- Cryptotwits

- Posts

- 2025 Review: Crypto Got Everything It Wanted And Nearly Killed Us 💀

2025 Review: Crypto Got Everything It Wanted And Nearly Killed Us 💀

Well, almost everything

Presented by:

OVERVIEW

2025 Review: Crypto Got Everything It Wanted And Nearly Killed Us 💀

Before we dive in, here’s today’s crypto market heatmap:

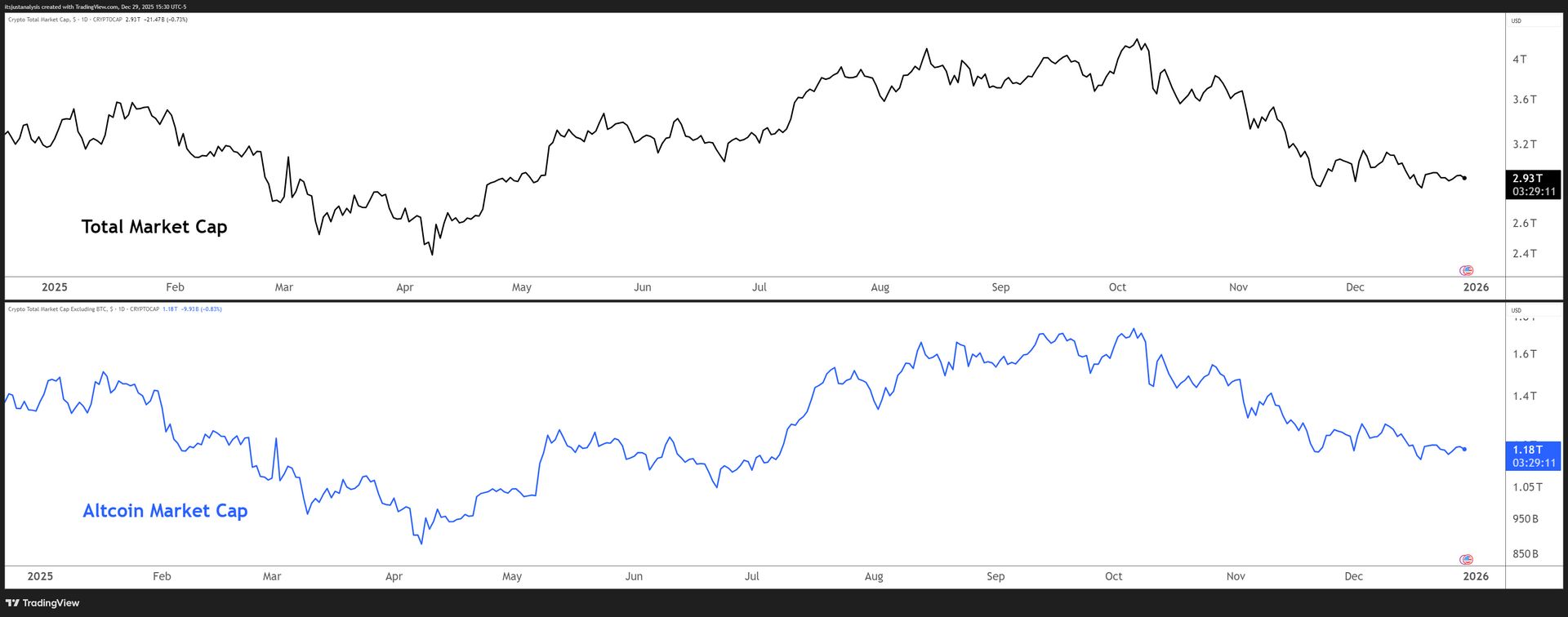

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

2025: The Year Crypto Got What It Wanted (Careful What You Wish For) 😶

Crypto spent years begging Washington to pay attention, and then to stay the eff away, and then to pay attention. 👋

Bitcoin hit $126,000, then a $19 billion liquidation event reminded everyone that leverage doesn't care about politics. The SEC went from enforcement agency to cheerleader. A sitting president launched his own memecoin (sort of). And buried under all that noise? Stories that actually mattered.

Here's what happened - and what you probably missed. 😲

SPONSORED

Invest in one of Crypto’s Fastest-Growing Networks…for a 0% Fee

Grayscale Solana Trust ETF (ticker: GSOL) delivers exposure to SOL, the native token of Solana, a high performance, low-cost, user-friendly blockchain emerging as one of the industry's most used networks. SOL is among the largest and most widely traded digital assets, a result of Solana’s wide range of applications and functional utility.

GSOL is now delivering enhanced value to investors, including 100% staking and a 0% management fee. Solana staking rewards have historically averaged 6-8% a year 2 , which is accretive to GSOL’s total return potential.

GSOL is sponsored by Grayscale, the world's largest digital asset-focused investment platform 3 . GSOL trades on NYSE Arca and is available through your brokerage account, offering efficient exposure to SOL in an ETP wrapper.

1 Gross expense ratio at 0% for 3 months or the first $1.0 billion of assets. After GSOL reaches $1.0 billion in assets or after a 3-month waiver period ending February 5, 2026, the fee will be 0.35%. Brokerage and other fees may apply.

2 Stakingrewards.com. The range observed is from 09/16/22 to 09/28/25 and the average over this period is 7.10%.

3 Largest crypto-focused asset manager based on AUM as of 10/31/2025. For other companies in this category, AUM is considered as of most recent public disclosure.

Grayscale Solana Trust ETF (GSOL), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GSOL is subject to significant risk and heightened volatility. GSOL is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GSOL is not a direct investment in Solana.

Please read the prospectus carefully before investing in the Fund.

Foreside Fund Services, LLC is the Marketing Agent for the Trust.

Staking Risk. When the Fund stakes Solana, Solana is subject to the risks attendant to staking generally. Staking requires that the Fund lock up Solana for the period of time required by the staking protocol, meaning that the Fund cannot sell or transfer the staked Solana, thereby making it illiquid for the period it is being staked. In addition, during the lock-up period, the Fund is subject to the market price volatility of Solana, and it may miss opportunities to sell the staked SOL during opportune times. During the unstaking period, the Fund may miss out on earning opportunities because, in some cases, the staked SOL may not earn rewards during the unstaking period or may only earn rewards during part of the unstaking period. Staked SOL is also subject to security breaches, network downtime or attacks, smart contract vulnerabilities, and validator or custodian failure or compromise, which can result in a complete loss of the staked Solana or a loss of any rewards.

Digital assets represent a new and rapidly evolving industry. The value of GSOL depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies, and the fundamental investment characteristics of the digital asset. Digital assets may be volatile and subject to fluctuations due to a number of factors.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NEWS

Q1: The Takeover 1️⃣

January: The circus comes to town

The headlines: Trump launched the $TRUMP memecoin 48 hours before inauguration. Market cap hit billions within hours. Two days later, Melania got her own token. First time a U.S. president directly launched a cryptocurrency. Day one back in office, Trump pardoned Ross Ulbricht - Silk Road founder serving two life sentences.

Campaign promise fulfilled.

What you were distracted: While everyone chased memecoins, Czech National Bank Governor Aleš Michl proposed putting up to 5% of the nation's €140 billion reserves into Bitcoin. First Western central bank to formally propose this. Eventually led to a $1 million pilot program. Nobody noticed because we were too busy watching shitcoins.

February: North Korea's payday

The headlines: February 21 - North Korean hackers (Lazarus Group) pulled off the largest crypto theft in history. $1.5 billion in ETH from Bybit. They compromised a developer's machine at Safe{Wallet}, injected malicious JavaScript, and redirected "routine" transfers. Same week: SEC dismissed its Coinbase case with prejudice.

The buried lede: Q4 2024 13F filings dropped. Abu Dhabi's sovereign wealth fund disclosed $567 million in BlackRock's Bitcoin ETF. Harvard's endowment: $433 million. First major institutional and sovereign wealth funds to publicly acknowledge significant Bitcoin ETF exposure.

March: America officially becomes a Bitcoin nation

The headlines: March 6 - Trump signed an executive order establishing the U.S. Strategic Bitcoin Reserve. Approximately 200,000 BTC ($17B) from seized assets. Mandate: this Bitcoin will NOT be sold. Senate voted 70-28 to repeal Biden-era IRS rules forcing DeFi front-ends to collect user data.

The story nobody ran: March 12 - Utah passed HB 230, arguably the most comprehensive digital asset bill in American history. Enshrined "crypto rights" as protected activities - right to run nodes, stake, accept crypto. First state to do this. Six days after the Strategic Bitcoin Reserve order consumed all coverage. 🤯

NEWS

Q2: The Shakeout 🤙

April: Tariffs meet leverage

The headlines: Trump's "Liberation Day" tariffs crystallized crypto's new reality: it's a "liquid, high-beta macro trade" now. Bitcoin dropped to $74,000 by April 7. Crypto shed $180 billion in 24 hours. DOJ disbanded its crypto enforcement team.

What got buried: Day before tariff chaos - UPCX payment platform hacked for $70 million via compromised private key. Payment platforms are targets too, not just exchanges and DeFi. G

May: Ethereum ships, Sui stumbles

The headlines: Pectra upgrade deployed May 7 - Ethereum's biggest since The Merge. Account abstraction, staking cap jumped to 2,048 ETH. May 22 - Cetus Protocol (largest DEX on Sui) drained of $223 million in under 15 minutes. Sui validators voted to freeze attacker funds. So much for "immutability."

The much bigger deal: May 29 - SEC clarified staking is NOT a securities transaction. Complete reversal of their 2023 Kraken enforcement. Green light for the $30+ billion staking market.

June: Congress plays nice together

The headlines: Senate passed the GENIUS Act - first federal stablecoin licensing framework. Coinbase disclosed contractors were bribed to steal data from 69,461 customers. Attackers demanded $20M ransom; Coinbase offered $20M bounty instead.

The story nobody ran: Iran's largest exchange Nobitex hit by hacktivists. $90 million drained - but attackers deliberately sent funds to burn addresses containing anti-government messages. Intentionally destroyed $100 million rather than stealing it. 😆

SPONSORED

100% Staking, 0% Fee

Grayscale Solana Trust ETF (ticker: GSOL) now offers 100% staking and a 0% management fee 4 . Solana staking rewards have historically averaged 6-8% a year 5 .

GSOL is designed to capture the continued growth potential of Solana, a high performance, low-cost, user-friendly blockchain emerging as one of the industry's most used networks.

GSOL is sponsored by Grayscale, the world's largest digital asset-focused investment platform 6 , with over a decade of expertise innovating within the asset class.

4 Gross expense ratio at 0% for the first 3 months of trading or the first $1.0 billion. Afterwards, the fee will be 0.35%. Brokerage and other fees may apply.

5 Stakingrewards.com. The range observed is from 09/16/22 to 09/28/25 and the average over this period is 7.10%. Past performance is not indicative of future results.

6 Largest crypto-focused asset manager based on AUM as of 10/31/2025. For other companies in this category, AUM is considered as of most recent public disclosure.

Grayscale Solana Trust ETF (GSOL), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GSOL is subject to significant risk and heightened volatility. GSOL is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GSOL is not a direct investment in Solana.

Please read the prospectus carefully before investing in the Fund.

Foreside Fund Services, LLC is the Marketing Agent for the Trust.

Staking Risk. When the Fund stakes Solana, Solana is subject to the risks attendant to staking generally. Staking requires that the Fund lock up Solana for the period of time required by the staking protocol, meaning that the Fund cannot sell or transfer the staked Solana, thereby making it illiquid for the period it is being staked. In addition, during the lock-up period, the Fund is subject to the market price volatility of Solana, and it may miss opportunities to sell the staked SOL during opportune times. During the unstaking period, the Fund may miss out on earning opportunities because, in some cases, the staked SOL may not earn rewards during the unstaking period or may only earn rewards during part of the unstaking period. Staked SOL is also subject to security breaches, network downtime or attacks, smart contract vulnerabilities, and validator or custodian failure or compromise, which can result in a complete loss of the staked Solana or a loss of any rewards.

Digital assets represent a new and rapidly evolving industry. The value of GSOL depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies, and the fundamental investment characteristics of the digital asset. Digital assets may be volatile and subject to fluctuations due to a number of factors.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NEWS

Q3: The Breakout 👊

July: Whales cash out

The headlines: Trump signed GENIUS Act into law. Galaxy Digital completed sale of 80,000+ BTC ($9.3 billion) for a "Satoshi-era" whale who held dormant coins for 14 years. 900,000%+ return.

What actually mattered: Post-GENIUS Act, stablecoins with >$10M supply nearly doubled (75 to 142). Non-USD stablecoins crossed $1 billion.

August: ETH finally does something

The headlines: Ethereum hit $4,954 ATH (August 24) - first new high since November 2021. ETH gained 24% in August, crushed Bitcoin. Spot ETH ETFs pulled $4 billion in inflows while BTC ETFs saw $600M outflows.

Off the front page: Exchange tokens OKB (+248%) and CRO (+112%) were August's top performers - among the strongest monthly gains by any tokens all year. CEXs fighting back with value-accruing native tokens. Best risk-adjusted returns of 2025.

September: ETF floodgates open

The headlines: SEC approved generic listing standards for crypto ETPs. Qualifying spot crypto ETFs can now list within 75 days instead of 240-day reviews. Nasdaq filed to enable tokenized equity securities trading.

The other headline: Same day as Nasdaq's filing - SwissBorg lost $41.5M via compromised third-party staking provider. September set a record: 16 hacks worth at least $1 million in one month.

NEWS

Q4: It Sucked 😰

October: Leverage meets reality

The headlines: October 10 - $19 billion in leveraged positions liquidated in 24 hours. Largest single-day liquidation event ever. Bitcoin dropped from $126,000 ATH to $104,782. Over 1.6 million accounts liquidated.

Oh, and I made a song aboot it (caution: bad naughty language):

While you were distracted: Trump pardoned CZ. Bitwise launched BSOL - first spot Solana ETP with staking. $417 million in first-week inflows - beat BlackRock's BTC ETF and all ETH ETFs combined.

November: DeFi's worst hack meets Wall Street's altcoin moment

The headlines: Balancer drained of $128 million via rounding-error bug that existed "for many years" and was missed by multiple audits. Seven XRP ETFs launched.

What actually mattered: Visa launched USDC stablecoin settlement in the U.S. - operational infrastructure with $3.5 billion in annualized settlement volume. Stablecoins quietly integrating into TradFi.

December: Justice served

The headlines: Do Kwon got 15 years. Combined with SBF's 25 and Mashinsky's 12, courts are treating crypto fraud as seriously as traditional finance fraud. Ethereum activated Fusaka hard fork.

Holiday happy: Christmas week - Uniswap burned 100 million UNI tokens ($596 million) and activated the fee switch. Trading fees now fund ongoing burns. Transforms UNI from governance token to value-accruing asset. 👍️

NEWS

The Only Thing Bearish Was The Price Action 📉

Crypto got everything it wanted in 2025: friendly regulators, ETF approvals, institutional capital, bipartisan legislation. 🥳

It also got $3 billion in hacks and a $19 billion liquidation cascade.

The under-the-radar stories matter more than the headlines. Central banks experimenting with Bitcoin reserves. Sovereign wealth funds accumulating through ETFs. Visa operationalizing stablecoin settlements. Uniswap reinventing tokenomics during Christmas.

Infrastructure is in place. Whether the industry can secure it is the question that carries into 2026. 🤷

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

How Was Cryptotwits Today? |

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋