- Cryptotwits

- Posts

- Deadtober, Rektober, Bleedtober, Helltober... But It's Definitely Not Uptober 🩸

Deadtober, Rektober, Bleedtober, Helltober... But It's Definitely Not Uptober 🩸

This month is a real biatch

OVERVIEW

Deadtober, Bleedtober, Helltober... But It's Definitely Not Uptober 🩸

Before we dive in, here’s today’s crypto market heatmap:

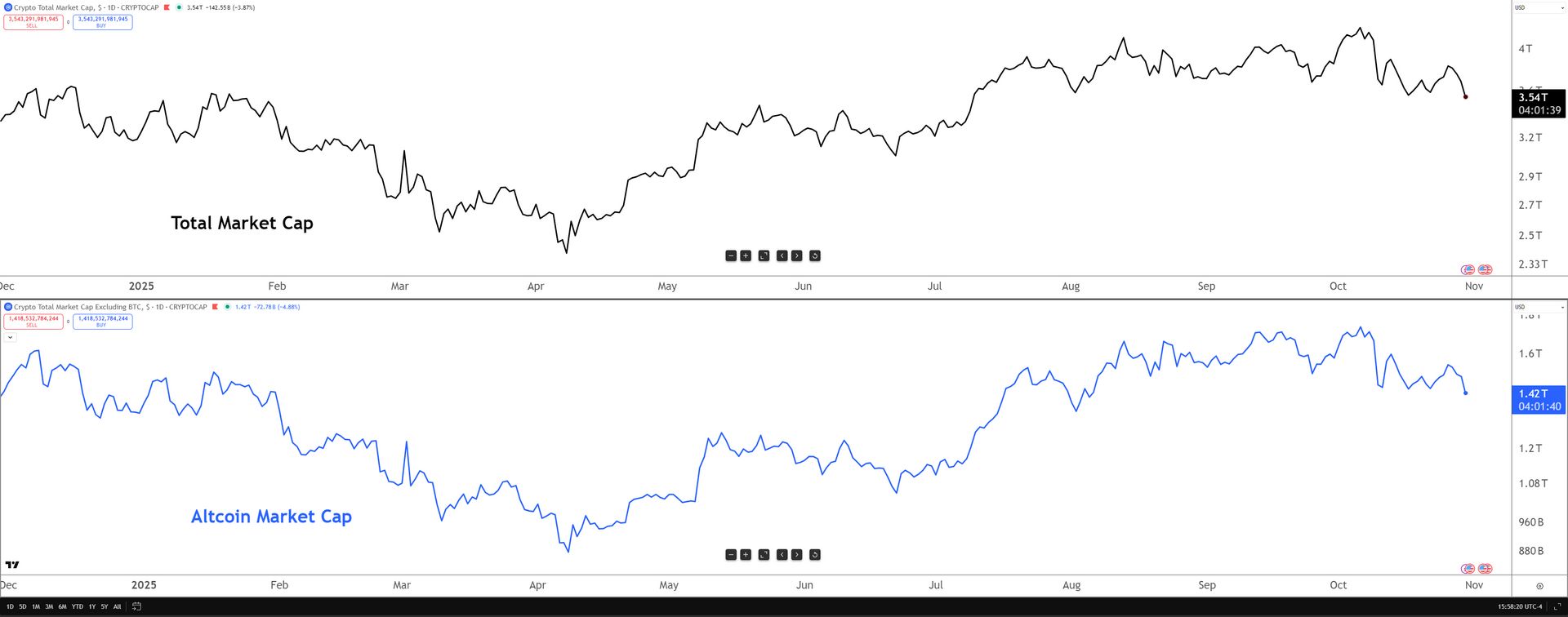

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Solana Had A Great Week. The Market Pretended Not To Notice 🤷

Any other week, and $SOL.X ( ▼ 2.15% ) might be making new ATHs given the kind of news it’s had this week. Solana got two majorly huge wins this week. 😥

The Staking ETF

Bitwise rolled out $BSOL.X ( ▼ 3.56% ) on the NYSE. It’s the first U.S. spot Solana ETP with built‑in staking. It stakes 100% of holdings through a dedicated validator, then reinvests rewards back into the fund.

Mechanically, BSOL is interesting. Rewards compound into NAV instead of getting paid out, and the structure includes a playbook for handling redemptions while tokens are in Solana’s cooldown.

It’s a small operational detail that matters when you, you know, stake all of it. Early read: decent day one attention, because yield plus simplicity tends to travel. 🚶

Western Union Exclusive With Solana?

And unless you only check Stocktwits or X a couple times yesterday, you missed the news about Western Union and Solana teaming up. 🫂

🚨 JUST IN: WESTERN UNION CEO - "WE CHOSE SOLANA OVER RIPPLE BECAUSE SOLANA IS FASTER, MORE EFFICIENT, MORE SECURE, AND MORE RELIABLE THAN RIPPLE."

#SOLANA ⚡️

— curb.sol (@CryptoCurb)

6:09 PM • Oct 29, 2025

It sounds pretty awesome, but the devil is in the details.

The actual press release from Western Union does not use the word exclusive. Marketing tweet vs legal document. Different sports.

There’s a rumor doing laps that Solana wrote a roughly $50M check for a six‑month exclusive plus a separate liquidity war chest. Unverified. Not in Western Union’s IR materials. Making the rounds on X and a couple aggregators because of course it is.

If that’s the deal, calling it “exclusivity” without the “we paid for it and we’re seeding liquidity” bit feels a little disingenuous. The shine doesn’t look the same when you disclose the subsidy.

It looks like business development. Which, to be clear, is still business.

None of this negates the bigger picture. On one side, you’ve got Bitwise with a mainstream SOL vehicle with staking economics inside the wrapper. And on the other, a payments heavyweight to push a USD stablecoin across Solana’s real corridors.

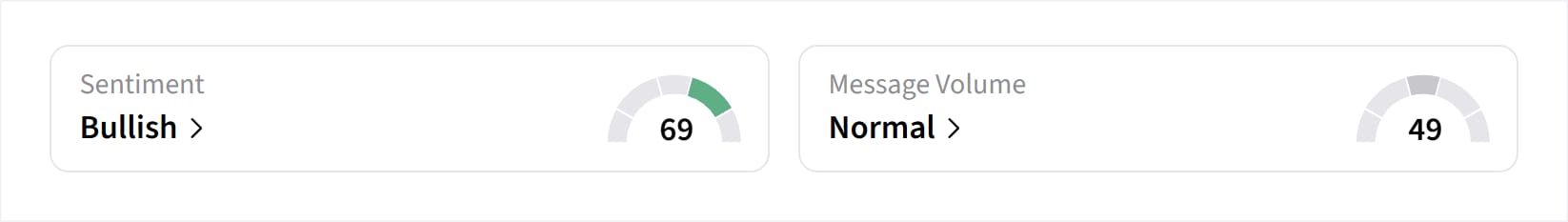

Stocktwits users appear unfazed - they’re still bullish and just coming off of being extremely bullish. Which is saying something given the crypto blood bath that is happening right now .

Price action may have stayed meh, and that’s fine. Infrastructure advanced. Liquidity paths widened. 👍️

NEWS

Wut Is x402?

I’ve gotten a lot of questions about this x402 business popping up. And, to be honest, until I started writing this little blurb, I didn’t know either. But now I do, and so will you. 🤯

I’m a poet and I didn’t know it.

What Is It?

x402 is basically $COIN ( ▼ 4.37% )’s attempt to bring actual payments to the internet instead of the “click accept cookies and give us your data” model. It’s built around the old HTTP code 402 - which literally means ‘Payment Required’ - and turns it into a way to pay for stuff online with stablecoins like $USDC.X ( ▲ 0.01% ).

In plain terms: you try to access something online, the server says “pay up,” you send crypto, and boom, you get in. It’s being hyped because it could let AI agents, apps, or even websites charge you per use instead of running through middlemen or subscriptions.

People are watching it because it might finally make micro-payments on the web actually work - something the internet’s been pretending it could do since dial-up. Early, but interesting. ⚠️

DEFI

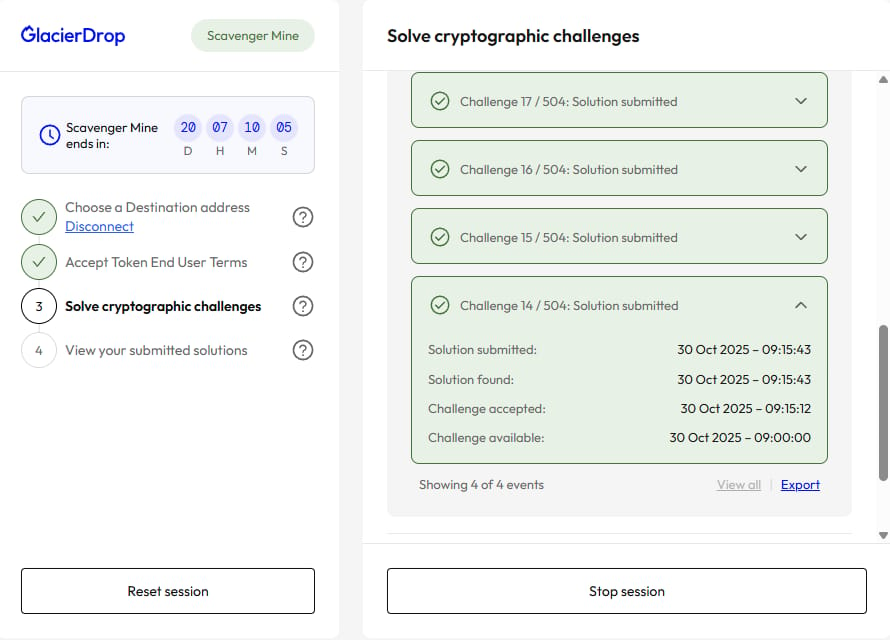

Midnight’s Scavenger Mine Is Live. Open Browser, Earn NIGHT. 😱

Midnight flipped the switch on phase two of its token launch. Scavenger Mine is up and running, open to anyone with a laptop, a desktop, and a functioning attention span.

No whitelists. No arcane dev setup. No sacred Discord rites. Just a web app that feeds your machine cryptographic puzzles and pays you in NIGHT for doing the work.

It’s really that simple, I’m doing it right now:

The Deets

What: Scavenger Mine - phase two of the NIGHT distribution from Midnight TGE.

When: 21 days total, split into 24-hour claim cycles that reset daily at 00:00 UTC.

How: Your browser accepts and solves hourly cryptographic challenges. You earn a proportional cut based on how many solutions you submit in that day’s cycle.

Pool: About 626,000,000 NIGHT available to participants across the event. Roughly ~30,000,000 NIGHT per day.

Where: sm.midnight.gd

Gear: Desktop or laptop only. Smartphones sit this out.

Effort: Keep the browser session open and the device awake. Electricity and fan noise are part of the game.

So… What’s The Point?

The point of this whole is twofold: redistribute the unclaimed tokens from phase one (the Glacier Drop) and give more people a fair shot at joining the ecosystem.

Scavenger Mine rewards participation instead of network status, so you don’t need to be a developer, validator, or early insider to get a piece. It’s also a smart way for Midnight to stress-test its systems while onboarding new users—turning idle browsers into decentralized contributors.

In short, you’re helping decentralize the network while getting paid in NIGHT for it. Not bad for leaving a tab open. God knows I’ve got a bajillion of those open at anytime, might as well make something on one of them. 🧠

What This Is Not

This is not some novel consensus invention masquerading as mining. It’s a token distribution phase that uses browser-solvable cryptographic challenges to allocate an existing pool. Fairer than a pure snapshot. Less chaotic than a gas war. Requires fewer goats than a whitelist meme.

If you’ve got a machine, a browser, and the patience to let a tab chew on puzzles, you can claim a slice of NIGHT while this runs. If you don’t, someone else will. Same as it ever was. 🫵

PRESENTED BY STONKTWITS

Stonk Market News 📰

The man right down thar with that wonderful Superman-esque head of hair is our very own Kevin Travers, author of the Daily Rip. Watch his short update on what’s happening with stonks. 👇️

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🕵️ Horizen Thinks Privacy Doesn’t Have to Mean Chaos

Horizen wants to kill the false choice between total transparency and total darkness by pushing “auditable privacy.” Instead of backdoors and special keys, users can prove compliance without exposing their data - privacy that regulators can live with. It’s like being naked in a glass house but only your accountant gets to peek. Which, as I write that out, is creepy. Horizen.

🕶️ COTI Brings Privacy Tokens to MetaMask, No Extra Tabs Required

Privacy is all the sudden the cool kid and COTI’s even bribing early users with free LOOT. COTI’s new MetaMask Snap lets users send and receive private tokens without touching shady mixers or 12-step tutorials. The integration uses selective disclosure to keep things compliant while letting you transact like a normal person who values their data. Coti Network.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏠 Landshare Finally Makes Real Estate Tokenization Useful

After years of tokenized ghost towns, Landshare built a real estate “Tokenization Hub” that actually connects property owners and investors. It turns idle onchain property tokens into yield-bearing assets inside an RWA pool linked to real liquidity. For once, the “tokenized condo” might do more than collect digital dust. Landshare.

🏦 Anchorage Digital Gives Institutions a DeFi Portal They’ll Actually Use

Anchorage integrated Uniswap’s Trading API into its institutional-grade wallet Porto, letting banks dip into onchain liquidity without blowing a fuse. The API adds slippage protection, routing, and custody control - no hot wallets, no drama. TradFi gets DeFi, but with fewer heart attacks. Uniswap.

🥞 PancakeSwap Lists 100+ Tokenized RWAs from Ondo Finance

RWAs just went from concept to Pancake menu item. You can now trade tokenized stocks, bonds, and ETFs on PancakeSwap’s BNB Chain with zero fees for 30 days. Ondo’s bringing Wall Street collateral onchain, fully backed by real securities and available 24/5 - take that, NASDAQ. PancakeSwap.

🧠 AI Won’t Take Your Job, It’ll Be Your Overachieving Coworker

Anthropic’s CEO says half of white-collar jobs are toast, but trueAGI’s Ben Goertzel says chill - AGI is more coworker than replacement. He thinks we’ll soon have “PhD-level assistants” doing grunt work while humans focus on judgment calls. God damn Cylons. Artificial Superintelligence Alliance.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

💧 Carbon DeFi Keeps Paying the Liquidity Degens

Precision DeFi for people who like their fees compounding and their hands nowhere near “withdraw.” Bancor’s Carbon DeFi kicked off Round 4 of its liquidity mining on TAC, still dangling APRs that make TradFi blush. Built as DeFi’s first decentralized limit order book, Carbon lets traders sculpt liquidity ranges tighter than a tax audit - all automated, all onchain. Bancor.

🔓 Neo X Goes Open Source, MEV Bots Start Sweating

Transparency as counter-programming? Neo X just threw open its GitHub doors, dropping public repos for everything from threshold encryption to anti-MEV tooling. Two years of stealth builds later, the EVM-compatible chain now invites devs to poke around its shiny, MEV-resistant architecture. Neo.

NEWS IN THREE SENTENCES

Protocol News 🏦

🏗️ Polymesh Shows Up Big in Busan’s Blockchain Ideathon

When local talent starts thinking tokenized invoices instead of karaoke apps, you know the industry’s maturing. Polymesh joined Avalanche, Woori Bank, and half of Korea’s brain trust for a one-day Ideathon that looked more like a tech startup bootcamp than a hackathon. The winning team, Triangle, pitched a trade-finance automation app for Busan’s port using Polymesh’s compliance rails - not bad for a student idea. Polymesh.

🧱 Cardano’s Q3 Report: Quietly Building, Loudly Auditing

Less hype, more code. Cardano spent Q3 tightening its foundation - new consensus upgrades, Hydra hitting v1.0, and Leios entering the CIP stage. The engineers fixed everything from ledger storage to formal verification, all while prepping for nested transactions and new stake incentives. Cardano.

🧩 Brevis Drops Zero-Knowledge Muscle Into Units.Network

Brevis just brought its zk-powered off-chain computation engine to Units.Network with an incentive campaign on KoalaSwap. It compresses entire reward histories into a single proof - goodbye spreadsheets, hello instant onchain verification. Waves.

🌌 Metis ReGenesis 2.0: Uniting Layers, Trimming Fat, Adding LazAI

Metis is aligning its sprawling L2 ecosystem - Andromeda, Hyperion, LazAI, ZKM, and GOAT - under one token and one economic model. DSeq yields drop from 20% to 15% while a new Ecosystem Growth Reserve funds validator rewards and AI expansions. Builders call it “optimization,” holders call it “less free money.” Metis.

LINKS

Links That Don’t Suck 🔗

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, XLM, ADA, ZEC, FET. 📋