- Cryptotwits

- Posts

- Feels Like Climbing Out Of A Hole Then Falling Into Another, Deeper, And Meaner Hole 😶

Feels Like Climbing Out Of A Hole Then Falling Into Another, Deeper, And Meaner Hole 😶

Global uncertainty spiked, and crypto’s risk premium detonated. The table for two is full. Crypto’s standing at the coat rack.

OVERVIEW

Feels Like Climbing Out Of A Hole Then Falling Into Another, Deeper, And Meaner Hole 😶

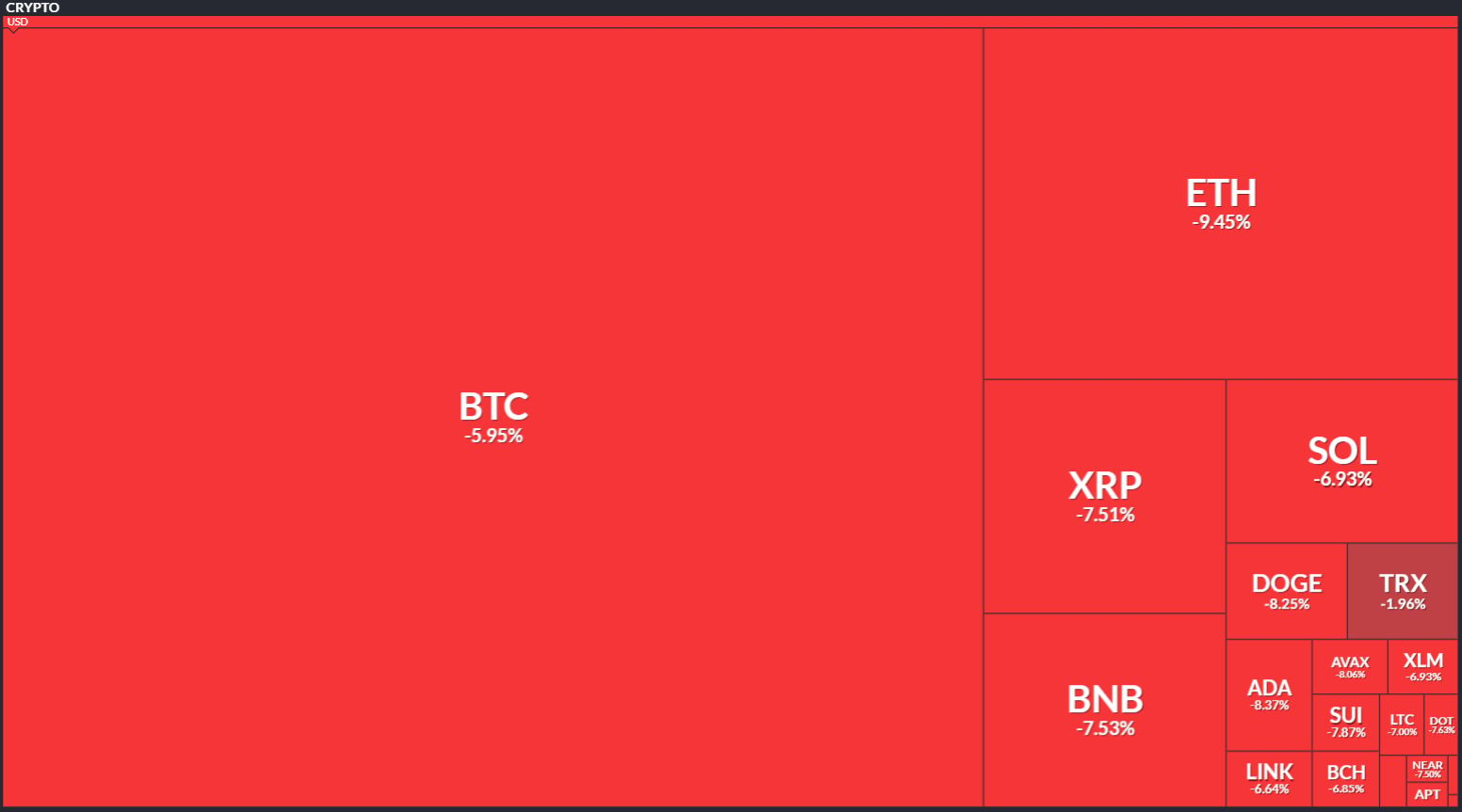

Before we dive in, here’s today’s crypto market heatmap:

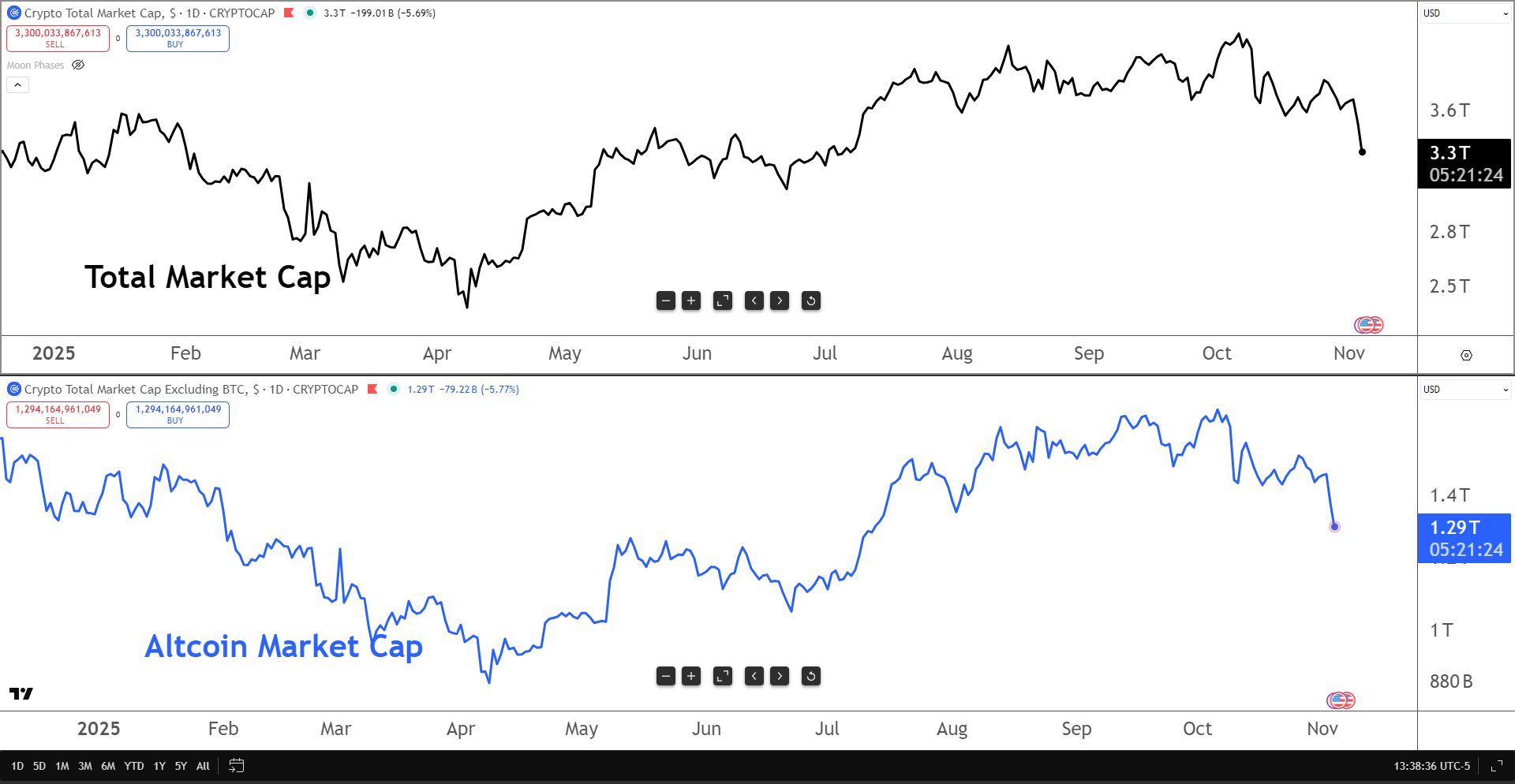

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

I’m in Miami. No, The Newsletter Is Not Taking a Vacation 😎

I’m in Miami this week repping Stocktwits at the Blockchain Futurist Conference. 🫡

I’ll be on the DeFi main stage with some other panelists talking about “DeFi’s Social Layer: Storytelling, Sentiment & Collective Power” - basically how real communities (like the ones on Stocktwits) shape trust, adoption, and momentum way more than just code ever could.

It’s about how the future of DeFi depends on authentic engagement, storytelling, and, yeah, a bit of chaos - all things we know plenty about at Stocktwits. The Cryptotwits Newsletter is still dropping this week, though between panels, travel, and talks with people way cooler than me, it might run a bit leaner on Wednesday or Thursday.

The Cryptotwits newsletter will still be delicious, just fewer calories. Like those Snackwell chocolate cookies from the early 1990s. 🍪

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

PRIVACY

Is Zcash’s Pump Different This Time? 🧠

When a heavyweight like Galaxy Digital drops a deep-dive research piece titled “Why Has Zcash Suddenly Soared?”, you probably should pay attention. 🤯

But you might be asking, ‘um, why should this research matter?’

Because most “coin write-ups” you skim through are thin - “we like this project, it has promise etc.” Galaxy’s approach is deeper: they dissect protocol evolution, nodecounts, anonymity sets, UX upgrades, cross-chain flows - all the kind of stuff you’d rather not ignore.

So when they throw their weight behind “this is a shift,” the market listens.

In this case: $ZEC.X ( ▼ 2.93% ) went from “privacy coin you vaguely know about” to “privacy coin making a legitimate push.” That transition is what Galaxy is highlighting - and yes, that triggers FOMO-alarms.

Galaxy On The Mechanisms Behind ZEC’s Pop

Zcash matches Bitcoin’s monetary model (21 M cap, halving, proof-of-work) but adds zk-SNARKs to hide sender/receiver/amount. That’s gold in a world where on-chain surveillance is routine.

UX improvements: the Zashi wallet, cross-chain intent rails via $NEAR.X ( ▲ 3.04% ) Intents. Less friction = higher use case.

Narrative game-changer: privacy is shifting from niche to “feature again.” Galaxy notes increased Google search interest for privacy and a broader cultural push.

Liquidity & trading: Perpetuals, derivatives open interest rising ($115-ish million as of Oct. 30).

Galaxy On The Risks

Node count: Zcash’s full nodes (100-120) are tiny compared to Bitcoin’s 24,000. Smaller footprint may invite criticism of decentralization.

UX/opsec: If users mis-use transparent addresses or mis-handle shielding, the tech advantage dissolves.

Regulation: Privacy coins sit high on regulators’ radars. Galaxy mentions Monero’s more aggressive scrutiny; Zcash has optional privacy which may help, but nothing’s guaranteed.

Is the surge just hype? Always the question. Galaxy’s view suggests tech + narrative alignment - but timing and macro still matter.

One good thing about an entity like Galaxy writing this kind of research is that Galaxy’s research isn’t fluff. They’re pointing out that ZEC might be entering a phase where its privacy stack, usability and market narrative align. 🫢

NEWS

MoonPay Hooks Up With Pump.fun 🤦

While the alt-pocalypse has moved into full blown, crypto wide FUD-pocalypse, this gem of a press release came out. 😐️

MoonPay Integrates with Pump.fun to Power Instant Crypto Purchases

Oh, great. Just what this industry needed: an easier way to go from “I have a dumb meme idea” to “I accidentally lost 3 SOL to a token named HippoButtSnifferGoldHolder.”

Now, inside the Pump.fun app (can confirm), users can buy crypto with Apple Pay, Google Pay, or even a credit card. The move supposedly “simplifies the onramp process,” which is corporate-speak for “removes one extra second between you and your next impulsive purchase.”

Pump.fun’s founders are thrilled. CEO Alon Cohen said MoonPay “drastically reduces friction,” which is true - friction is the one thing preventing half these shitcoins from existing in the first place.

Don’t get me wrong. I love MoonPay, I love memecoins, I don’t necesisarrily hate Rug.Pull, but that’s only because the people (I count myself among the degens to… occasionally try tricks there) who dare to play cryptos version of Russian roulette with an all cyclinders loaded .38 Special know what the hell they’re getting themselves into.

Also, MoonPay is yuge. Like, 30 million customers yuge and more licenses than your average U.S. bank. Anyway, MoonPay is live on Pump.fun right now. 💳

DEFI

Un-Balanced ⬇️

SHOCKER: Another DeFi entity was sploited. This time $BAL.X ( ▼ 7.9% ). 🤦

Here’s a timeline and update of what’s going on. First, yesterday, Balancer acknowledged what crypto was screaming:

Today, around 7:48 AM UTC, an exploit affected Balancer V2 Composable Stable Pools.

Our team is working with leading security researchers to understand the issue and will share additional findings and a full post-mortem as soon as possible.

Because these pools have been live

— Balancer (@Balancer)

4:55 PM • Nov 3, 2025

Monday, November 3, 2025 - EST

02:48 - Balancer confirms an exploit on V2 Composable Stable Pools. V3 and other pool types called unaffected.

03:15 to 05:00 - Outflows stack fast across chains. Media tallies swing from $110M toward the $120M–$128M band.

03:30 to morning - Balancer says affected pools that could be paused were paused and moved to recovery mode.

04:22 - An on‑chain note offers up to a 20% white‑hat bounty for a full return within 48 hours. Yes, the carrot came with a threat of forensics and law enforcement on the stick.

Morning - $BERA.X ( ▼ 0.5% ) validators halt the chain to prep an emergency hard fork after BEX exposure to the same Balancer V2 vector. Public comms peg roughly low‑teens millions at risk on BEX.

Tuesday, November 4, 2025 - EST

Overnight to early morning - StakeWise clawback: the StakeWise DAO emergency multisig recovers about 5,041 osETH (73.5% of the 6,851 osETH stolen on mainnet) plus 13,495 osGNO, with funds to be returned pro‑rata to affected users.

Early morning - Berachain ships the hard‑fork binary to validators. Foundation says they’re waiting on core infra partners to update RPCs before block production restarts.

Early morning - White‑hat angle on BEX funds: Berachain says the current holder is an MEV bot operator claiming white‑hat status and has pre‑signed return transactions to execute once the chain is live. Useful if true, and it’s coming from the team’s public comms.

Updates from Bera Core:

A binary has been cut to prevent the addresses holding funds which were taken from the BEX pools from transferring any tokens anywhere else, with the sole "whitelisted destination" of an address belonging to the Foundation.

This binary will also enforce

— Berachain Foundation 🐻⛓ (@berachain)

4:14 PM • Nov 3, 2025

And that’s where we’re currently at as of 10 AM EST. ⏲️

TL;DR Version

What Balancer actually said: exploit confined to V2 Composable Stable Pools, other pool types and V3 unaffected; pools paused where possible; phishing alerts active; full post‑mortem to come.

Berachain today: hard‑fork binary distributed, chain still paused pending partner RPC updates; pre‑signed white‑hat returns queued for BEX once blocks resume.

Recovered funds: 5,041 osETH + 13,495 osGNO recovered by StakeWise; plan is pro‑rata reimbursement to impacted users.

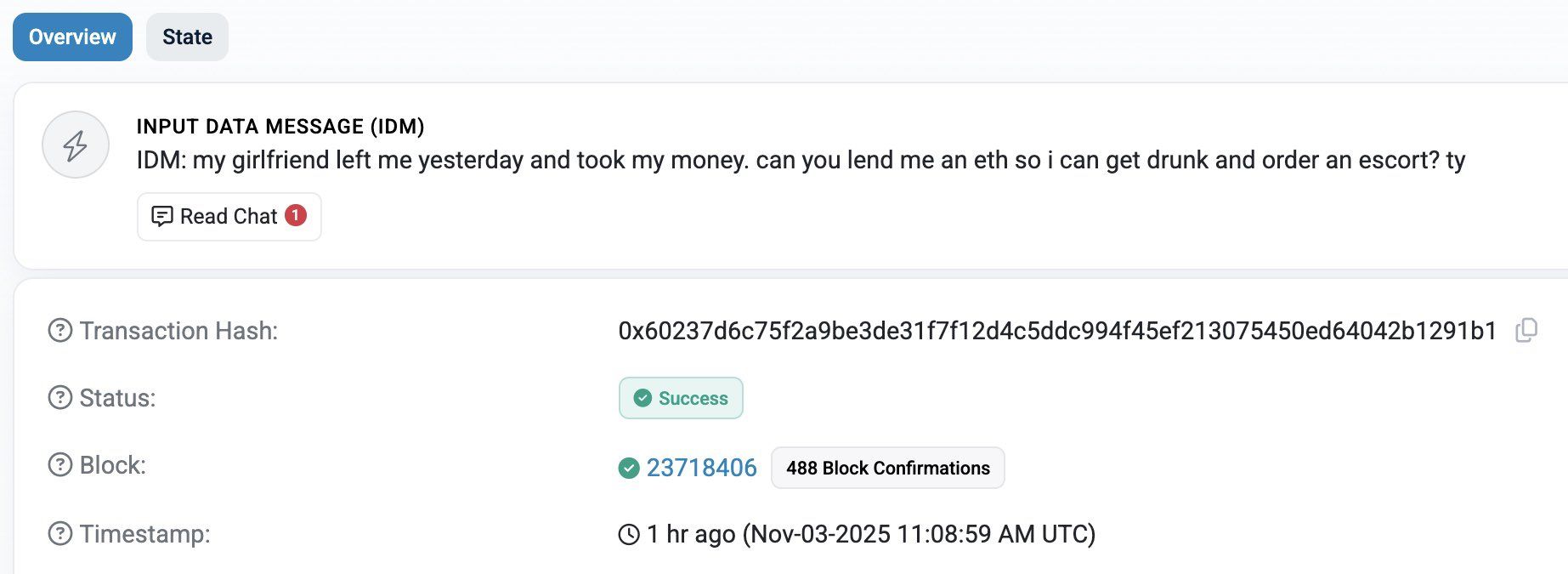

Oh, and because the sense of humor crypto has about this kind of shit is beyond gallows humor level, here’s the most degen thing I’ve seen about this latest DeFi shitstorm: a message someone sent to the hacker on-chain:

I’ll keep you updated as things develop. Be careful out there.💚

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🐙 Kraken Stakes $100 Million INJ, Goes Institutional With Injective

Oh look, a whale that knows how to follow compliance paperwork (ok, not a whale, but a kraken). .Kraken joined Pineapple’s $100M Injective treasury, staking directly into the network and bringing serious TradFi credibility with it. With licenses across four continents and a spotless record, Kraken is giving institutions the “safe” door into on-chain finance. Injective Protocol.

🔗 Quant vs Circle: One Unifies a Token, the Other an Economy

Circle’s Gateway makes USDC fluid across chains - a neat fix for one asset. Quant’s Fusion Rollup takes it further, linking every asset and ledger into one programmable interoperability layer. Circle wants to move dollars; Quant wants to move entire markets. Guess who’s thinking bigger. Quant.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🌍 UNDP + FLock.io Prove Blockchain Can Actually Save Things

Turns out Web3 can fix stuff when it stops minting cartoons. From NFTs funding gorilla conservation in Rwanda to blockchain carbon credits for India’s rice farmers, FLock.io’s tech is powering seven UN-backed projects tackling climate, gender finance, and healthcare. Smart contracts are literally paying subsistence allowances in Liberia and verifying carbon data in Sierra Leone. FLoCK.

🎮 World × Mythical Games Build a Human-Only Gaming Layer 3

Nothing kills fun faster than 147 billion bot clicks a month. World’s proof-of-human tech is heading to Mythical Games’ millions of players to nuke bots and level leaderboards. Mythical’s new Layer 3 on World Chain will run human-verified tournaments and fair in-game economies secured by Ethereum. Worldcoin.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🧱 Optimism Builds the Enterprise DeFi Stack of Dreams

Optimism’s OP Mainnet just added Morpho, Gauntlet, and Utila to deliver a full “earn” infrastructure with 250 ms transactions and sub-penny fees. Coinbase, Kraken, Sony, and Uniswap are already building chains on the OP Stack, proving enterprises want blockspace that feels like SaaS. But omg the price action sucks, it’s the worse named crypto out there folks. Optimism.

💰 Yearn Grows Up With YIP-88 and a New stYFI Model

Omg, another update from Yearn’s official blog (only the second in years). Yearn just rewired itself for adulthood: a single staking token (stYFI), on-chain team P&Ls, and profit-based YFI bonuses replace four-year locks and messy governance. veYFI holders migrate automatically with reward multipliers for loyalty. Yearn Finance.

NEWS IN THREE SENTENCES

Protocol News 🏦

🔷 Chainlink Turns Staking Into a Token Buffet With Rewards Season 1

Chainlink’s new rewards season gives LINK stakers cubes - basically blockchain airline miles - to allocate across nine Build projects like Dolomite, Space and Time, and Truf Network. The more you research and allocate, the more project tokens you claim, with bonus pools for the patient who don’t “Early Unlock” and bail. Chainlink.

⚙️ Akash Goes Full Rebuild With Cosmos SDK v0.53

The decentralized cloud finally runs like a real one - minus the AWS outage anxiety. After years of technical debt and slow upgrades, Akash just leapfrogged eight SDK versions in one go. The Mainnet 14 upgrade adds JWT logins, faster IAVL storage, and expedited governance so decisions move at internet speed instead of committee pace. Akash Network.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, XLM, ADA, ZEC, FET. 📋