- Cryptotwits

- Posts

- And So It Begins: The Great Yield Migration 🐘

And So It Begins: The Great Yield Migration 🐘

OVERVIEW

And So It Begins: The Great Yield Migration 🐘

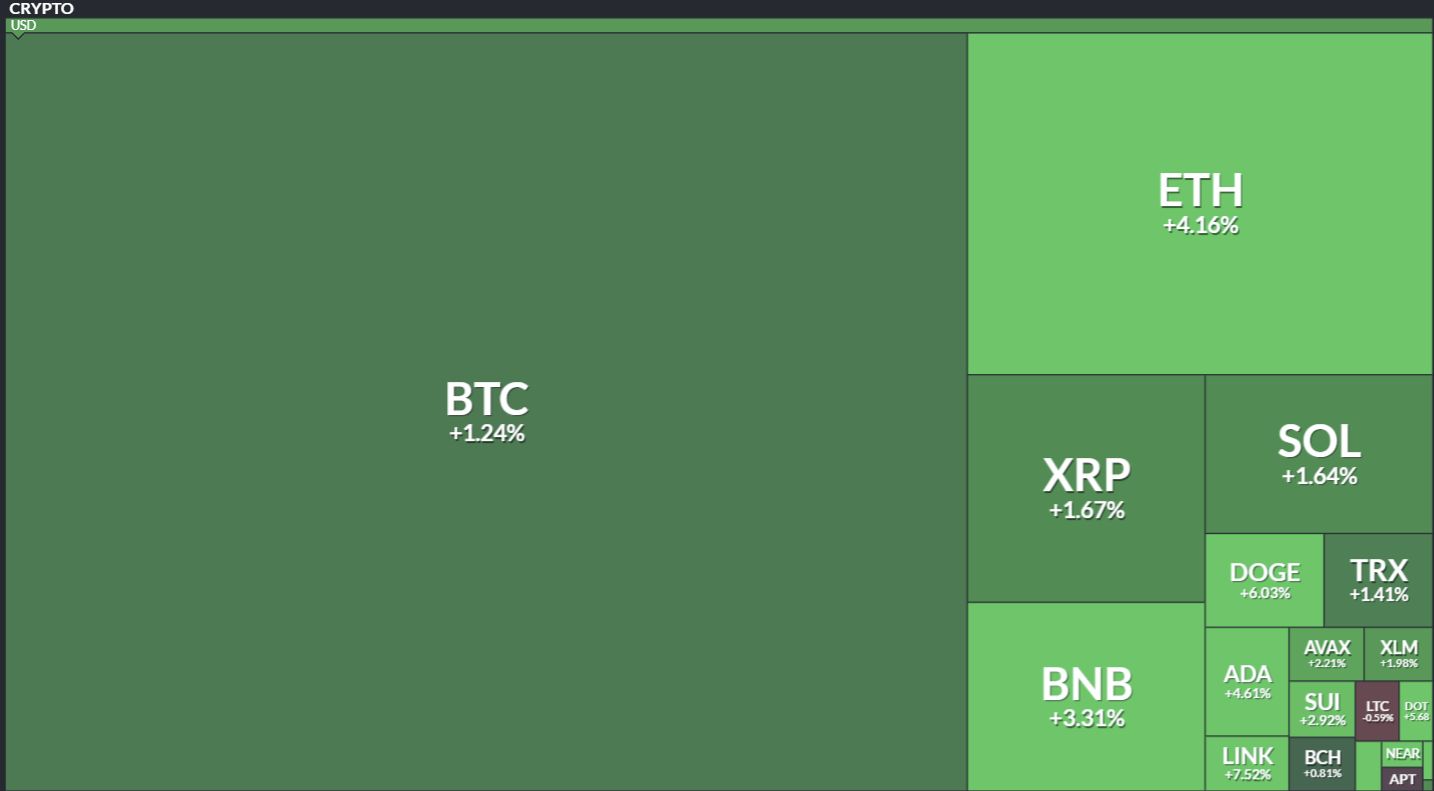

Before we dive in, here’s today’s crypto market heatmap:

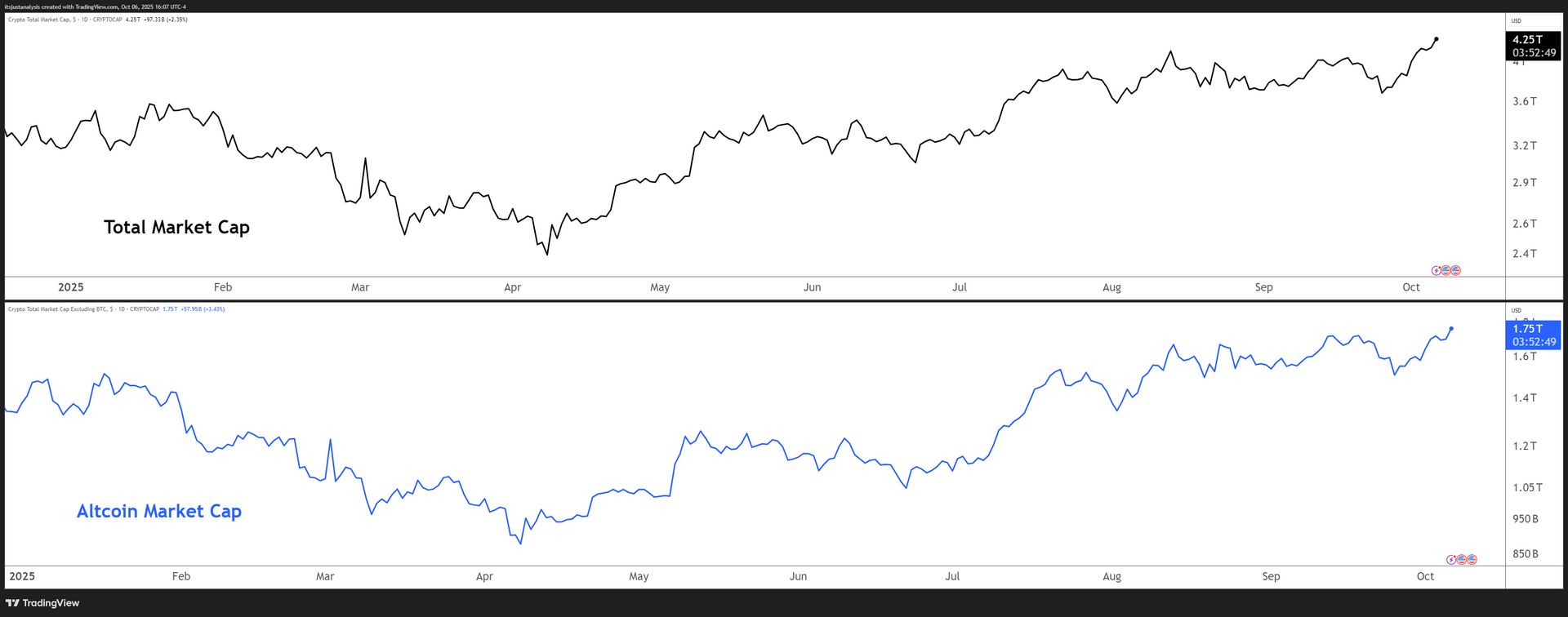

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

Lot’s Of Big Moves Lately 👀

Lot’s winner across the board over the weekend and into today. 📆

The Total Crypto Market Cap hit a new all-time high today: $4.25T!

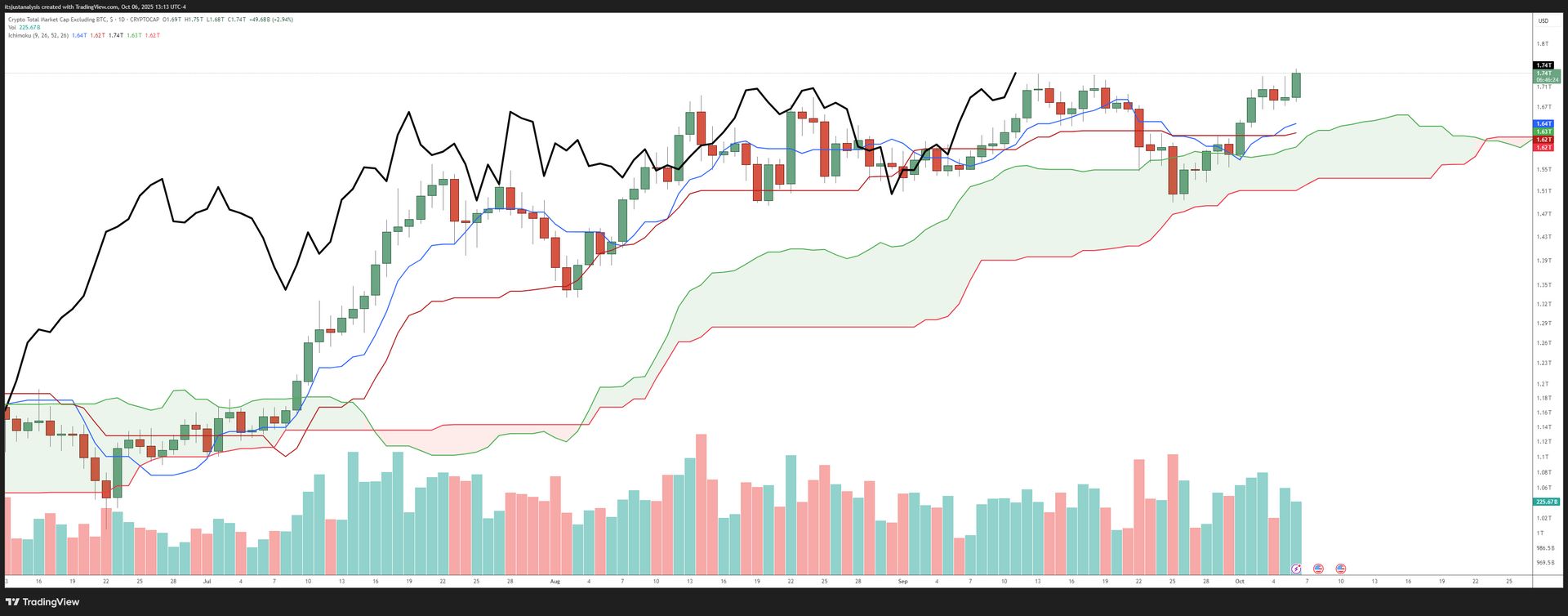

You’re going to hate me for saying this, but I gotta: short-term looks a little overdone. Those gaps between the Tenkan-Sen (blue average) and the candlestick bodies are biggly big.

But this is crypto and when expansion moves happen, they can go insane-o mode pretty quick and last for a while. Oh ya, the Altcoin Market Cap hit a new all-time high today: $1.75T!

And depending on how the rest of today goes, it could be the highest daily close ever, too.

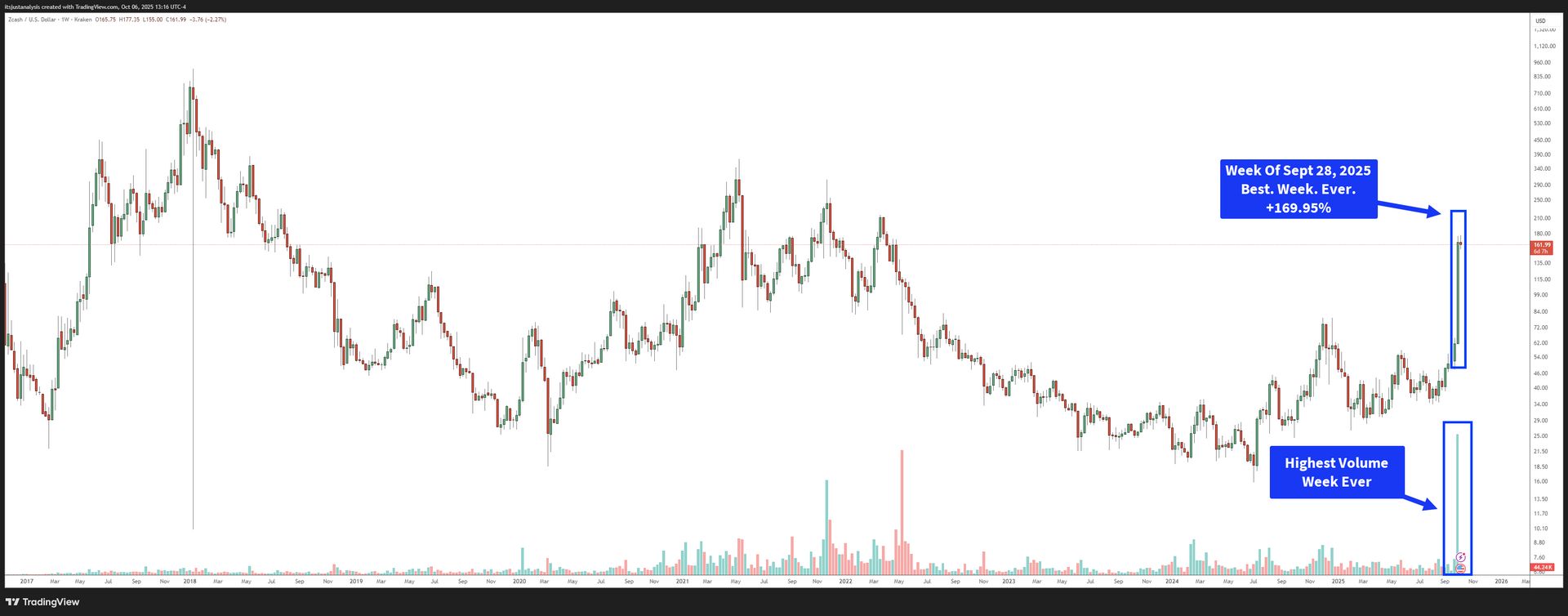

$ZEC.X ( ▲ 4.28% ) had a stupidly insane week last week. How good was it?

Last week was Zcash’s best week, ever and its highest traded volume week, ever.

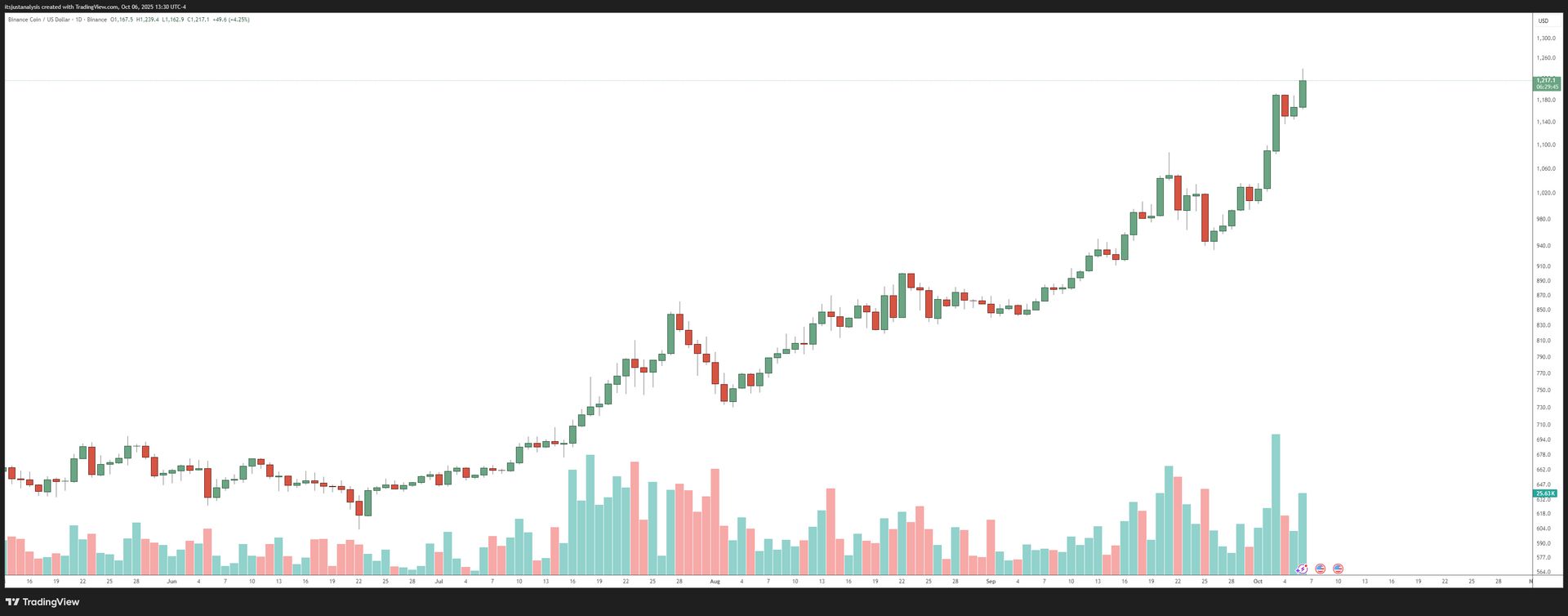

$BNB.X ( ▲ 4.87% ) made a new all-time high today.

The FUD regarding Aster and BNB doesn’t seem to be scaring anyone away (story about that is after this).

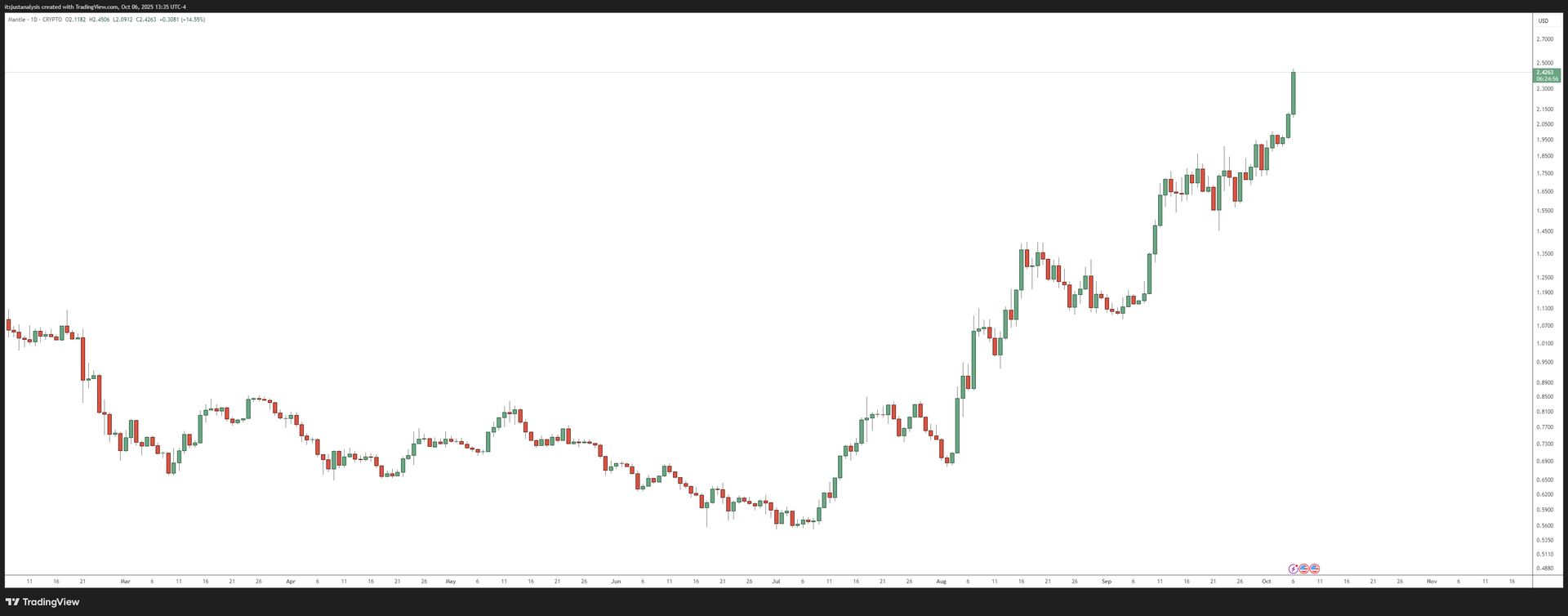

And $MNT.X ( ▲ 4.82% ) (kicking myself I missed this one) is just on a tear.

New all-time high hit today, and nearing the critical $2.50 value area. It’s up +338% from its July 8, 2025 lows. 😨

NEWS

The Great Yield Migration Begins 🐐

For decades, stock investors looking for income lived off the same old menu: BDCs, REITs, dividend ETFs, and covered-call funds that sell your upside for a paycheck. That monopoly is cracking. 🍽️

Grayscale Gets The Go Ahead

Today, Grayscale Ethereum Mini Trust ETF (Ticker: $ETH) and Grayscale Ethereum Trust ETF (Ticker: $ETHE) have become the first U.S.-listed spot crypto exchange-traded products (ETP) to enable staking, another first-mover milestone for the firm.

Grayscale Solana Trust (OTCQX:

— Grayscale (@Grayscale)

10:35 AM • Oct 6, 2025

Grayscale just got the go-ahead to enable staking inside its spot ETH funds, ETHE and ETH. Huge deal. But don’t expect monthly mailbox money. Their funds list “Distribution frequency: None,” meaning staking rewards stay locked inside the fund and build into NAV, not your cash flow (but that could change).

If you want that income check, REX/Osprey’s your huckleberry. Their Solana $SSK ( ▲ 0.66% ) explicitly pay monthly distributions from staking rewards, treating crypto yield like any other dividend ETF.

September data even shows SSK’s distribution rate north of 5%, labeled as return of capital.

And now that Grayscale got the go-ahead, I’d expect a stupid amount of staking focused tickers and ETFs to pump out soon. Hodling crypto passively in a DAT or ETF is great - but getting the yield on it, too? Yes please. 👍️

Why This Breaks The Income Status Quo

Traditional income depends on humans. Rent checks, interest spreads, or call overwriting sessions that require discretion and luck. Staking income’s robotic by design - protocol rules and validator uptime determine yield.

No CFO fiddling with payout ratios.

Now wrap that inside a ticker you can buy at Schwab, and you’ve got a clean, compliant yield source sitting next to $O ( ▼ 0.24% ) , $ARCC ( ▲ 0.68% ) , $SCHD ( ▲ 0.35% ) , and $JEPI ( ▲ 0.51% ) . Comparable yield, monthly cash, plus network growth upside. 🤯

What Happens Next

The 10-year monopoly on mid-single-digit monthly income is officially broken. Staking ETFs won’t replace O or JEPI tomorrow - in fact, we don’t even have a clear ticker that basically says This One Is For Staking Income, but they’ll eventually force every dividend product on Wall Street to actually compete again. 🔥

NEWS

DeFiLlama Nukes Aster’s Volume Data After Wash-Trading Claims 🧹

So, Aster’s victory lap didn’t last long. 🤏

Not Funny

The hyped-up Binance-backed perp DEX got erased from DeFiLlama’s leaderboard after the site’s founder 0xngmi accused the platform of fabricating its trading volume 📉.

We've been investigating aster volumes and recently their volumes have started mirroring binance perp volumes almost exactly

Chart on the left is XRPUSDT on aster, you can see the volume ratio vs binance is ~1

Chart on the right is XRP perp volume on hyperliquid, where there's

— 0xngmi is hiring (@0xngmi)

11:38 AM • Oct 5, 2025

0xngmi posted charts showing that AsterDex’s perpetual-volume data began shadowing Binance’s movements tick-for-tick starting late Saturday. You know, like a mirror with latency.

When the supposed independent DEX has a 0.96 correlation to Binance and can’t provide lower-level trade data to prove otherwise, that’s a problem.

This Part Is Funny

DeFiLlama and Dune got dragged into the crossfire after a KOL (not sure which word is worse: influencer or KOL) used Llama’s API to build a Dune dashboard claiming to disprove the wash-trading.

Aster KOLs claims "Defillama is centralized and can delist $ASTER anytime"

Just to share a dashboard that is using Defillama API.

The source to get this data is only one: Aster API.

Defillama had a wrapper to get data from it and they decided to shut it down.

Big shoutout to

— dethective (@dethective)

5:21 PM • Oct 5, 2025

Turns out that dashboard was literally pulling data from Llama’s own API - the one that flagged Aster in the first place.

Lot of noise today around Aster, @DefiLlama & @Dune

Quick context from the guy who actually built the Dune dashboard everyone’s quoting 😅 @dethective

This started off with DeFiLlama shutting down Aster’s API after seeing signs of wash trading

But @ShiLLin_ViLLian decided to

— odbtc.sol (@Overdose_BTC)

9:05 PM • Oct 5, 2025

For now, DeFiLlama says Aster stays off its site until the team provides verifiable trade-level data. Until then, Aster’s DEX volume story looks like it was written by a copy-trader with Ctrl + C.

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20-22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking - all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets are moving fast, grab yours → Exclusive Early-Bird Pricing

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

⚡ Aptos Hits $1B in Stablecoins - Up 500% YoY

USDT, USDC, and Ethena’s USDe now dominate Aptos, making it a legit stablecoin hub with $1B+ in supply. Lending markets like Aries and Echelon are already stuffed with deposits, kicking out 8%+ yields. Aptos.

💵 Ethena Wrapped September With $16B TVL And Binance Partnership

So Ethena went from “fastest-growing stablecoin” to “everywhere, all at once” in 30 days. USDe supply hit $14.5B, TVL crossed $16B, and Binance plugged it into a 280M-user platform where $3B minted in a week. Ethena also launched on Plasma, Avalanche, Sui, and Kraken while raising $530M more PIPE financing for ENA. Ethena.

💵 Alchemy Pay Hooks Into Agora’s AUSD

Agora’s dollar stablecoin now plugs into Alchemy Pay, giving 173 countries an easy fiat on-ramp through Visa, Mastercard, Apple Pay, and friends. Reserves are held at State Street, managed by VanEck - not some shady offshore trust. Alchemy Pay.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🏗️ Decentraland DAO Grows Legs: Regenesis Labs Goes Live

Not a new Foundation, just the DAO finally giving itself arms and legs instead of waving proposals into the void. DCL Regenesis Labs is now the DAO’s execution arm - the missing piece between votes and actual delivery. It can hire, sign contracts, and run long-term projects like mobile clients or VR expansions. Decentraland.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

💳 Holochain Bets Big On Unyt As Peer-to-Peer Payment Rails

The Holochain Foundation is shifting focus to Unyt, the accounting arm behind HoloFuel, after realizing its tools double as generalized p2p payment rails. Edge Node experiments continue, but Unyt is where the trillions-sized payments market lives. Holochain.

🌉 VeChain DeFi Brings 0% Bridge Fees And Fat Yields

With Wanchain integration, assets from 47+ chains can move to VeChain without bridge fees all October. Bridge-to-Earn pays users in BTC, ETH, USDT, and B3TR just for providing liquidity, then you can dump into BetterSwap for 20%+ APR or Juicy Finance for 10%+. VeChain.

🤖 ReacDEFI Brings Stop Orders On-Chain

Here’s some proof that reactive contracts can actually ship tools normal traders want.The first app born on Reactive Network is live: stop-loss orders for DEXes. It automates the “sell before you cry” move, a feature CEXs had forever but DeFi ignored. Reactive Network.

NEWS IN THREE SENTENCES

Protocol News 🏦

🛠️ Hashgraph September: AI Studio, Hackathons, and HIP Soup

Hedera’s AI Studio got a facelift, making it easier to spin up AI agents that plug into DeFi. The Hello Future Ascension Hackathon kicks off Nov 3, with tracks from AI wallets to tokenized real estate. Also on deck: HIP-1200 swaps RSA for threshold signatures, HIP-1215 brings on-chain cron jobs, and HIP-1261 cleans up fee models. Less hype, more builder ammo. Hedera.

📊 Ondo Finance: Tokenized Stocks, Stellar Yieldcoins, and a Fidelity Play

September saw Ondo launch Global Markets with 100+ tokenized U.S. stocks and ETFs, plus WisdomTree joining its alliance. OUSG anchored Fidelity’s tokenized fund, while USDY launched on Stellar for yield-hungry users. Add a heavyweight hire from Coinbase/SEC/Treasury and an open letter to exchanges, and Ondo’s staking a claim as the RWA shop Wall Street actually listens to. Ondo Finance.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋