- Cryptotwits

- Posts

- CSI: CRYPTO - The 2025 Report 🚨

CSI: CRYPTO - The 2025 Report 🚨

CASE FILE #2025-CRYPTO - STATUS:CLOSED - BODY COUNT: HIGH

OVERVIEW

CRYPTO CRIME SCENE 2025 REPORT 🚨

CASE FILE #2025-CRYPTO | STATUS: CLOSED | BODY COUNT: HIGH

INCIDENT SUMMARY

Responding officers arrived at the scene of the 2025 crypto market to find multiple narratives deceased, several portfolios in critical condition, and one privacy coin fleeing the scene with unexplained gains.

The victims had been promised a post-halving supercycle. They were told institutional adoption would save them. They believed "up only" was a constitutional right.

They were wrong.

This forensic report examines the crime scene in detail. We have identified eight persons of interest. Six sustained critical losses. One walked away unscathed. And one, against all odds, left the scene 810% richer than when they arrived.

The evidence has been collected. The autopsies are complete. What follows is the official record. 👇️

TECHNICAL ANALYSIS

VICTIM #1: BITCOIN 🪙

Status: Wounded but alive

Annual Return: -7.39%

Cause of Injury: Betrayal by historical precedent

Crime Scene Analysis

The victim was found clutching a chart showing four previous post-halving cycles, all of which had delivered positive returns. The look of betrayal on the chart's face was unmistakable.

This is the first negative post-halving year in Bitcoin's entire history.

2013 (post-halving): +5,870%

2017 (post-halving): +1,338%

2021 (post-halving): +60%

2025 (post-halving): -7%

The Murder Weapon: Q4

Bitcoin hit an all-time high of $126,186 in October. Pure euphoria. Champagne corks were popping. Lamborghini dealerships were taking reservations.

Then Q4 pulled out a -23.2% and shot the party in the face. November alone (-17.54%) was like watching someone's 401k get mugged in broad daylight. The worst November since 2018's -36% massacre.

If Bitcoin's 2025 were a heist movie, the crew got the vault open in October, celebrated prematurely, and then somehow managed to lock themselves inside while the building caught fire.

Witness Testimony: The Two Halves

H1 2025: +13.3%. "4-year pattern bruh, moon. Everything was fine. Bitcoin was acting normal. We had no reason to suspect anything."

H2 2025: -18.3%. "It all happened so fast. One minute we were at $126K, the next we were identifying the body at $87K."

February deserves special mention in the police report. That -10.74% was the worst February in Bitcoin's recorded history. 😨

SPONSORED

Why Floki's Long-Term Community Outlasts Market Cycles

Every cycle, projects rise on hype and disappear just as quickly. What lasts is something much harder to build: people who stay when timelines are quiet and prices are flat.

This year was a reminder that long-term communities are forged during drawdowns, delays, and slow markets. When attention moves elsewhere, the real foundation gets laid.

Floki and TokenFi never stopped attracting builders, users, and holders who care less about short-term noise and more about direction.

That kind of alignment doesn't show up in daily charts, but it compounds over time.

Cycles come and go. Products evolve. Markets reset.

Communities that survive those resets don't just outlast cycles, they define the next one.

As the year closes, that's the real signal worth paying attention to.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TECHNICAL ANALYSIS

VICTIM #2: ETHEREUM 🫀

Status: Critical condition, narrative on life support

Annual Return: -10.97%

Cause of Injury: Celebrated too early, got blindsided

Crime Scene Analysis

The victim was found at the scene of their own celebration. Forensic analysis confirms Ethereum printed a new all-time high of $4,956 in August, then proceeded to somehow lose 11% on the year anyway.

Imagine winning the lottery, throwing a party, and waking up to discover your accountant embezzled everything while you were drunk. You peaked. And you still lost.

The worst annual performance since 2018's -82% bloodbath. At least in 2018, there was no all-time high to make the loss feel personal.

The Assault Timeline

Q1 2025 was a drive-by shooting: -45.4%. The second-worst Q1 in Ethereum history. The only worse one was Q1 2018, when the entire ICO bubble was actively exploding.

February 2025: -32.2%. The 8-year average for February was +17%. This February showed up 49 percentage points below expectations, like a dinner guest who arrives empty-handed and then does an upper decker in the main bath.

The Three Survivors

2025 had exactly three green months: May (+41.0%), July (+48.7%), and August (+18.7%). Three months tried to save the year. Nine months showed up with baseball bats with nails in them.

Win rate: 25%. Ethereum's 2025 was a boxing match where it landed three punches and took thirty-seven to the face. 🤕

TECHNICAL ANALYSIS

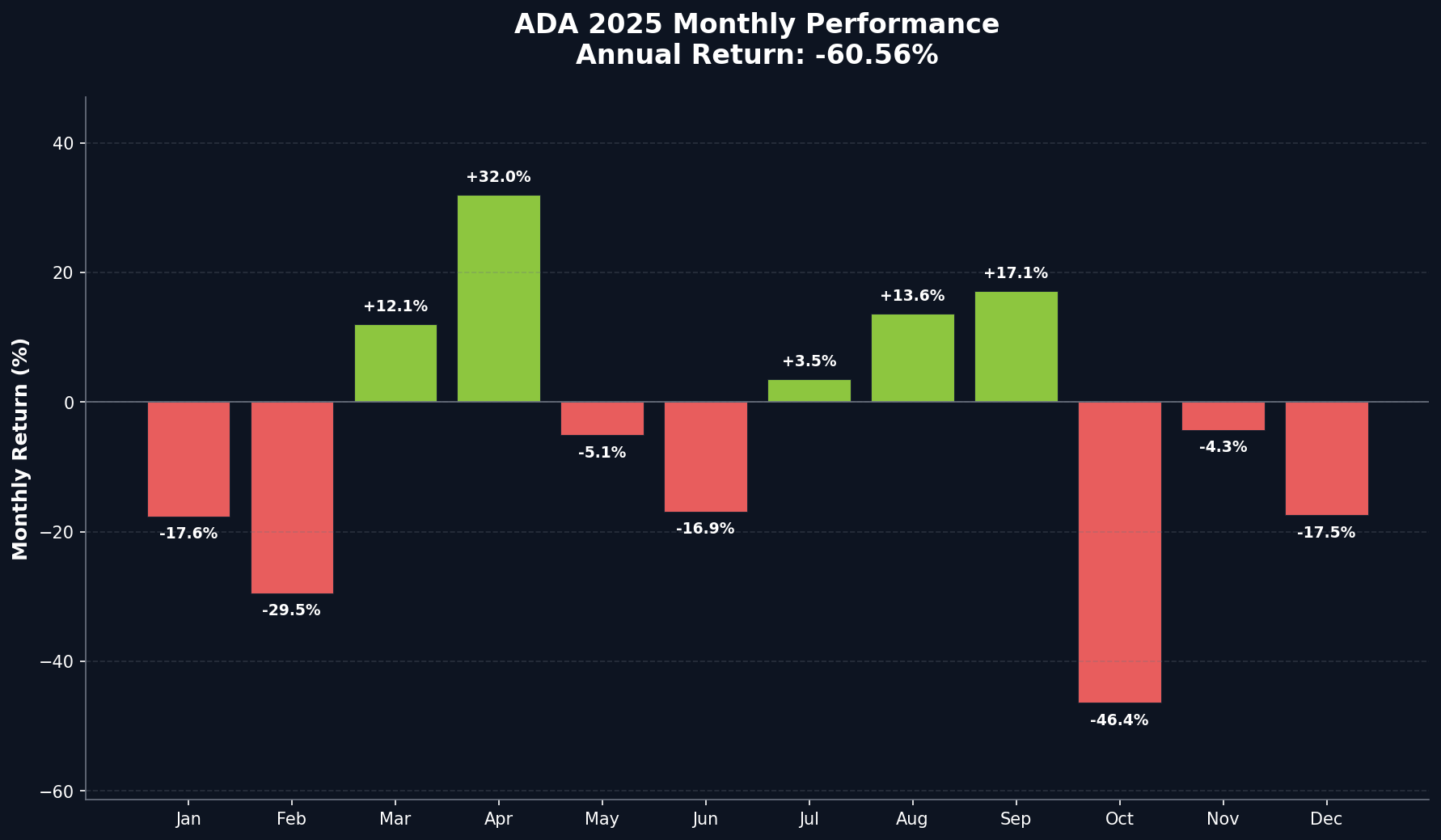

VICTIM #3: CARDANO 😶

Status: Found in shallow grave

Annual Return: -60.56%

Cause of Death: Aggravated narrative failure in the first degree

Crime Scene Analysis

We regret to inform the family that Cardano's 2021 dreams have been found deceased. Time of death: sometime in Q4 2025. The body was discovered at $0.33, approximately 89% below its all-time high.

Cardano's 2025 was the worst ADA year since 2018's -94% extinction event. And at least in 2018, everyone was dying together.

The October Flash Crash: A Hate Crime Against Portfolios

October had a 206% intramonth range. To visualize this: imagine your portfolio as a person. Now imagine that person falling down an elevator shaft, hitting every floor on the way down, somehow surviving, and then getting hit by the elevator on the way back up.

October high: $0.89

October low: $0.29

The low was literally one-third of the high. Same month. Financial domestic violence.

Autopsy: Both Halves Were Bad

H1 2025: -32.3%. "We thought it couldn't get worse."

H2 2025: -41.7%. "Shit. It got worse."

Q4 came in with a -58.7%. The worst Q4 in Cardano's history. Q4 killed the rally, buried the body, and then went back to kill any witnesses. 🔪

TECHNICAL ANALYSIS

VICTIM #4: XRP ⚠️

Status: Survived the SEC, got mugged by the market

Annual Return: -11.60%

Cause of Injury: Post-victory complacency

Crime Scene Analysis

XRP spent four years in legal purgatory fighting the SEC. The XRP Army held the line. The community stayed loyal. In July 2025, XRP finally broke its 2018 all-time high for the first time in 7.5 years. Vindication. Celebration. Moon emojis.

And then it dropped 50% and closed the year in the red.

Getting acquitted after a four-year trial, walking out of the courthouse, walking across the street with a smile and getting smacked in traffic. But smacked in a Brad Pit in ‘Meet Joe Black’ kind of smack.

The November Curse Breaks

XRP had two legendary Novembers: Nov 2020 (+177%) and Nov 2024 (+282.5%). These months were so good they probably funded several divorce lawyers and at least one yacht.

November 2025: -14.1%. The magic is gone. November looked at XRP holders in 2025 and said "I gave you two miracles, figure it out yourselves." But hey, at -14.1% it was still one of the best performing majors. The least robbed and mugged of the bunch.

Q4 2024 vs Q4 2025: a 276 percentage point swing. Two completely different assets wearing the same ticker symbol. 👬

TECHNICAL ANALYSIS

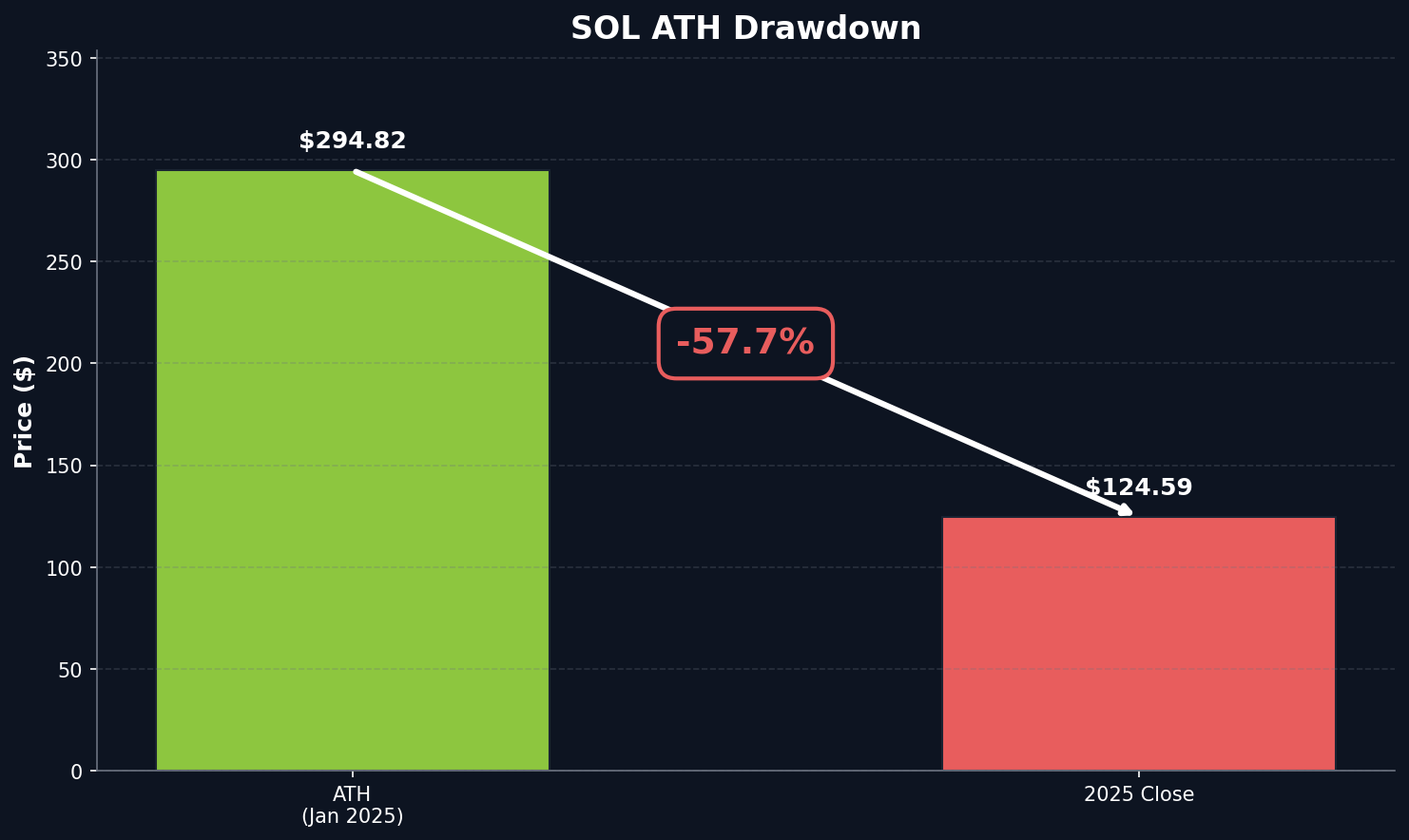

VICTIM #5: SOLANA 😺

Status: Survived assassination attempt, still got kneecapped

Annual Return: -34.26%

Cause of Injury: Flew too close to the sun, forgot parachute, but not just the primary, the reserve/emergency chute, too

Crime Scene Analysis

The backstory: November 2022, FTX collapses. SOL drops to $8.09. Twitter declares it dead. The "Sam Bankman-Fried chain" gets its death certificate notarized.

The comeback: 2023 (+920%), 2024 (+87%), January 2025 (new ATH at $294.82). The dead coin walked. Then it ran. Then it flew.

Then it flew directly into a mountain called Q4 and closed the year at $125.

The crypto equivalent of surviving a plane crash, hiking to safety, getting rescued, doing interviews about your miraculous survival, and then choking on a celebratory steak dinner.

The Whiplash Report: January vs February

January 2025: +22.3%. New all-time high! $295! FTX survival arc complete! Champagne!

February 2025: -36.1%. One of the worst months in SOL history. The hangover from hell.

The Summer Recovery That Got Murdered

April through September: five green months out of six. SOL rallied from $95 to $253. A +166% recovery. SOL maxis were vindicated. Again.

Then Q4 showed up with -40.4% and erased six months of gains in 90 days. A professional hit job on everyone who bought the summer dip. 😢

TECHNICAL ANALYSIS

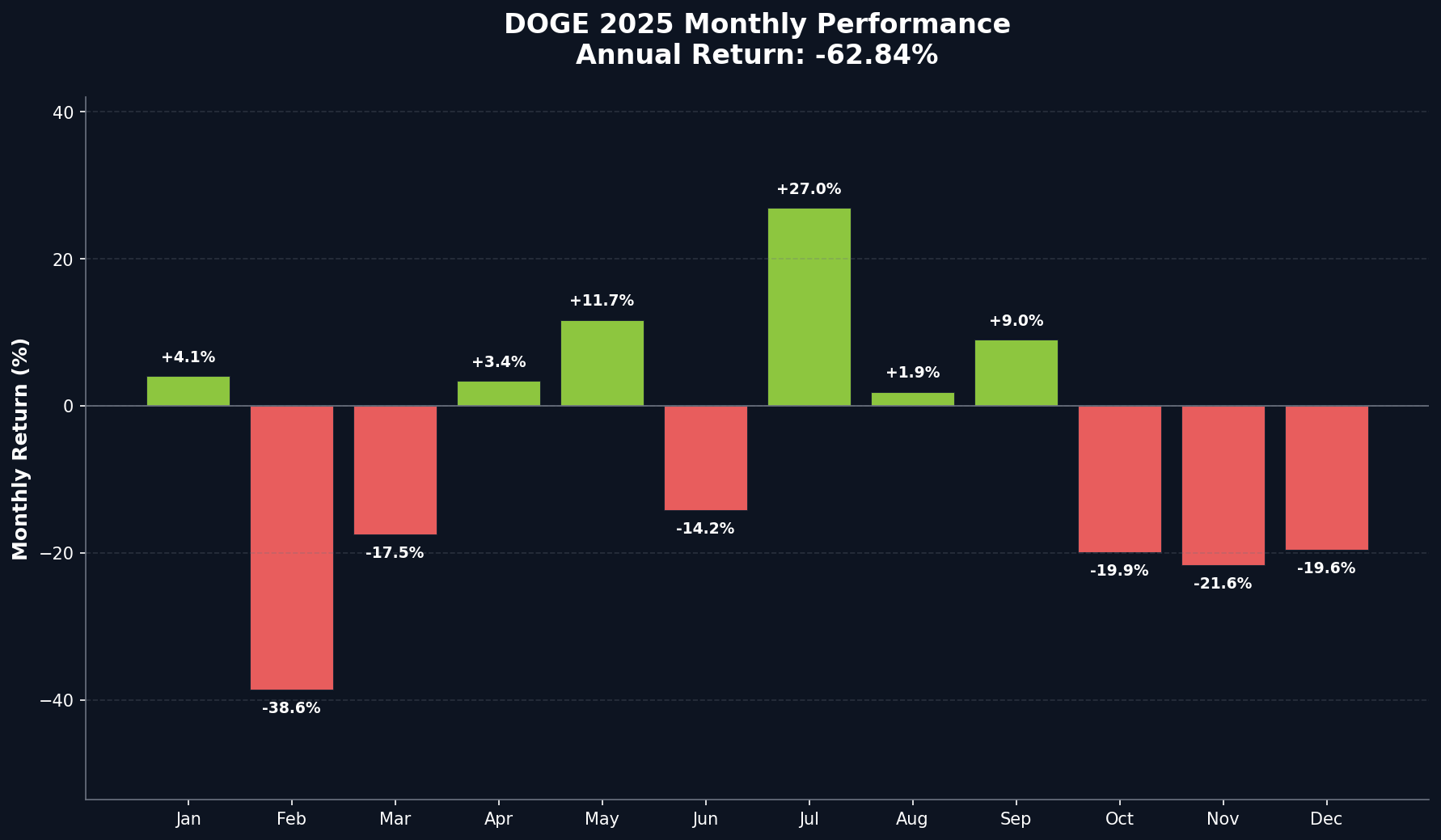

VICTIM #6: DOGECOIN 🐶

Status: Deceased. The meme has left the building.

Annual Return: -62.84%

Cause of Death: Elon withdrawal syndrome

Crime Scene Analysis

Ladies and gentlemen of the jury, we present Exhibit A: the OG memecoin that rallied 161% in November 2024 because a billionaire made jokes about a future government department.

Exhibit B: That same cryptocurrency losing 63% of its value over the next 12 months.

The prosecution rests.

DOGE's 2025 was the worst performance in our entire eight-asset investigation. A faceplant so hard it left a crater. The "Department of Government Efficiency" trade had a shelf life of approximately six weeks.

The February Massacre

February 2025: -38.61%. The single worst month for DOGE in years. The intramonth range was 82.8%.

The Autopsy Report

Dogecoin closed 2025 at 15.9% of its all-time high. A financial extinction event.

H1 2025: -47.7%.

H2 2025: -28.9%.

No good half existed. Only "terrible" and "less terrible but still terrible." 💀

TECHNICAL ANALYSIS

SURVIVOR #1: BNB 📈

Status: Walking away from explosion without looking back

Annual Return: +23.02%

How It Survived: Being boring, having actual utility, avoiding meme status

Incident Report: The One That Got Away

While the rest of the market was busy dying, BNB quietly had the best year of any major in our investigation.

+23.02%. The only blue-chip crypto that finished green. BNB broke $1,000 for the first time and set a new all-time high nearly double the 2021 peak.

The New All-Time High

May 2021 ATH: $690.87

October 2025 ATH: $1,373.40

Exceeded old ATH by: 98.8%

BNB nearly doubled its old high. And unlike Bitcoin, Ethereum, Solana, and XRP (which all set new ATHs but still finished negative), BNB actually held its gains.

The Binance Resilience Story

DOJ settlement. CZ departure. Regulatory death spiral. BNB at $220 in June 2022 looked like the final chapter.

Three years later:

2023: +26.8%

2024: +125.1%

2025: +23.0%

Boring. Profitable. Green. 👍️

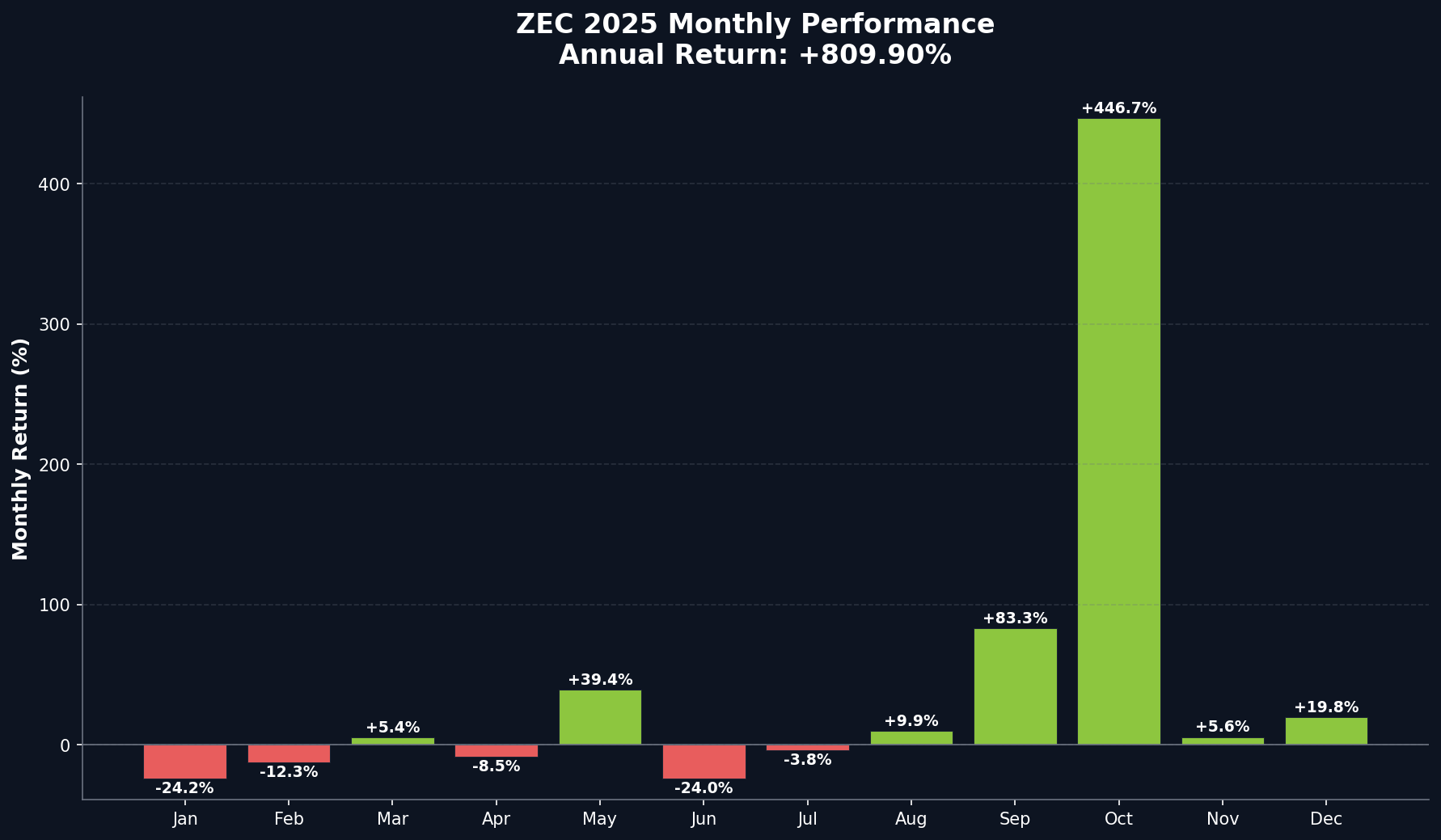

TECHNICAL ANALYSIS

PERSON OF INTEREST: ZCASH 🕵️

Status: Fled scene with 810% in unmarked gains

Annual Return: +809.90%

Suspected Motive: Unknown. Investigation ongoing.

Crime Scene Analysis: What The Hell Happened?

Zcash, the privacy coin everyone forgot existed, posted +809.90% for 2025. While Bitcoin bled, Ethereum stumbled, and Cardano dug its own grave, ZEC pulled off the heist of the decade.

October 2025: +446.70%. One month. Four hundred and forty-seven percent.

Sep Close: $74.03. "Just another dead privacy coin."

Oct High: $411.99. "WHAT IS HAPPENING."

Oct Close: $404.75. "...did we just 5x?"

The intramonth range was 456%.

The Full Year Range: A Crime Against Statistics

2025 Low (February): $24.91

2025 High (November): $741.38

Full year range: 2,876%

From the February low to November high, Zcash rallied 2,876%. A 30x move in a single calendar year. If you bought the February bottom and sold the November top, congratulations: you're now the subject of a "how did they know?" investigation.

The Resurrection Report

Zcash was supposed to be dead. The evidence was overwhelming:

2018: -88.4%

2019: -50.3%

2022: -74.6%

2023: -27.9%

By late 2023, ZEC was trading at $26. Down 97% from its 2018 ATH. The privacy coin narrative was dead. Everyone had moved on.

And then the corpse stood up, walked out of the morgue, and came within 7% of its all-time high from seven years ago.

H1 2025: -32.1%. A typical "dying altcoin" performance.

H2 2025: +1,241%. Twelve hundred and forty-one percent. Read it again.

A crazy year and it’s still holding onto the majority of it’s gains. 🤯

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋