- Cryptotwits

- Posts

- Bitcoin's Hidden Scorecards 🤫

Bitcoin's Hidden Scorecards 🤫

Get your nerd on for this one

OVERVIEW

Bitcoin's Hidden Scorecards 🤫

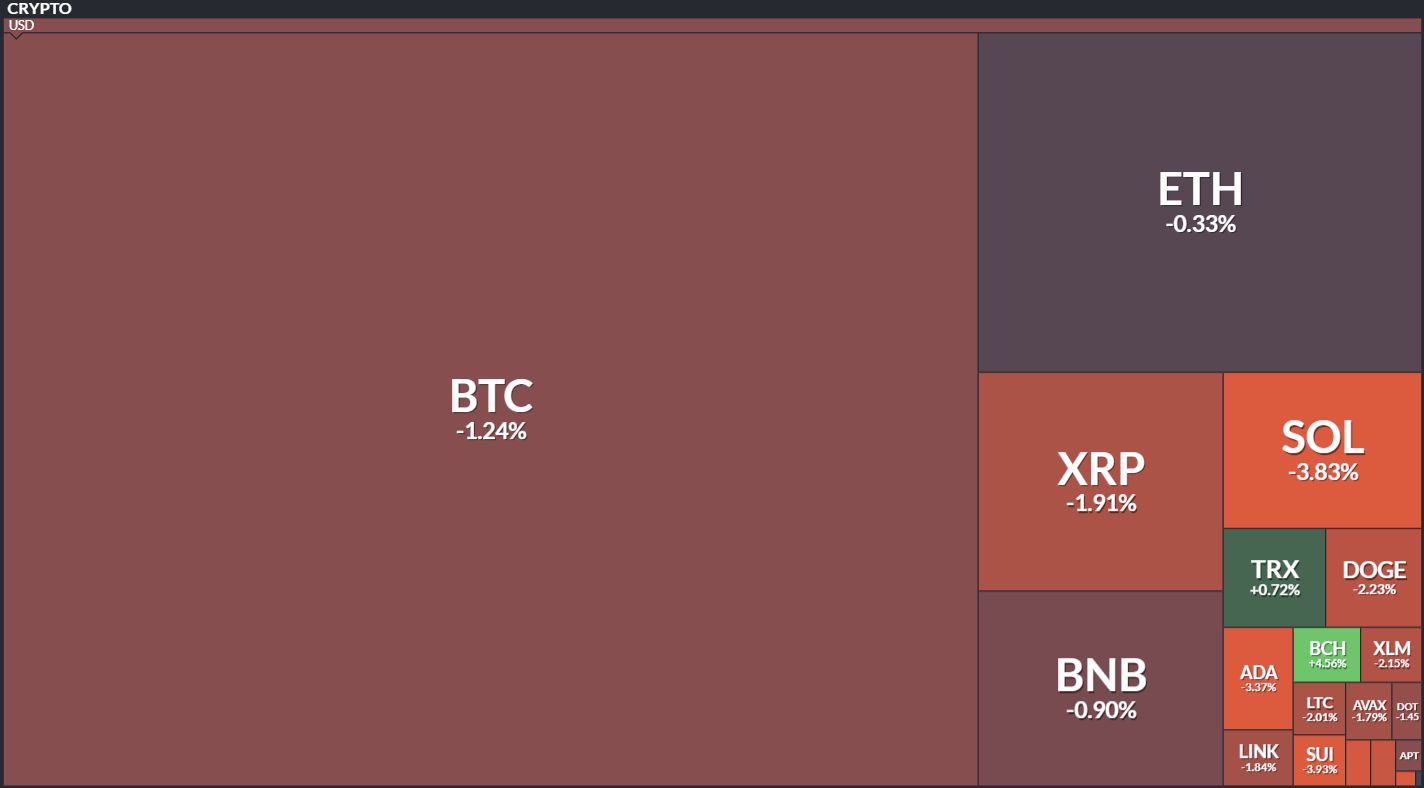

Before we dive in, here’s today’s crypto market heatmap:

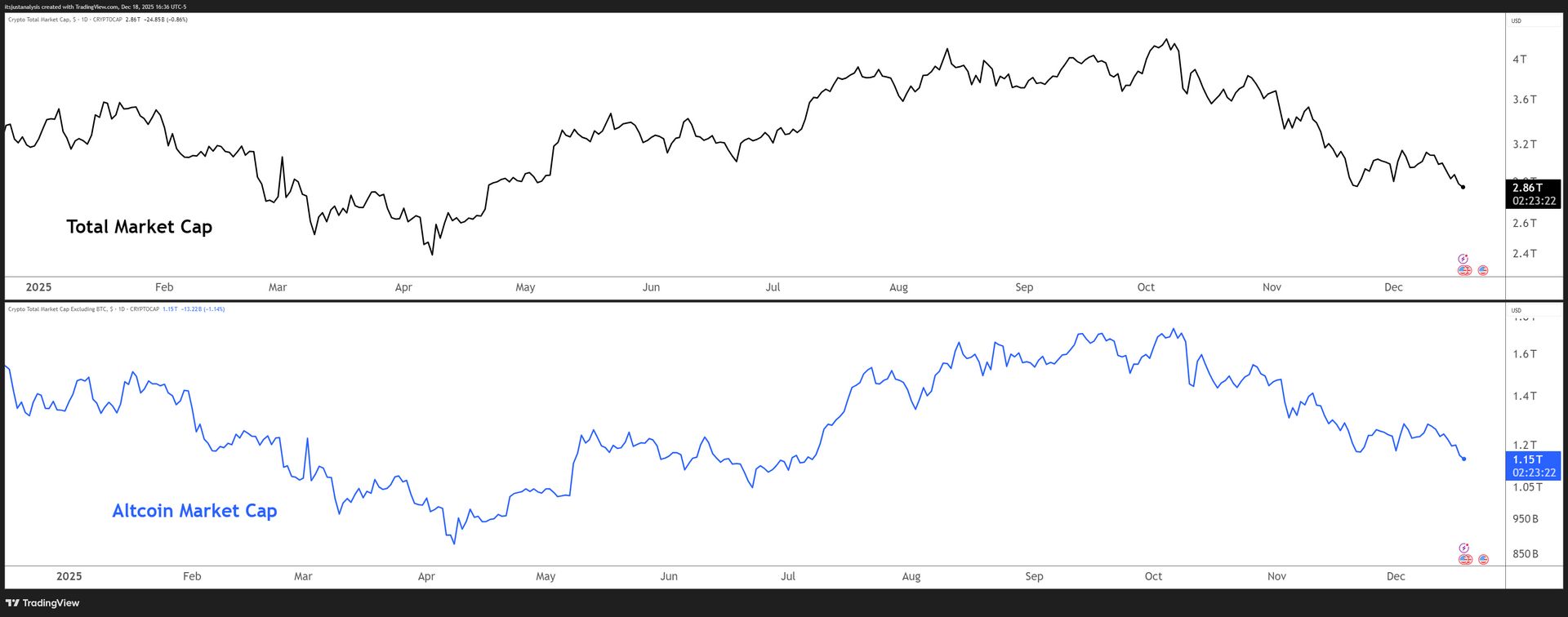

And here’s a look at crypto’s total market and altcoin market cap charts:

ON-CHAIN ANALYSIS

Bitcoin's Hidden Scorecards: What MCTC and S&P 500 Divergence Are Really Telling Us 🤔

Two of the most underappreciated metrics in on-chain analysis are flashing signals that deserve your attention right now: The Market Cap to Thermocap Ratio (MCTC) and the BTC & S&P 500 Price Divergence. 🔢

Today, we’re going to look at a five year history of $BTC ( ▼ 0.06% ) using these two on-chain metrics. But first, because this is crypto and on-chain, we need to understand what the MCTC and BTC & S&P 500 Price Divergence are.

Market Cap to Thermocap Ratio (MCTC)

Think of thermocap as Bitcoin's cost basis from the perspective of miners - it's the cumulative total of all block rewards and transaction fees ever paid to miners, valued at the time they were earned.

If you want to get uber super technical, it represents the aggregate security spend that has gone into protecting the network.

The MCTC ratio divides Bitcoin's current market cap by this thermocap figure. What you get is essentially a measure of how much premium the market is paying over the total cost of producing and securing all existing Bitcoin.

High MCTC readings (historically above 35-40) suggest the market is paying a significant premium over production costs - often a sign of euphoric conditions.

Low readings (below 10) indicate Bitcoin is trading closer to its "break-even" value relative to what miners have spent securing the network - historically excellent accumulation zones.

The 2021 peak hit 44.99 in April. The COVID crash bottomed at 5.50. The FTX collapse saw levels around 6.53. 🫢

BTC and S&P 500 Price Divergence

You’ve probably seen line charts with both BTC and the S&P on it and comparing how they move against each other. This metric combines it into a single line.

This metric tracks the performance gap between Bitcoin and the S&P 500 over time.

Positive values mean Bitcoin has underperformed equities (stocks winning).

Negative values means Bitcoin has outperformed (BTC winning).

When this metric goes deeply negative, Bitcoin is leaving traditional markets in the dust. When it's elevated positive, Bitcoin is lagging behind the stock market's gains. 💹

SPONSORED

Floki Enters a New Era of Utility, Growth, and Global Expansion

Floki is rapidly evolving from a community-driven memecoin into one of the most active ecosystems in crypto. With the launch of Valhalla, the Floki Trading Bot, and Floki Hub as a Web3 identity layer, the project now spans gaming, DeFi, digital identity, and global brand partnerships.

Global visibility has also accelerated through sports sponsorships, marketing campaigns, and increased institutional access, highlighted by Floki's European ETP. Meanwhile, TokenFi's (a sister project) rapid growth in the tokenization market extends the ecosystem's reach into institutional-grade finance.

As blockchain adoption accelerates worldwide, Floki is positioning itself at the intersection of culture, utility, and global accessibility. This new era marks a decisive step toward making Floki one of the most recognized and used crypto ecosystems in the world!

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ON-CHAIN ANALYSIS

The Full Picture: 2020-2025 🖼️

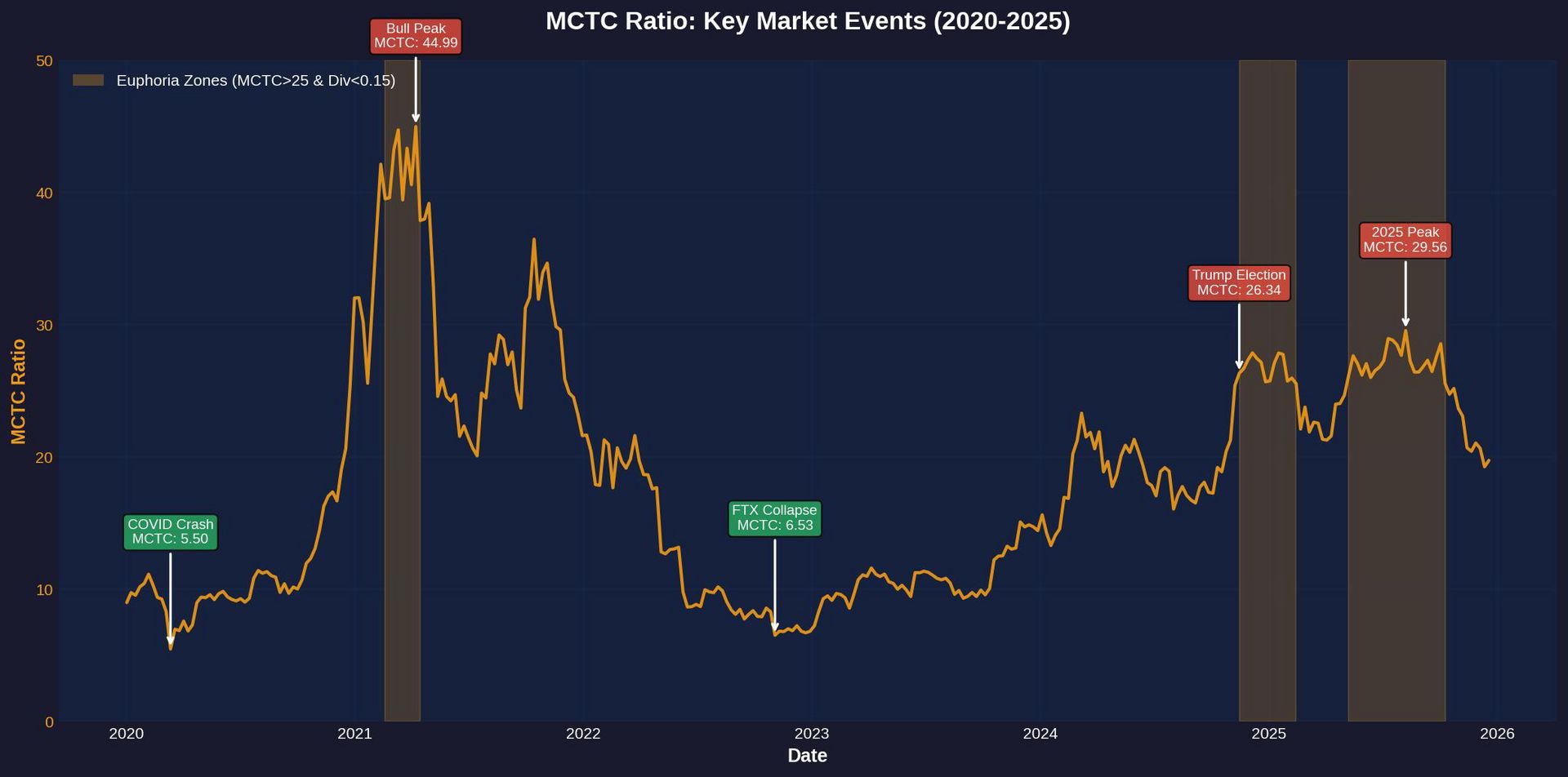

The chart below tells the whole story. 📕

These two metrics maintain a -0.78 correlation across the entire dataset - they're telling the same story from different angles. When MCTC rises (Bitcoin valuation expanding relative to mining cost basis), S&P divergence typically falls (Bitcoin outperforming stocks).

As you can probably see, every major MCTC spike corresponds to a divergence compression, and every MCTC washout aligns with divergence blowing out.

Current Status

As of this week:

MCTC Ratio: 19.76 - sits at the 57th percentile historically

S&P Divergence: 0.2993 - sits at the 35th percentile

On the surface, these look unremarkable. But context changes everything. 🧠

ON-CHAIN ANALYSIS

Key Market Events: The Extremes Tell the Story 📗

The MCTC ratio has been an eerily reliable marker of cycle extremes 💪:

COVID Crash, March 2020

2021 Bull Top, April 2021

FTX Collapse November 2022

2025 Top, August 2025

December 2025 (where we’re at now)

The shaded "euphoria zones" in the chart highlight periods where MCTC exceeded 25 AND divergence dropped below 0.15 - meaning Bitcoin was both richly valued relative to miner costs AND outperforming equities.

45 total weeks in the dataset met these euphoria criteria, and they clustered in three distinct phases:

February - April 2021: 7 weeks (the run to $64K)

November 2024 - February 2025: 11 weeks (post-election rally)

May - October 2025: 23 weeks (extended summer dominance)

We exited euphoria territory in late October - which is the nicest way I’m going to frame that hellish experience. The current readings suggest the market has cooled to a consolidation phase. 🗜️

ON-CHAIN ANALYSIS

2025: The Year Bitcoin Went Its Own Way 😕

2025 produced something unprecedented in Bitcoin's entire measurable history: the first negative S&P divergence readings ever recorded. 😱

The Santiment dataset extends back to July 2010 - 806 weeks of data spanning 15+ years. Across that entire period, through every bull run and bear market the S&P 500 divergence metric never once went negative.

Until this year. 😶

BUT - you might be asking yourself, ‘wait, hasn’t Bitcoin outperformed the S&P 500 over 15 years.’ Yes. In absolute terms. Let’s get our nerd mode on:

According to Santiment’s method of calculating their S&P 500 Divergence metric, they use scaled prices - not raw cumulative returns.

Bitcoin is roughly 5x to 10x more volatile than the S&P 500. So for BTC to register as "outperforming" on this metric, it needs to outperform beyond what its volatility profile would predict.

A 10% BTC rally while the S&P gains 2% might still register as positive (BTC "underperforming") if Bitcoin's expected move given its risk signature was 15%.

The metric being positive for 794 of 806 weeks means that even during massive BTC rallies, the S&P was often "keeping pace" on a volatility-adjusted basis.

2025 going negative means Bitcoin was winning beyond what its historical volatility premium would predict. That's what makes these readings kind of nutz.

The S&P 500 Divergence got very close in December 2024 (0.036) to negative territory, but didn’t pull it off. The next closest were the bull peaks in 2021 (0.108) and 2017 (0.269).

The 20 lowest Divergence readings in Bitcoin's 15-year history all occurred in 2025. Every. Single. One. 🤯

ON-CHAIN ANALYSIS

Where Are We Now? 👀

The scatter plot above maps every weekly reading since 2020, colored by time (purple = 2020, yellow = 2025). The two key zones:

Euphoria Zone (bottom right): High MCTC (>25), low/negative divergence. Bitcoin is richly valued AND outperforming stocks. This is where tops form.

Capitulation Zone (top left): Low MCTC (<15), high divergence (>0.40). Bitcoin is cheap relative to miner costs AND lagging stocks badly. This is where bottoms form.

The current reading (white star) sits in neither extreme - firmly in mid-cycle territory. We're above the historical mean MCTC of 18.31, which is constructive. But divergence is climbing, meaning the relative equity underperformance is back.

In A Nutshell

For now, the market is taking a breather. The miners' cost basis framework says we're trading at a reasonable premium. The equities comparison says we've given back summer gains but haven't fully surrendered.

The -0.78 correlation between these metrics means they're redundant signals - when one moves, the other tends to follow inversely. Right now, both are telling the same story: mid-cycle consolidation.

But this is just for Bitcoin. We’ll take a look at altcoins in a future newsletter.🧠

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

📡 Helium Is Bringing People-Powered Mobile to Brazil

Helium partnered with Mambo WiFi to expand its network using 40,000 existing access points across Brazil. Over half the country remains under-connected, with 100 million users relying on public WiFi as their main internet source. They also opened an international waitlist for other regions, so this is clearly just the start. Helium.

🔒 Polymesh Made Private Settlement on a Public Chain Actually Work

Confidential Assets are now live on the Polymesh DevNet, enabling encrypted balances and transactions with controlled auditor access. The P-DART protocol keeps positions and flows private while still supporting atomic multi-asset settlement and force transfers for compliance. Institutions can finally tokenize private securities without exposing everything to the market. Polymesh.

🧪 COTI's Privacy Sandbox Lets You Play With Encrypted Smart Contracts

The new Programmable Privacy Sandbox demos how encrypted data can be stored, computed, and compared on-chain without revealing the underlying values. Garbled Circuits power the whole thing - your data stays encrypted while smart contracts still run logic on it. You can try it now at sandbox.coti.io, no setup required. COTI Network.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🅿️ The $144 Billion Parking Lot Industry Is Getting Tokenized

Casper and Stobox are teaming up to fractionalize parking properties and distribute yield to token holders. Parking assets have predictable revenue and steady usage patterns, which makes them weirdly ideal for blockchain-based passive income. Both teams are also in the ERC-7943 working group, so this is just the first of many RWA plays. Casper Network

🌉 Ondo Built the Biggest Bridge for Tokenized Stocks

Ondo and LayerZero launched a bridge for 100+ tokenized stocks and ETFs across Ethereum and BNB Chain. The unified architecture means any of LayerZero's 2,600+ integrated apps can add Ondo assets with minimal work. Stargate already did it, and more EVM chains are coming in weeks. Ondo Finance.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🌐 Your Website Can Now Survive Cloudflare Going Down

ENS published a guide on deploying decentralized websites using IPFS, Filecoin, and Safe multisigs - no centralized DNS or cloud hosting required. The stack uses content-addressed storage and onchain naming so even if gateways fail, you can still access sites by running a local IPFS node. Aerodrome already used this approach after getting DNS-hijacked, so it's not theoretical anymore. Ethereum Naming Service.

🇺🇸 Jito Foundation Is Moving Back to America

After years of offshoring due to regulatory hostility, Jito is bringing core Foundation operations to U.S. soil now that the environment has shifted. The GENIUS Act passed, Gensler stepped down, and suddenly building crypto in America doesn't feel like a legal minefield. They're throwing a party in DC in January to celebrate. Jito.

NEWS IN THREE SENTENCES

Protocol News 🏦

🗳️ Mina Passed Four Upgrades and Nobody Had to Fight About It

All four Mesa MIPs passed the on-chain vote - reduced slot time, increased state limits, higher event and action limits, and expanded account update limits. These require a hard fork, so they'll ship with the Mesa Upgrade next year. Mina Protocol.

🔥 Hyperliquid Wants to Officially Burn Tokens That Were Already Unspendable

The Hyper Foundation is proposing a validator vote to formally recognize Assistance Fund HYPE as burned - even though the tokens are already in a system address with no private key. This is binding social consensus to never authorize a protocol upgrade that could access the address. Validators signal by December 21, stake-weighted results finalize December 24. Hyperliquid.

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋