- Cryptotwits

- Posts

- Fear Index Hits Fetal Position 👶

Fear Index Hits Fetal Position 👶

Analysts recommend deep breaths and avoiding portfolio apps.

OVERVIEW

Fear Index Hits Fetal Position 👶

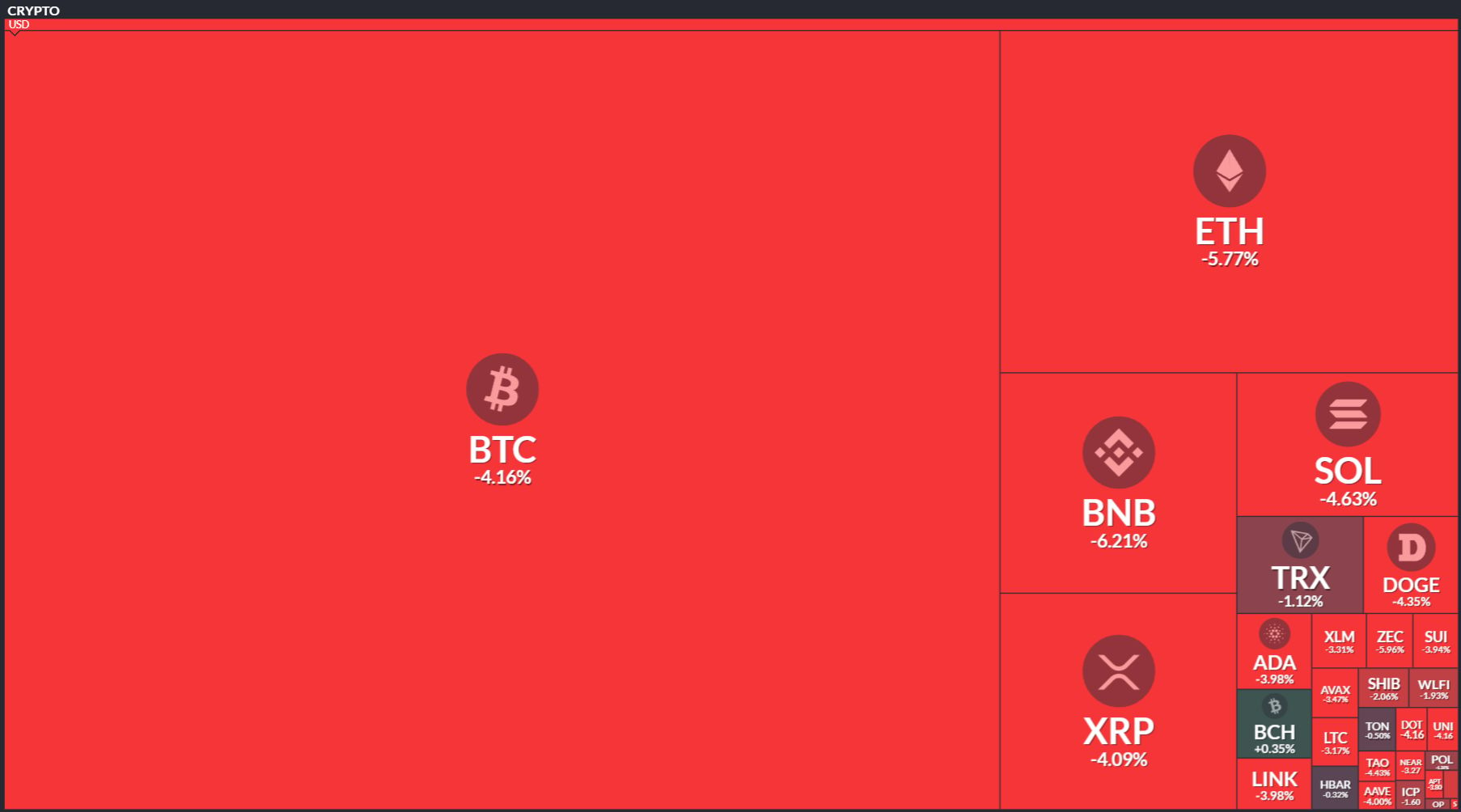

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

Welcome Back To The Leverage Absorption Ratio ❤️🩹

Open interest tells you leverage is building. It doesn't tell you if that leverage is healthy or a bomb. That’s why I developed the Leverage Absorption Ratio (LAR). 🧠

When I was originally developing the LAR, I included data about funding rates, liquidations and funding swings (periods when longs and shorts get wonked). For a long time, those three stats had little to no effect on the LAR - they just made the work longer.

Buuuuut.

Now we’re in an environment where it makes sense to include those variables:

Funding Rate Penalty - Crowded positioning (funding >0.8%) applies 40% penalty to base LAR

Liquidation Context - Shows if the same crowd is re-levering into the same losing trade

Bi-Directional Chaos Detection - When funding swings -1% to +0.9%, both sides are getting destroyed, also BDCD sounds cool, so does chaos. Anyway.

That’s what we’re looking at today. 👇️

TECHNICAL ANALYSIS

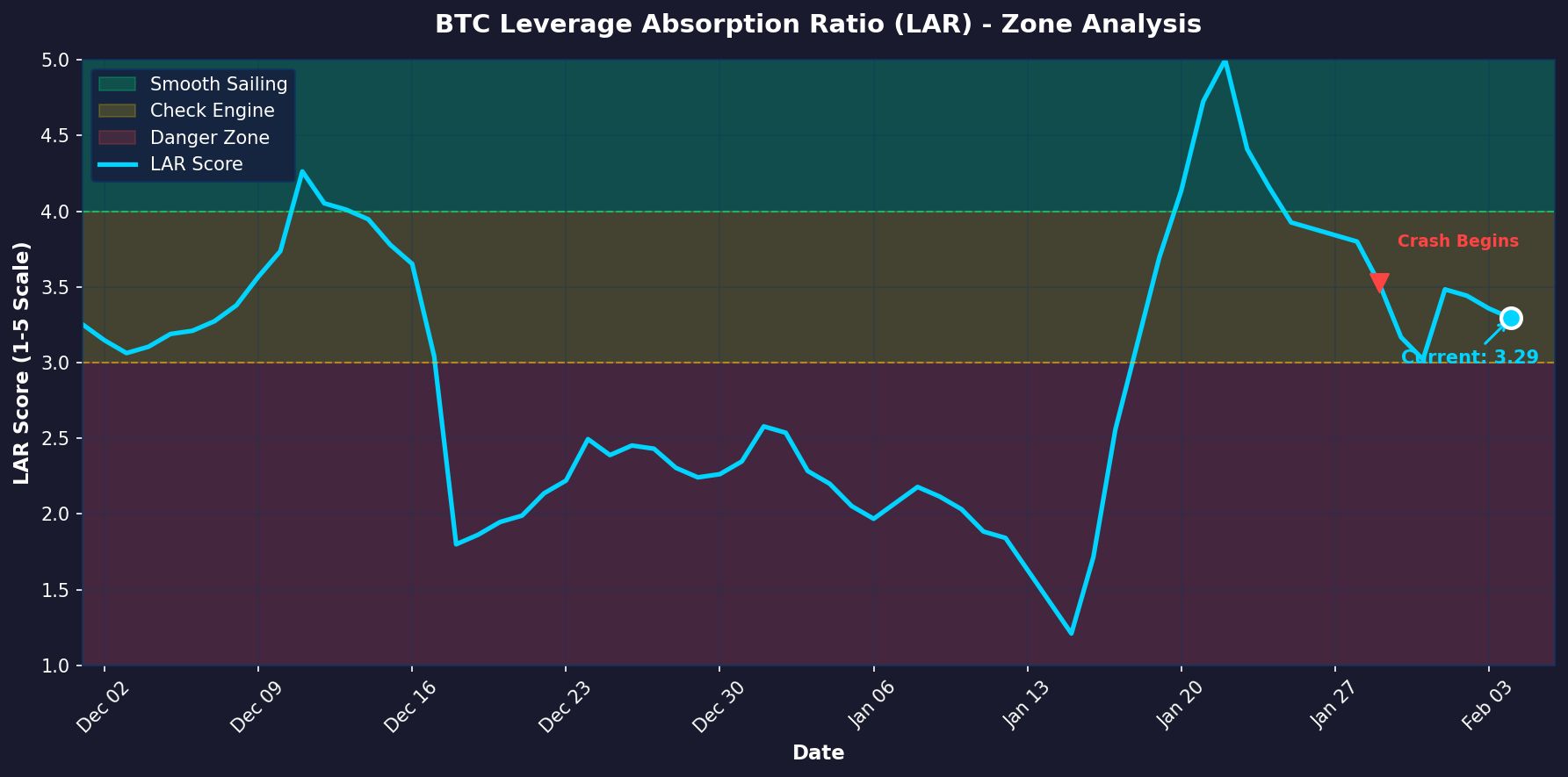

BTC LAR Analysis 📊

You'd think after watching three-quarters of a billion dollars get vaporized, the degenerate long crowd might take a breather. Maybe touch grass. Call their mothers. Reflect on their life choices.

Nope.

Funding rates are back at 0.90%. These people saw a $771M liquidation cascade and thought "this is fine, I should lever up again." It's like watching someone touch a hot stove, scream, and then immediately lick it. 🍳

The Numbers (For Those Who Enjoy Pain)

The base LAR at 3.29 would normally put us in "cautious but okay" territory. But here's the thing about the crypto degen community - we have the pattern recognition of a goldfish with a gambling addiction.

When we apply the funding penalty for the 0.90% rate, the adjusted LAR is an ugly 1.98.

That's not "Check Engine." That's "Your Engine Is On Fire And You're Driving Into A Lake." 🔥

Pre-Crash Warning Signs? Yup

In the 28 days before the crash:

60.7% of days in Danger Zone

Average funding at 0.35% (translation: everyone was long)

Multiple readings at 0.9% (translation: everyone was VERY long)

Where We’re At

Look, the post-crash LAR did hold up better than expected. We went from 1.21 (catastrophic) to 3.29 (merely bad). The flush cleared some leverage.

But watching funding rates jump right back to 0.9% is like watching your buddy who just got out of rehab order a double of Jameson, neat. I want to believe, but the evidence suggests otherwise.

NEAR-TERM LEAN: BEARISH 🐻

ON-CHAIN ANALYSIS

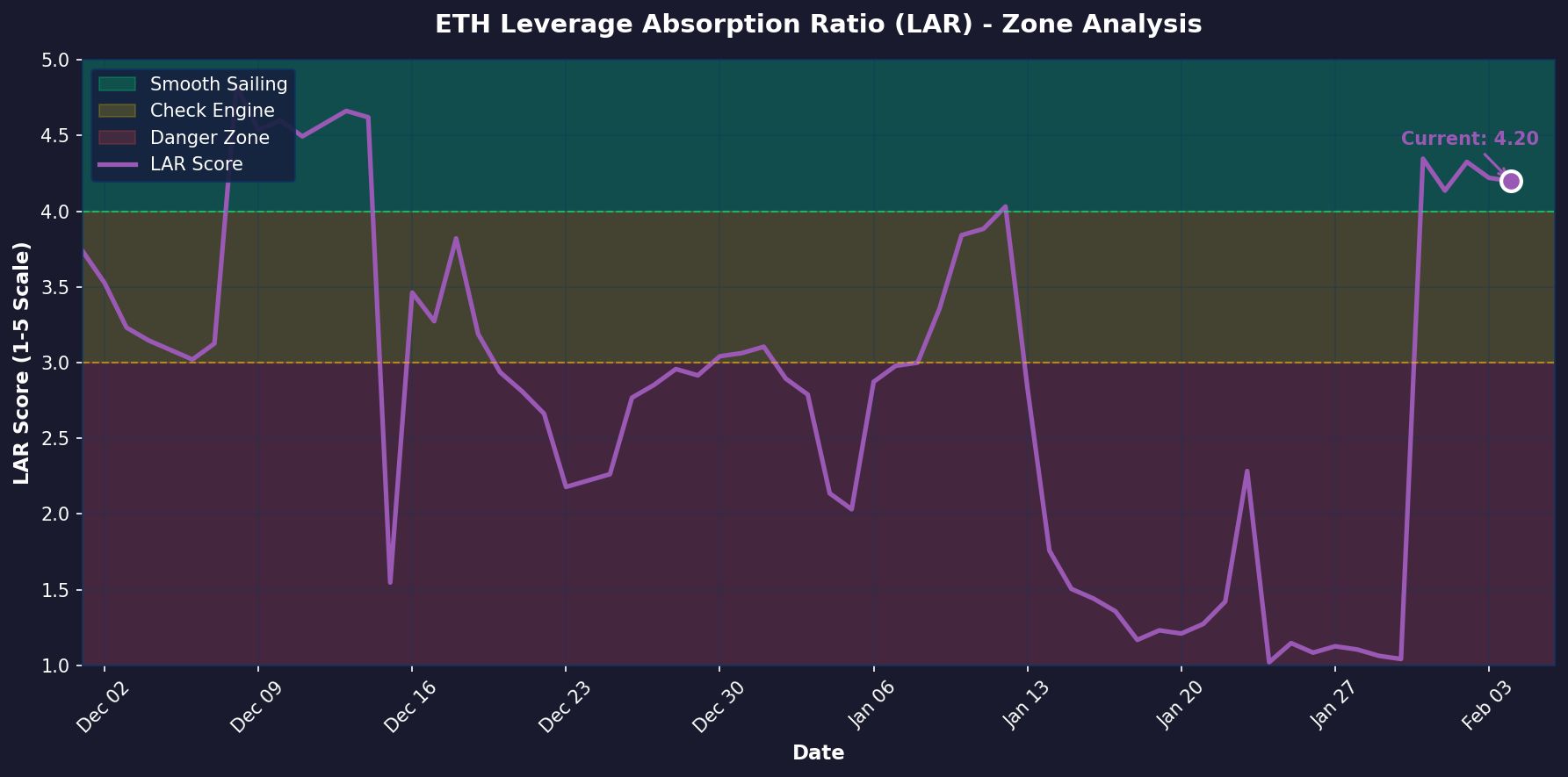

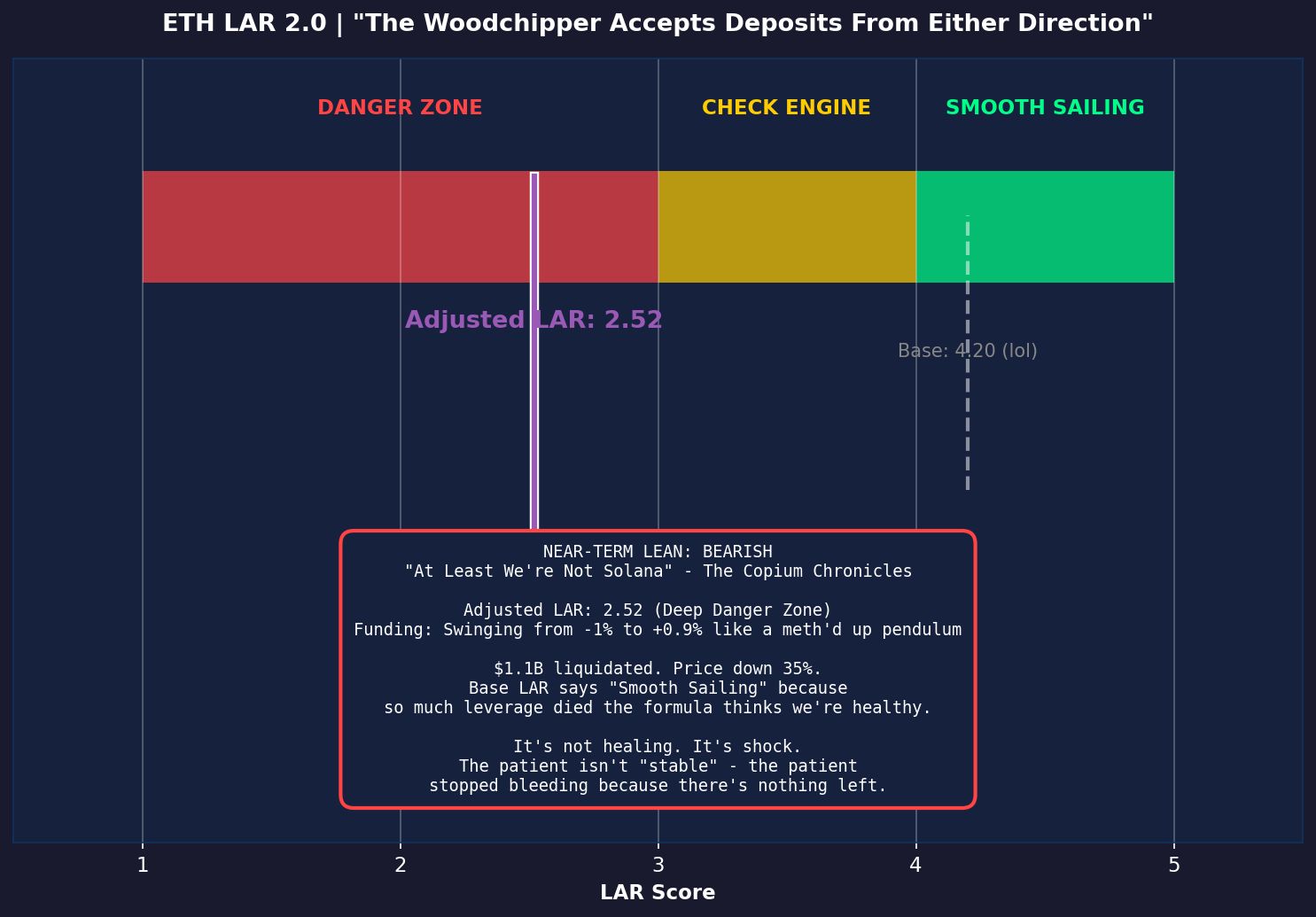

ETH LAR Analysis 🥈

ETH got taken behind the barn and shown what happens when $1.1 billion in longs meet $0 in mercy.

Price went from $3,300 to, as of writing this (1300 EST), $2,100. For context, if ETH were a stock, CNBC would be running "IS ETHEREUM DEAD?" segments with concerned-looking anchors. But it's crypto, so we just call it "Wednesday." 📆

The base LAR reads 4.20 - "Smooth Sailing." You know why? Because so much leverage got obliterated that the formula thinks we're healthy now. It's like saying a patient is cured because the disease killed them. Technically the metrics improved! 🙂

Also, if BTC’s funding is bad, then ETH;s funding is chaotic evil. The swings from -1% to +0.9% mean BOTH sides are getting liquidated in rapid succession. It's a woodchipper that accepts deposits from either direction.

The Adjusted LAR Makes ETH Look Horribad

Throw in the funding rates and liquidation history over the past 30-days and the base LAR feels kind of… well just mean.

The funding whipsaw is a dealbreaker. You can trade a market where everyone's long. You can trade a market where everyone's short. You cannot trade a market where the crowd changes direction every 48 hours like a school of fish on meth.

The massive OI flush means there's actually less leverage in the system now. If funding stabilizes and volatility compresses, ETH could bounce harder than BTC precisely because it got hit harder. The rubberband effect.

But I need to see funding calm down first. Right now it's oscillating like a seismograph during an earthquake.

Oh, and Buterin’s recent comments about ETH and L2’s isn’t helping. More on that later though.

NEAR-TERM LEAN: BEARISH 🐻

ON-CHAIN ANALYSIS

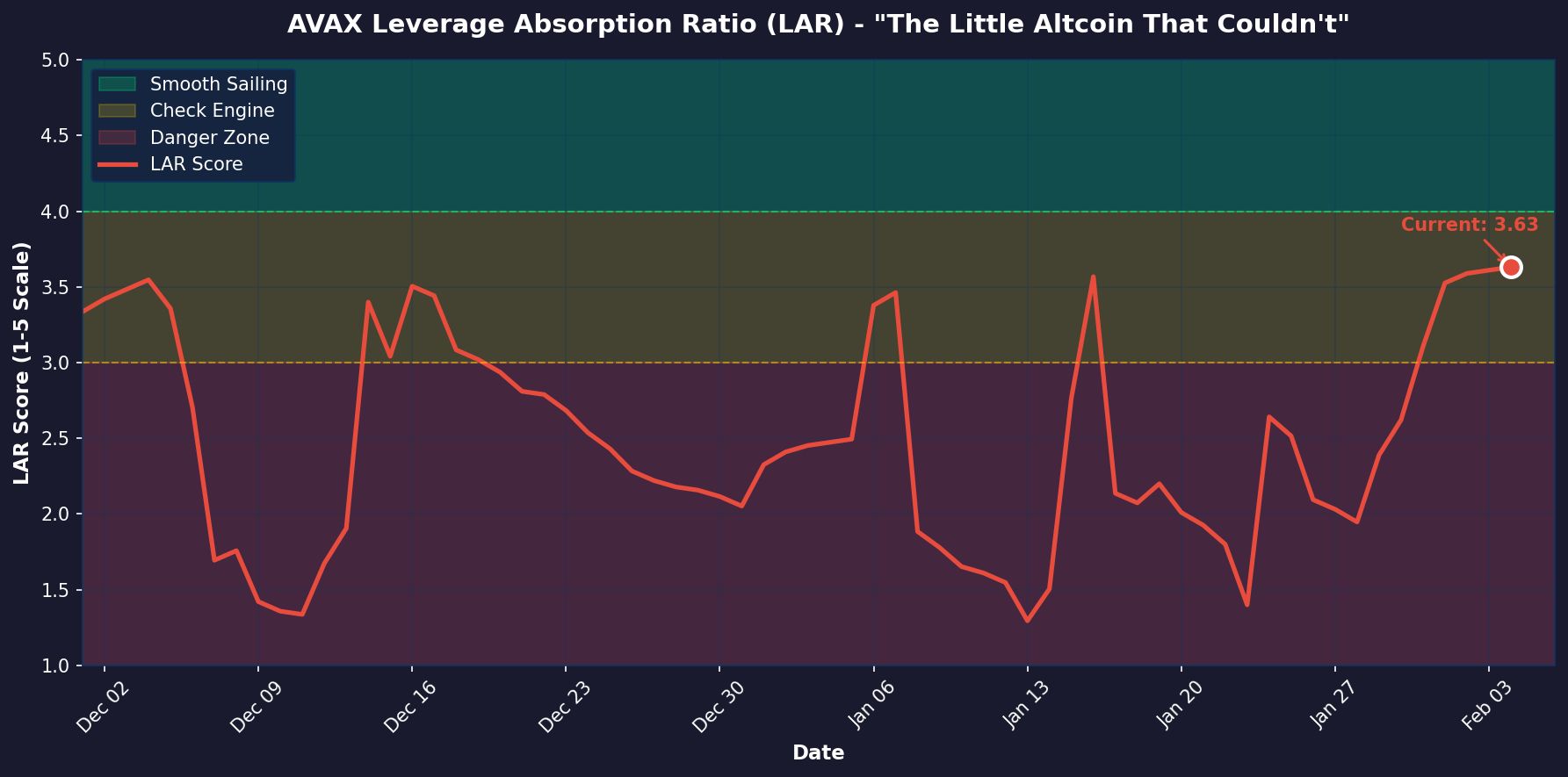

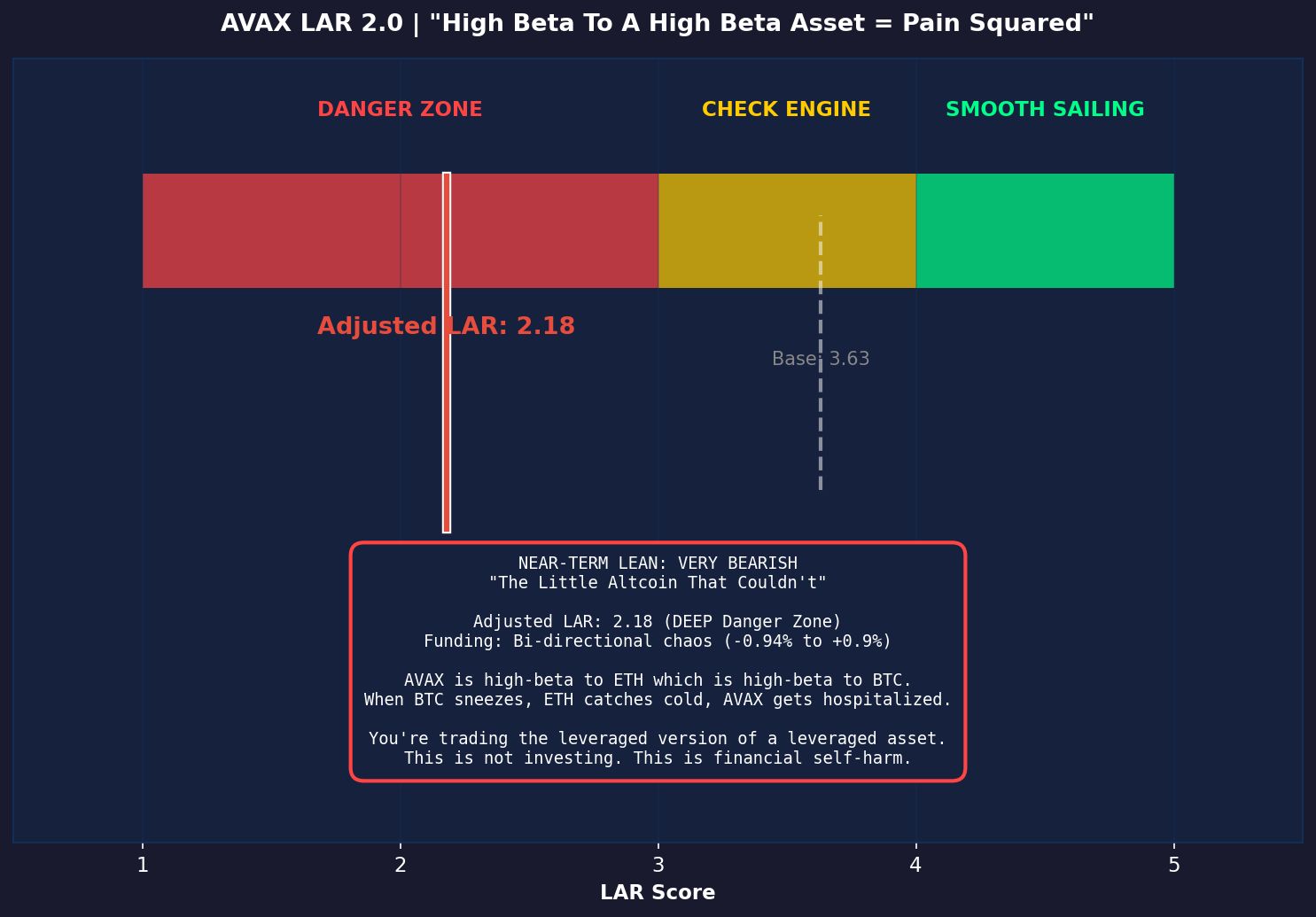

AVAX LAR Analysis 🏔️

Here's the thing about AVAX - it's high-beta to ETH, which is high-beta to BTC. So when BTC dropped hard, ETH dropped a little harder, and AVAX dropped... well just hard but with more violence and fewer survivors. 😱

The base LAR reads 3.63 - "Check Engine." Sounds manageable, right? Like maybe you just need to top off the oil and rotate the tires.

No.

When you factor in the bi-directional funding chaos, adjusted LAR drops to 2.18. The check engine is really, quite literally, check the physical engine because it blowded up already. 🧨

The Funding Rate Situation (A Shakespearean Tragedy)

AVAX experienced the the same bi-directional chaos we looked at in ETH, which means the same thing: BOTH sides are getting liquidated in rapid succession. Longs get destroyed, shorts pile in, shorts get destroyed, longs pile in, repeat until everyone is poor.

When you have bi-directional liquidation cascades in a thinner order book, the moves get more violent. $4.8M in AVAX liquidations doesn't sound like much compared to BTC's $771M, but relative to it’s open interest, it's proportionally devastating.

And when you account for the liquidations and funding rates, the adjusted LAR is ugly. Stupidly ugly.

And consider this: AVAX spent nine out of every ten pre-crash days in the Danger Zone. And somewhere, someone is reading this thinking "but that means it's oversold, right?"

Sure. It's also possible to be correctly positioned in a falling knife factory. But at some point you have to ask yourself: is this investing, or is this just financial self-harm with extra steps?

Oh, to be clear, I still hodl my AVAX and added to those bags because I love pain.

NEAR-TERM LEAN: VERY BEARISH 🐻

ON-CHAIN ANALYSIS

The Contrarian Take: What Flips This Bullish? 🤔

Is it all doom and gloom? Nope. One thing about this LAR 2.0 or Adjusted LAR (I haven’t decided on a name yet) is that the changes that could flip the bearish lean can happen very quickly. ⏩️

What To Watching For The Bear Turning Into A Bull

Funding normalization (BTC <0.10% for 3+ days, ETH/AVAX stops swinging) - check CoinGlass’ funding rates page here.

Volatility compression (BTC toward 3-4%, ETH toward 5-6%, AVAX toward 6-7%)

OI rebuilds without price weakness

Why This Could Happen Faster Than Expected

Billions already liquidated - weak hands gone (but damnit if they don’t keep coming back)

OI collapsed 25-40% - less liquidation fuel

ETH’s base LAR spiked to 4.20 - formula detecting improved structure

Mean reversion is real - 0.9% funding doesn't stay forever

ETHEREUM

Vitalik To L2s: Thanks for Building, Now Please Stop 🤔

Well, this is awkward. 😶

Vitalik Buterin dropped this gem yesterday morning:

It’s basically a "it's not you, it's me" breakup letter to Layer 2s. After years of telling everyone that rollups were the future and L2s would scale Ethereum to infinity and beyond, the co-founder now says "the original vision of L2s and their role in Ethereum no longer makes sense."

Buterin 2020: "We need L2s to scale Ethereum! Build rollups! Be our branded shards!"

L2s: spend five years and billions of dollars building rollup infrastructure

Buterin 2026: "Actually, stop calling yourselves Ethereum scaling solutions. Find a different value prop. Maybe try privacy or AI or something."

The data backs up the awkwardness. TokenTerminal shows L2 monthly active addresses dropped from 58.4 million to 30 million since mid-2025, while Ethereum L1 users nearly doubled.

But there's something deeply ironic about spending half a decade pushing a rollup-centric roadmap, watching an entire ecosystem orient around that vision, and then publishing "we need a new path" when the L2 tokens are already down 80% from their highs. 🤦

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋