- Cryptotwits

- Posts

- Checking Charts Every 5 Minutes Really Paying Off In Terms Of Stress 😰

Checking Charts Every 5 Minutes Really Paying Off In Terms Of Stress 😰

Doctors recommend 10,000 steps a day. You're doing 10,000 refreshes.

OVERVIEW

Checking Charts Every 5 Minutes Really Paying Off In Terms Of Stress 😰

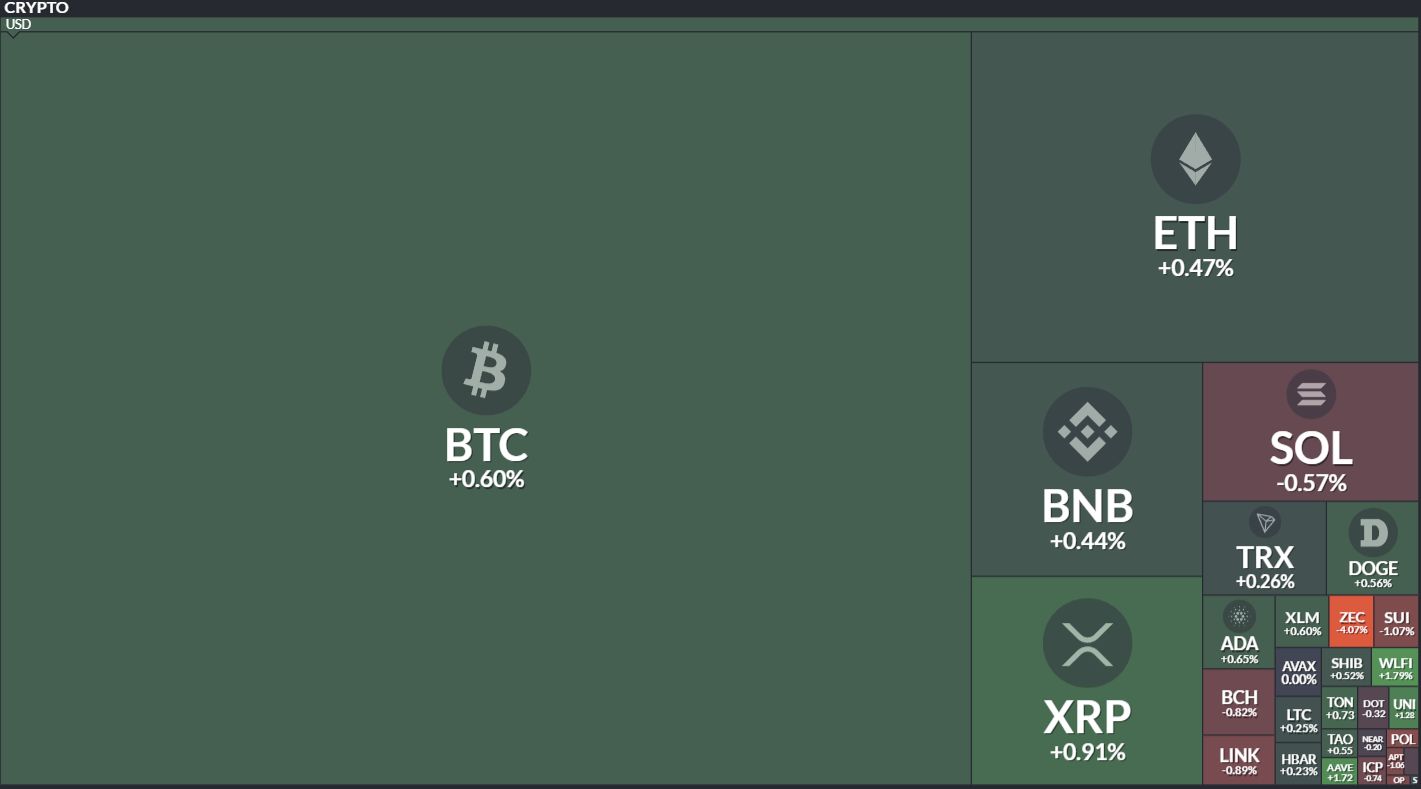

Before we dive in, here’s today’s crypto market heatmap:

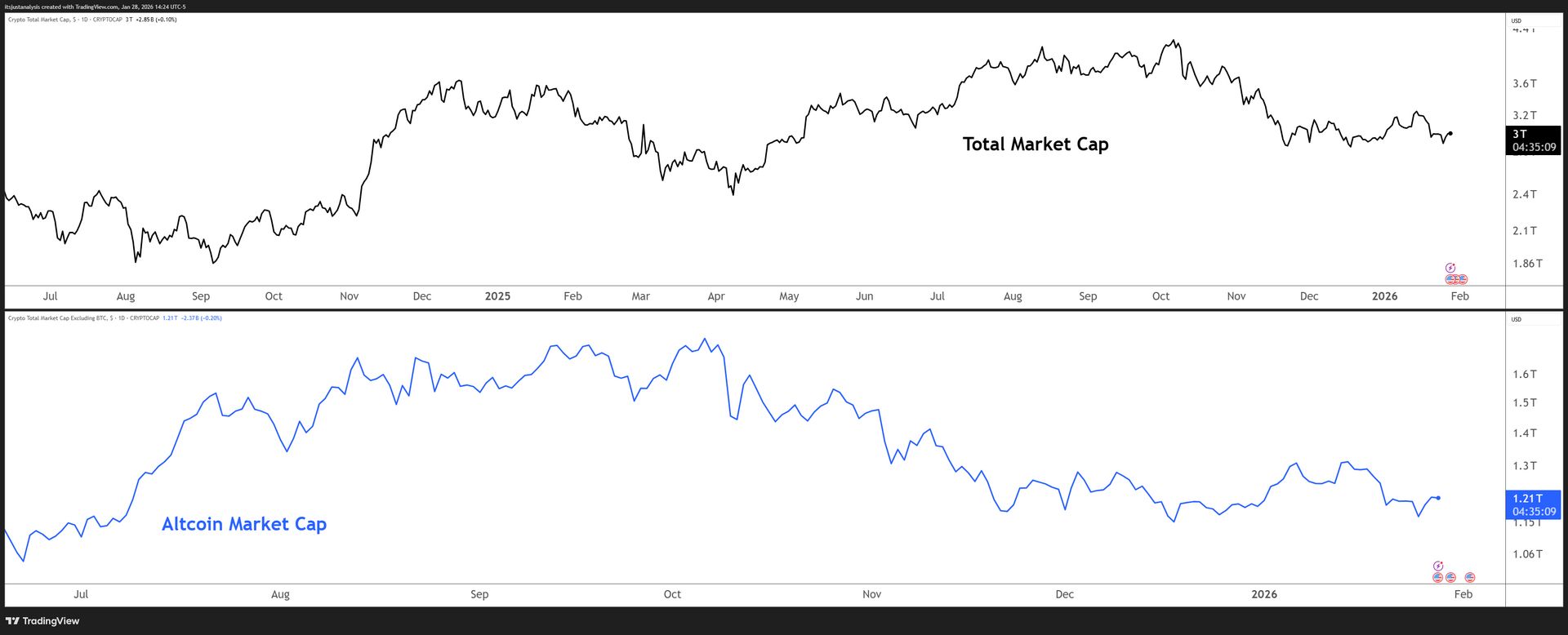

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Gold Hits $5k, Silver Hits $115, Now Everbody Gets A Token 🪙

The great tokenization gold rush of 2026 is here. You can finally own gold without actually owning gold. Revolutionary. Nobody has ever done this before. 🙄

Welcome to the tokenization boom, where the solution to not owning physical metal is... another token.

So far, in January 2026, there is at least 15 press releases I’ve looked at about precious metal tokenization. Fifteen. In one month. That's roughly one new way to own "gold" without holding gold every two days.

You get a token. And YOU get a token. And EVERYBODY GETS A TOKEN.

The Yield-Bearing Paper Metal Revolution

Why just own tokenized gold when you can own yield-bearing tokenized gold?

Theo Network launched thGOLD - yield generated through lending to Singapore gold retailers.

Streamex and tZERO announced GLDY offering 4% APR paid in "additional gold ounces."

Bybit's pushing 11% APR on Tether Gold. Eleven percent. On gold.

In what universe does a non-yielding asset generate 11%? The one where counterparty risk is someone else's problem.

What's Getting Tokenized?

Gold: Token bonanza - 10+ products launched or expanded

Silver: Just starting - AABBS launching Feb 10, MEXC futures live

NatGold Digital filed seven patents for tokenizing in-ground gold - metal that hasn't been mined yet. We've reached the point where you can buy a token representing gold that's still dirt. 💩

Every one of these tokens is a claim on gold, not gold itself. You're trusting custodians, audits, smart contracts, and yield mechanisms that seem… iffy. Or at least iffy-ish.

Gold's rallying because of macro uncertainty. The crypto industry's response is to build seventeen solutions to problems that might be solved by just... buying the metal. 🤦

STONKTWITS

Latest Stocktwits Video & Podcast Drops 🎙️

Cryptotwits Podcast - Bitcoin Death Cross: Signal or Clickbait?

Community Rip - LIVE W/GPAISA, JFDI, & HOLDINGBAGS

NEWS

SBF Still Thinks He Did Nothing Wrong, Shockingly 🤯

Sam Bankman-Fried is talking again. From prison. I guess the Tucker Carlson interview - rumored to have been conducted via smuggled phone, which allegedly earned him a stint in solitary and a transfer to a new facility - didn't teach him anything. 😶

This time it's a written exchange with Mario Nawfal, and surprise: Sam still believes he's the real victim here.

A lot of it is the same stuffs we’ve all heard or read before: FTX had a "liquidity crisis," not an insolvency problem. Oh, but this time he trots out the classic mortgage analogy - you owe $200k on a $500k house, you're not broke, you just need time.

Ya. It’s just like that. 🤦

SBF claims Alameda held $25 billion in assets against $15 billion in liabilities. The problem? Those "assets" were illiquid bags of tokens his own companies created. But sure, just needed a few more weeks to dump them on someone.

His biggest regret isn't the fraud conviction. It's clicking a DocuSign link that let lawyers take over. The lawyers are the villains here, apparently.

On his cooperating ex-colleagues, including Caroline Ellison: "They were put in a really shitty position." No comment on who put them there.

Asked about a Trump pardon? He declined to answer on record. Reading between the lines isn't hard. 📕

ON-CHAIN ANALYSIS

January's Liquidation Carnage: A Tale of Two Halves 😨

January 2026 has been an absolute meat grinder for leveraged traders. 🍖

Nearly $9.62 billion in total liquidations through the 27th. Somewhere out there, a whole lot of "this time is different" traders are updating their LinkedIn profiles.

Early January: Shorts Learn Nothing

The month kicked off with shorts getting their faces ripped off. January 1st alone saw $333 million in short liquidations as Bitcoin pushed higher, and January 4th delivered another $457 million beatdown to the bears. For the first four days, shorts were liquidated at a 2.3:1 ratio versus longs.

The Turn: January 5-13

Then the script flipped. From January 5th through the 7th, longs absorbed $890 million in liquidations as price action turned against the bulls. A relative calm followed through the 11th - a kind of ‘please stop hitting me’ mood hit.

Then the shorts got whacked.

January 12th hit with a $626 million short squeeze, the largest single-day short liquidation of the month (for shorts). Shorts continued bleeding the next day with another $284 million wiped out.

Oh Lawd: January 18-19

But none of that compared to what came next. January 18-19 produced the month's defining liquidation event: $1.67 billion in long liquidations over 48 hours ($681M + $991M).

January 24th delivered one more gut punch to longs, $615M.

The Scorecard

Long Liquidations: $5.51B (57.3% of total)

Short Liquidations: $4.11B (42.7% of total)

Combined: $9.62B

Cool fact: The 18th - 19th flush accounted for 30% of all long liquidations. 🥇

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

💵 PayPal's PYUSD Hits Aave and Immediately Crosses $400M Deposited

PYUSD is now live on Aave for lending and borrowing, because PayPal apparently wants its stablecoin everywhere DeFi happens. It crossed $400 million in deposits almost immediately, which Aave is calling "the Aave effect" with zero humility. Aave.

🎯 EigenAI Claims Deterministic LLM Inference - Same Input, Same Output, Every Time

LLMs are nondeterministic by default, which is fine for chatbots but catastrophic for AI agents managing money or making medical calls. EigenAI achieved bit-exact reproducibility across 10,000 test runs with under 2% overhead by controlling every layer - GPU architecture, math libraries, inference engine, the whole stack. Now you can actually verify what an AI did by re-running it and checking if the bytes match. Eigen Layer.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🎬 IDC Says Media Storage Needs to Go Distributed

A new IDC Spotlight report explains why centralized cloud storage is failing media production - egress fees, latency, and regional replication nightmares are killing budgets and workflows. The report validates distributed object storage as the fix for global teams dealing with exploding file sizes and AI-driven pipelines. Storj gets a mention for pioneering the approach, which is convenient since they're the ones sharing the report. Storj.

🐟 Finnish Startup Uses IOTA to Track Fish From Net to Plate

Kalalohko joined the IOTA Business Innovation Program to bring transparency to the seafood supply chain, which is apparently controlled by oligopolies squeezing local fishermen. They're using IOTA Identity for tamper-proof actor IDs, Notarization for provenance tracking, and the Gas Station so nobody pays transaction fees. Iota.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎓 Zilliqa Funded a Free Dev School So People Build on Zilliqa

Plunder Academy is a free, hands-on learning platform for Zilliqa EVM, funded by gZIL Collective Season 1 because builder onboarding was the actual bottleneck. It's got 23 modules across five themed zones, AI-powered code review, exploit detection, and NFT achievements for people who need gamification to learn Solidity. The goal is turning learners into deployers. Zilliqa.

🖼️ Nifty Gateway Is Closing But At Least They're Being Nice About It

Nifty Gateway extended the withdrawal deadline to April 23rd after the community understandably panicked about the shutdown announcement. They're migrating metadata to Arweave for permanence and building a bulk withdrawal tool so you don't have to move NFTs one by one like a peasant. Pre-2021 NFTs with legacy metadata will stay hosted by Nifty forever. Arweave.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🔄 Pendle Kills vePENDLE Voting, Replaces It With Math

Pendle's new Algorithmic Incentive Model goes live January 29th, cutting emissions by 30% while automatically allocating rewards based on TVL and fee generation instead of manual votes. New pools get frontloaded liquidity incentives that taper toward fee-based rewards as they mature - no more parking half the emissions in dead pools. Protocols can boost their markets with external incentives and get up to 40% extra from Pendle. Pendle.

💧 River Brings satUSD to Sui

River is deploying satUSD on Sui, a chain-abstracted stablecoin that lets capital from other ecosystems settle natively without wrapped asset headaches. Builders get cross-ecosystem liquidity they can integrate directly; users get to move capital into Sui-native DeFi without five bridge transactions. Sui.

NEWS IN THREE SENTENCES

Protocol News 🏦

🏔️ Hedera Went to Davos and Talked Tokenization With People Who Matter

Hedera showed up at the World Economic Forum talking tokenization, AI, and the future of payments with policymakers and enterprise leaders at USA House. Co-founder Mance Harmon hit CNBC, CEO Eric Piscini did firesides with the Institute of International Finance, and Chief Policy Officer Nilmini Rubin collected an award for blockchain policy leadership. Hedera.

🚢 Wanchain's 2025: $1.7B Bridged, 1M WAN Burned, Post-Chain Era Incoming

Wanchain bridged $1.7 billion and burned over a million WAN in 2025 while shipping XFlows for native-to-native cross-chain swaps, Bridge-to-Earn for liquidity incentives, and integrations with Polygon, Sui, VeChain, and a dozen other networks. They also launched the first-ever NIGHT bridge on day one of Midnight's airdrop and got Binance using Wanchain-wrapped assets. Wanchain.

LINKS

Links That Don’t Suck 🔗

adf

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋