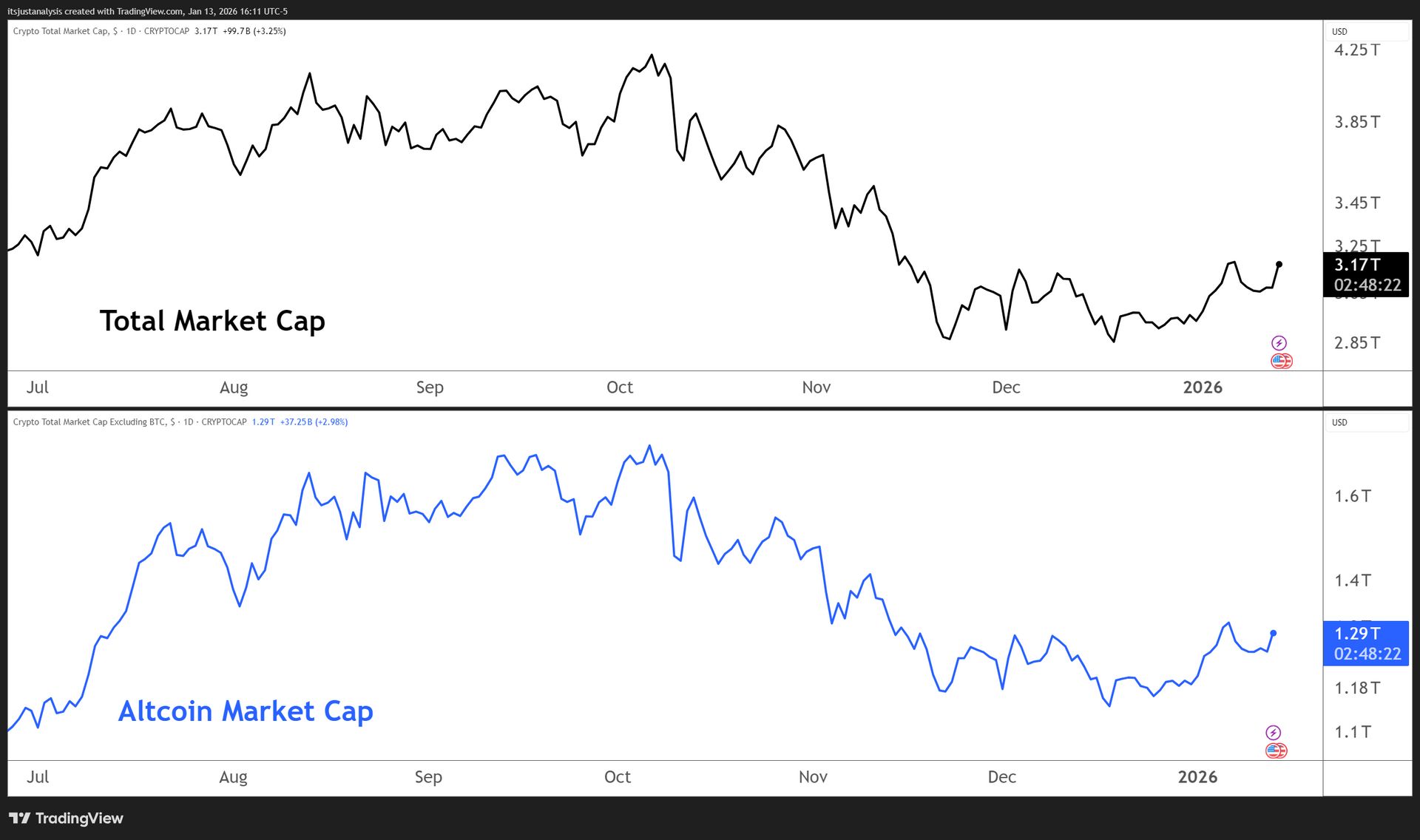

And here’s a look at crypto’s total market and altcoin market cap charts:

PRIVACY COINS

Privacy Coin Pump Has a Real Catalyst - DASH Finally Solves Its Fiat Problem 🤯

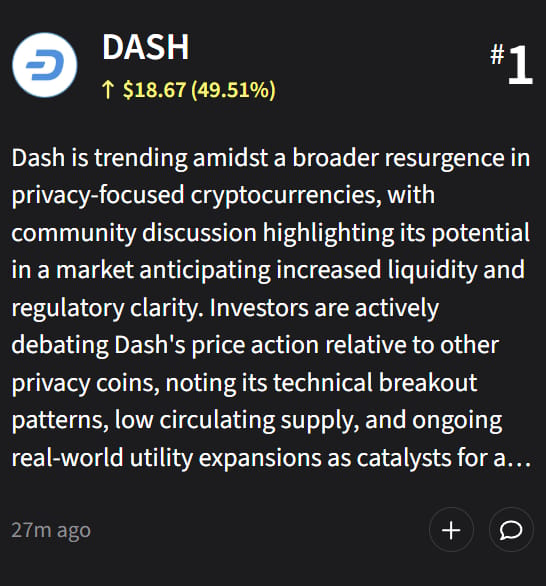

Privacy coins are ripping. $DASH ( ▼ 0.36% ) surged over 60% in 24 hours, XMR blew past $680, CoinGecko flagged both as the most-searched coins in a three-hour window and it’s been trending at #1 on the Stocktwits app. Trading volume on DASH exploded 380%. 😱

But this isn't just momentum chasers piling in. There's an actual catalyst.

The News Nobody's Talking About

$ACH ( ▼ 1.57% ) just integrated DASH into their fiat on-ramp infrastructure. If you've followed privacy coins for more than five minutes, you know why that’s kind of a yuge deal.

Dash launched in 2014 - pre-Ethereum ancient. The project pioneered DAO governance, masternode architecture, and instant transaction finality before those were VC buzzwords.

But here's the persistent problem with privacy coins: banks and payment processors want nothing to do with them. Regulatory pressure, compliance headaches, debanking risk - the fiat-to-privacy-coin pipeline has always been the choke point.

You could use DASH once you had it. Actually getting it with dollars meant jumping through hoops or paying P2P premiums. Like, stupidly high in excess of +20% premiums.

Alchemy Pay Is Everywhere

Alchemy Pay isn't some rando-no-name entity. They hold 12 U.S. Money Transmitter Licenses (and they keep adding more), with regulatory approvals across Southeast Asia, Korea, Europe, and the UK. Their infrastructure covers 173 countries, 50+ fiat currencies, and 300+ payment channels - Visa, Mastercard, Apple Pay, Google Pay, mobile wallets, bank transfers.

For a privacy-focused blockchain to get that kind of fiat accessibility is not normal. The compliance burden alone usually kills these partnerships. Alchemy Pay is essentially saying they're comfortable enough with Dash's optional privacy features (PrivateSend is opt-in, not default) to give it first-class treatment.

Great job all ye DASH hodlers! 👍️

TECHNICAL ANALYSIS

Tether Froze $182M in USDT 👀

Tether pulled the plug on $182 million in USDT over the weekend, freezing five wallets on $TRX ( ▼ 1.06% ) in one shot. 🎯

Biggest freeze the company has ever done. No long blog post. No victory lap. Just locked funds and a very loud silence.

Markets filled in the blanks fast. Venezuela is the likely target.

USDT has become financial duct tape for the country. Sanctions block banks. The Bolívar barely functions. So stablecoins stepped in. By most estimates, around 80% of PDVSA’s oil revenue now moves through stablecoins, mainly USDT on Tron.

Tether hasn’t confirmed the wallets were tied to Venezuelan oil flows. They didn’t deny it either. And this wasn’t a rounding error. Their last headline freeze was about $5 million. This was nearly 40x that.

Tether Has To Play Nice

Here’s the part people keep skipping: Tether isn’t operating in a vacuum anymore. It’s now tied into Wall Street. Represented by Cantor Fitzgerald. Sitting on Treasury-heavy reserves. Tangled up with TradFi products, ETF issuers, and big-ticket structures like Twenty One, the Bitcoin vehicle backed by SoftBank money and Cantor dealmaking.

That exposure cuts both ways.

Tether has a past. Opaque reserves. Regulatory tap-dancing. Years of “trust us” energy. Wall Street doesn’t love that. Once you’re plugged into real balance sheets and real counterparties, you play by grown-up rules. Or you don’t get invited back. ⚠️

NEWS

NYC Token: Great. Another One 😶

Eric Adams - New York's self-proclaimed "Bitcoin Mayor" - launched his NYC token this week to fight "antisemitism and anti-Americanism" and teach kids about blockchain. Noble stuff. What actually happened? 🤔

The token pumped to a $600 million market cap, then cratered 81% to $110 million while a deployer-linked wallet quietly extracted nearly $1 million from the liquidity pool.

Wallet 9Ty4M pulled $2.43 million in USDC at the top added back $1.5 million after a 60% drawdown. That's $932,000 unaccounted for. On-chain analytics firm Bubblemaps confirmed the activity to Decrypt and noted the uncomfortable parallel - looks a lot like LIBRA.

Speaking of LIBRA, court filings now name Meteora co-founder Benjamin Chow as allegedly running the same playbook across 15 token launches, including MELANIA (which went from $7 billion to $80 million).

Look, I'm not saying every politician token is a rug. I'm saying the pattern is getting pretty obvious: celebrity launch, pump, suspicious liquidity moves, crash, silence. Rinse and repear.

Big shoutout to Decrypt's André Beganski and the team for solid on-chain detective work here. This is the kind of reporting crypto needs more of. Go read the full piece. 👍️

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🛡️ Secret Network's 2026 Roadmap Is Security Hardening and Hoping AMD Saves Them

After wiretap.fail and tee.fail exploits forced the network into semi-permissioned mode, 2026 priorities include deprecating EOL CPUs, integrating Proof of Cloud, and developing MPC for network seed so nodes don't store the full seed in sealed files. AMD SEV-SNP support is coming Q1 to reduce Intel dependency, and "SGX Decoupling" will eventually let non-SGX nodes run as validators - which requires tokenomics changes and community approval. Secret Network.

🔒 COTI and Zoniqx Are Building Privacy-Enabled RWAs for the $30 Trillion Market That Doesn't Exist Yet

The partnership embeds COTI's Garbled Circuits into Zoniqx's institutional tokenization infrastructure for confidential issuance, transfers, and settlements. Institutions won't move trillions in bonds, real estate, and private credit on-chain without end-to-end privacy that meets MiCA/SEC standards. First initiative is launching the world's first privacy-enabled RWA assets, which is either historic or marketing depending on how you define "first." COTI Network.

🤖 Sui Foundation Wrote 4,000 Words About Verifiable AI and It's Actually Coherent

From Sui: as AI becomes the system rather than sitting on top of it, trust has to be designed into the infrastructure - from verifiable data provenance to programmable rights to agentic payments. Their Walrus handles storage, Seal manages access and encryption, Nautilus runs computation in trusted execution environments, and Sui coordinates everything on-chain. It's a full-stack argument for why the Sui ecosystem should be the trust layer for autonomous AI. Sui.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🪙 Aragon Says 2026 Is the Year Tokens Either Become Investable or Die as Memecoins

The Ownership Token Index launches to help investors verify whether tokens have actual enforceable on-chain rights or are just governance theater with extra steps. Aragon's thesis: most tokens failed because they came with no rights, no ownership, and no utility - if you invest in those, you're gambling or donating. Their 2026 focus is automation that reduces governance overhead while making whatever rights exist actually matter. Aragon.

🌿 VeChain Built an App Ecosystem Where Saving the Planet Earns You Tokens

VeBetter now has 5 million users across 50+ apps logging 43 million verified actions - 350,000 kg of plastic reduced, 8 million kWh saved, and 90 million liters of water preserved, all recorded on a blockchain that's had 100% uptime since 2017. The trick is making blockchain invisible: users just track their reusable cups or community cleanups and get rewards without ever thinking about consensus mechanisms. VeChain.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎮 Decentraland Season 4 Wants You to Log In Three Times a Week for Free Stuff

Marketplace Credits are back with 280 total credits up for grabs through March 1st - log in three days, attend two events, visit a featured location, and take a photo with someone. Each credit equals 1 MANA, and you can spend them on community-made Wearables, Emotes, NAMEs, or publishing fees. Decentraland.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🔐 Oasis Says Your TEE Attestation Is Basically Meaningless Without a Real Trust System

Remote attestation proves that specific code ran on specific hardware at a specific moment - and absolutely nothing else. It doesn't prove freshness, doesn't prevent rollback attacks, doesn't verify operator identity, and definitely doesn't help you if Intel quietly updates TCB levels. Oasis argues you need a BFT network of slashable validators reaching consensus on attestation validity, which turns a static quote into usable on-chain state that normal humans can actually verify. Oasis.

🔗 ONTO Wallet Explains Why CeDeFi Isn't Actually a Dirty Word

Ontology wants you to access centralized exchange liquidity without giving up your keys by routing through partners like Changelly, SimpleSwap, and Exolix directly from a non-custodial wallet. Ontology calls this "trust applied deliberately and proportionally," which is a very polite way of saying "stop making people choose between convenience and self-sovereignty." Ontology.

NEWS IN THREE SENTENCES

Protocol News 🏦

📁 Filecoin's 2025 Was Onchain Cloud, Fast Finality, and Finally Getting Paid

The ecosystem shipped Filecoin Onchain Cloud with composable services for storage, retrieval, and payments - 170+ wallets, 30+ service providers, and 4,000 onchain deals on testnet. Fast Finality (F3) and Proof of Data Possession (PDP) made the network actually fast enough for hot storage use cases like AI datasets and dApp frontends. They also stored Cornell astrophysics simulation data from the world's fastest supercomputer. Filecoin.

📡 Celestia Just Announced 1 Terabit Per Second of Blockspace Because Why Not

Well, well, well, Celestia finally updated their official blog. Fibre is a new DA protocol running alongside Celestia's L1 that hit 1Tb/s across 498 nodes in testing - that's 1,500x their original roadmap target and enough for roughly one transaction per second for every human on Earth. The ZODA-based encoding is, and I have no idea if this is true or not or even what it means, 881x faster than KZG commitments, enabling use cases that only make sense with insanely cheap blockspace: adspace auctions, pay-per-crawl markets for AI, micropayments for content, and onchain orderbooks for every market that exists. Celestia.

LINKS

Links That Don’t Suck 🔗

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋