- Cryptotwits

- Posts

- Green Candles On Friday The 13th, Rally Into Valentine's Day. Nothing Suspicious Here. 😐️

Green Candles On Friday The 13th, Rally Into Valentine's Day. Nothing Suspicious Here. 😐️

Seems a little sus

OVERVIEW

Green Candles On Friday The 13th, Rally Into Valentine's Day. Nothing Suspicious Here. 😐️

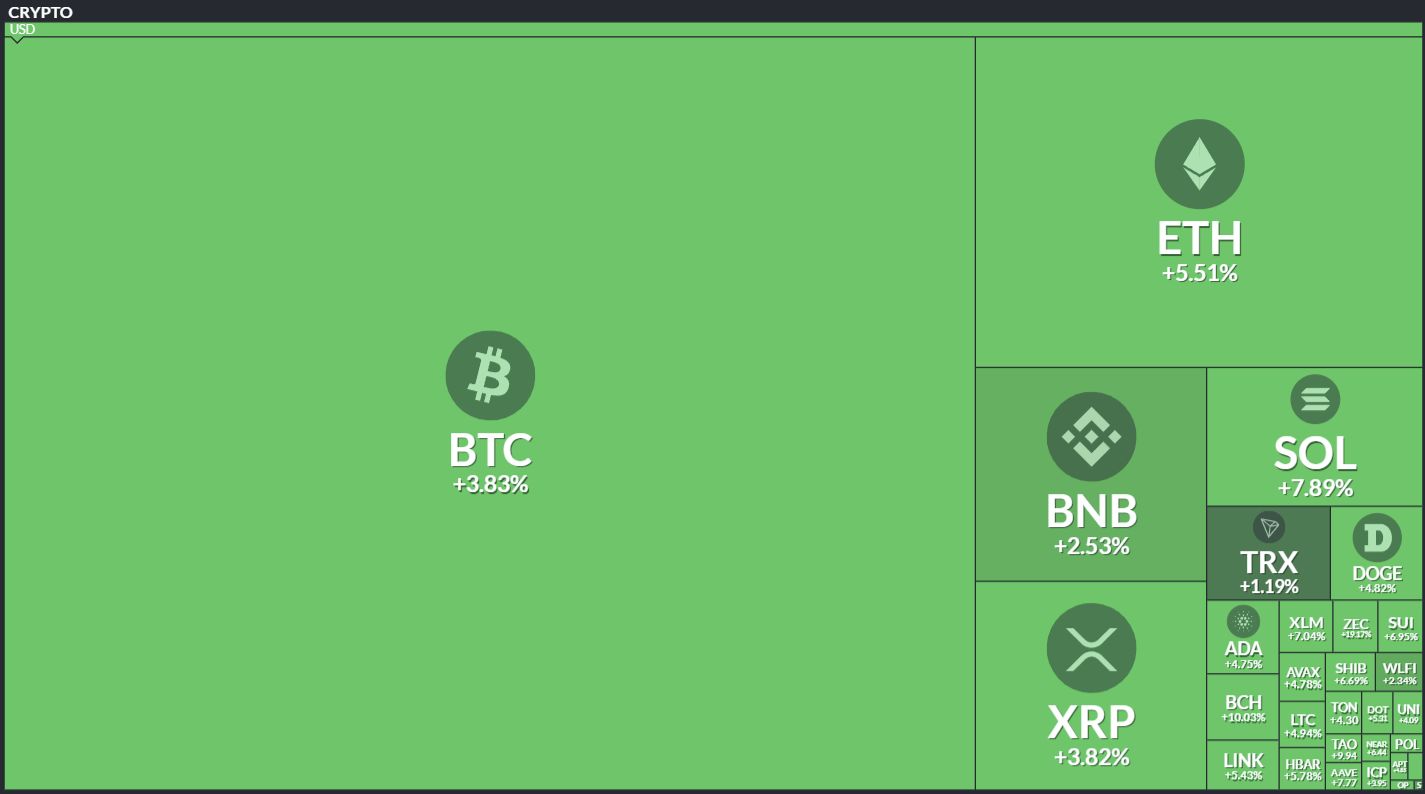

Before we dive in, here’s today’s crypto market heatmap:

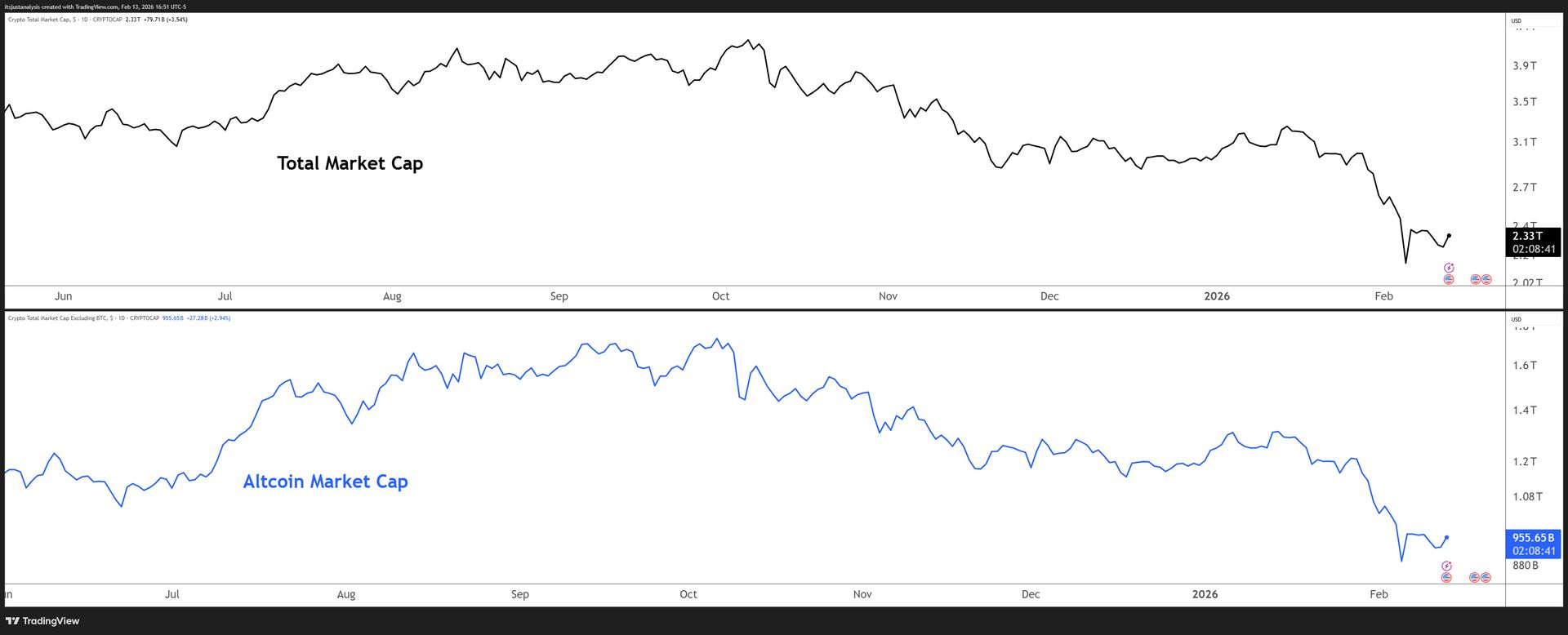

And here’s a look at crypto’s total market and altcoin market cap charts:

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

STABLECOINS

Hell Freezes Over: Legacy Media Defends Stablecoins Against the Banking Lobby 🧊

Mark the calendar - Reuters just published a piece that doesn't read like it was ghostwritten by Jamie Dimon's PR team. 😯

Stephen Gandel's Breakingviews column basically dismantles the banking lobby's panic campaign against stablecoins, and I had to double-check I wasn't reading a crypto-native outlet. Banks are crying wolf about stablecoins draining $6 trillion in deposits, but the argument is fundamentally flawed.

Gandel actually points out that deposits don't leave the banking system - they just move. When someone buys a stablecoin, that cash goes into reserves like T-bills or bank accounts elsewhere. It's musical chairs.

Even better, Reuters ran the numbers using actual bank regulatory filings. Of over 4,000 profitable U.S. banks, only 174 tiny ones would go red if forced to pay just 1% more on consumer deposits. That's less than 0.5% of the total deposit base. Hardly the apocalypse BofA's Moynihan is shilling.

Oh, and here’s the juicy bit: the piece highlights that during the last rate hiking cycle, banks passed on only 40% of rate increases to retail depositors while business customers got 60-80%. So maybe, just maybe, more competition from yield-bearing stablecoins is exactly what regular savers need.

A mainstream financial outlet essentially arguing that stablecoins could be good for consumers and that banks are just protecting their cushy spread? In 2026? Someone check on the legacy finance commentariat - they might need smelling salts.

The banking sector survived money market funds. Savers won. Gandel's suggesting the same playbook applies here. And he's not wrong. 👍️

STOCKTWITS

Latest Stocktwits Podcasts & Videos 😱

The Latest Cryptotwits Podcast - From Charles Whiteboard to Building the Only Perp DEX on Cardano (Strike Finance)

The Howard Lindzon Show - Robinhood (HOOD): The Mob Turns, Crypto Noise, and What Matters

True Odds Podcast - Super Bowl Winners Recap + What’s Next: NBA All-Star, Olympics, WBC + Earnings

Ballpark Figures - Cooper Flagg PSA Flood + Bo Bichette Mets Bump (Bulls & Bears)

StocktwitsTV - AI Bubble or Reality? Markets Are Telling Us Something

The Philosphical Quant - Software Panic to All-Time Highs: How We Traded the IGV Reversal

DEFI

The Most Boring $2.5 Trillion Market Nobody's Talking About 🥱

Private credit. Two words guaranteed to glaze your eyes faster than a CoinDesk panel on "regulatory clarity." No mascot. No memecoin. Zero people drawing ascending triangles on it at 2 AM. 😴

While the rest of speculators and investors were betting on who would say what over Polymarket, whether crypto is in a bear, or if SBF will ever just STFU, credit quietly ballooned from $300 billion to roughly $2.5 trillion.

Double-digit returns. Low correlation to public markets. The kind of boring, consistent money that makes family offices do unspeakable things for allocation.

Strip away the jargon and it's just direct lending. Companies need capital, lenders provide it, everyone shakes hands. No bond market, no exchange, no prospectus. Most of the Global South runs on this stuff - and access is basically a "who you know" game.

So why hasn't crypto touched it? Because DeFi liquidity was built for assets that trade constantly. Private credit positions are sparse, time-bound, and meant to sit there and pay you back. Jamming them into a Uniswap-style AMM is like parking a tractor in a sports car garage.

It won’t fit, it’ll scratch up your cars, and when you’ve ruined the tractor John Deere won’t let you work on it yourself so now you’ve got a busted ass garage, ruined cars, and half a million dollars in farm equipment just taking up space.

Enter $BNT ( ▲ 6.37% )’s Carbon DeFi and Textile. Carbon lets participants define exactly when and at what price they'll trade, with no forced two-sided markets. Trades settle once and stay settled. Textile layers on top as a credit network where underwriters stake their own capital as first-loss risk.

Good underwriting earns more. Bad underwriting loses money. Skin in the game.

Is this the sexiest narrative in crypto? Not even close. But $2.5 trillion in boring money looking for better rails tends to move markets. 🚉

REAL WORLD ASSET TOKENIZATION

Jet Engines On The Blockchain: The RWA Nobody Asked For 🤔

Of all the things in the known universe you could slap on a blockchain - fine art, real estate, intellectual property, carbon credits, Treasury bills - someone woke up and said, "You know what the world needs? Tokenized jet engines." 🤦

$ETHZ ( ▲ 2.35% ) just announced the Eurus Aero Token I, which lets accredited investors buy $100 tokens representing revenue rights on two CFM56 jet engines currently leased to a major U.S. airline.

The engines cost $12.2 million total, the target return is roughly 11%, and distributions come monthly via ERC-20 tokens on an Ethereum Layer 2. Ok, this is starting to make a little more sense on the ‘why’.

And this is interesting: the leases run through 2028 (that’s not the interesting part) and include a $3 million put/call option at the end of each lease, so there's even a built-in exit mechanism.

Contracted cash flows, unlevered assets, defined term, maintenance handled by the carrier. On paper, it's a solid income instrument. But the sheer specificity of it is what kills me.

We skipped straight past the obvious tokenization candidates and landed on... commercial aviation turbofans. The RWA narrative has officially entered its "anything that isn't bolted down" phase. I mean these are bolted down. Technically. I think. I mean I hope to God they are otherwise that option exit is gonna be pretty sus…. 😶

NEWS

sUSD Promises It's Changed (Again) 🤦

$SNX ( ▲ 6.26% ) published a blog post this week titled "Rebuilding sUSD" but at this point it’s like a text from an ex who swears they're different now because they moved back to their hometown. 🙄

sUSD, for those who don’t know, is a, I hesitate to call it stable, but it’s a stablecoin. A stablecoin that changed its name three times (eUSD, nUSD, sUSD) like someone cycling through fresh-start identities.

And has depegged so many times across three market cycles that it should come with a therapist's referral. The 2020 crash. The post-UST fallout in 2022. The Curve liquidity blowup in 2024.

And then the crown jewel: SIP-420 in early 2025, which slashed collateralization from 750% to 200%, nuked the arbitrage incentive that actually defended the peg, and sent sUSD crashing south to $0.66.

Kain Warwick (Synthetix founder) changed his X handle to "kain.depeg." The community begged them to just get out of the stablecoin business entirely.

So what's the plan now? Move back to Ethereum Mainnet, launch some perps, do some buybacks, build "basis trade vaults," and pinky-promise a re-peg by Q2. They estimate $5 million in "strategic support" should do the trick.

Baby, you haven't changed. You just changed zip codes. 🥸

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

💸 Toku Puts Stablecoin Payroll on Sei So You Can Get Paid Instantly

Toku integrated Sei into its payroll API, letting companies pay employees in USDC that settles instantly instead of waiting for banks to pretend it's still 1995. The system plugs into Workday and ADP, so HR just keep clicking buttons while money moves. Sei's processed $3B in stablecoin volume in 30 days, which means real humans (maybe) are using this. Sei.

🤖 MultiversX Ships Five Protocols So AI Agents Can Buy Stuff

MultiversX integrated UCP, ACP, AP2, MCP, and x402 into what they're calling the "Universal Agentic Commerce Stack"- discovery, authorization, execution, and settlement for AI agents that need to spend money autonomously. The Supernova upgrade brings 600ms blocks with sub-300ms finality. First L1 to integrate Google's Universal Commerce Protocol. MultiverseX.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🚀 EVE Frontier Hackathon Offers $80K to Mod a Live Universe on Sui

I spit Celsius all over my keyboard when I read this beauty: CCP Games (the EVE Online people) is running a hackathon with $80k in prizes for building in-world mods and external tools for EVE Frontier, a space survival game where player-created systems persist in a shared universe. Build Smart Assembly mods that other players can encounter, defend, or destroy - or create external maps and coordination tools using the live API. PvP FTW. Sui.

🧠 Decentraland Launches Trivia Thursdays

Decentraland is running weekly live trivia at 2pm and 8pm UTC for six weeks, with themes ranging from Cult Sci-Fi to 90s Pop Culture and absolutely no prizes. Games cap at 20 players, the leaderboard resets after each round, and the whole point is "showing up and playing together" rather than grinding for rewards. It's basically a pub quiz without the pub, the alcohol, or the sticky floors. Decentraland.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🍣 Sushi Lands on Stellar

Sushi V3 AMM is now live on Stellar, bringing concentrated liquidity to a network that's spent a decade being really good at payments and not much else. Cross-chain functionality is "coming in the coming weeks," which in crypto time means somewhere between tomorrow and never. SushiSwap.

⚖️ Curve, Aave, and Metalex Discuss Whether DAOs Are Countries or Just Confused

The "DAO on Trial" podcast brought together Michael Egorov, Marc Zeller, and Gabriel Shapiro to debate where on-chain governance collides with real-world law, human incentives, and trademark disputes. Consensus: DAOs are closer to countries than companies, governance only works when it has real teeth, and off-chain assets remain the structural weakness everyone's ignoring. Curve Finance.

📈 Robinhood Chain Testnet Goes Live on Arbitrum With $1M for Developers

Robinhood launched its chain testnet on the Arbitrum platform, committed $1M to the Open House developer program, and released a faucet with test versions of Tesla, Amazon, and Palantir Stock Tokens. They want to validate demand on shared infrastructure before migrating to the real deal. Phase 1 is testing; Phase 2 is mainnet; Phase 3 is presumably regulators asking questions. Arbitrum.

NEWS IN THREE SENTENCES

Protocol News 🏦

⚡ Optimism Partners With Succinct to Kill the 7-Day Withdrawal Wait

Optimism named Succinct as its first preferred ZK prover, making validity proofs canonical on the OP Stack so withdrawals can eventually be instant instead of requiring a week-long challenge period. Custody providers and market makers can finally stop locking capital like it's 2021. This is still the worst named crypto in history. Optimism.

🎨 Kusama Gets 10M DOT for ZK, Proof of Personhood, and Weird Art

Web3 Foundation is allocating 10 million DOT to three Kusama bounties covering zero-knowledge proofs, proof of personhood, and art/social experiments. Proposals are open for builders, researchers, and "dreamers,". The Spammening stress test hit 143k TPS; now let's see what the artists can break. Kusama.

🇬🇧 IOTA, Sui, Cardano, and Avalanche Tell UK Regulators to Chill on Non-Custodial Stuff

Four foundations submitted a joint response to the FCA's crypto consultation arguing that regulation should focus on custody and control, not punish infrastructure providers who never touch user funds. They said custodial staking needs rules, non-custodial staking doesn't, and calling every DeFi developer a "controlling person" will kill innovation. Iota.

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋